Markets are the vibrant engines of the global economy, constantly evolving and adapting to shifting forces. From the bustling aisles of a local farmers market to the complex trading floors of Wall Street, markets facilitate the exchange of goods, services, and resources, shaping our lives in countless ways.

This exploration will delve into the diverse landscape of markets, examining their fundamental types, the dynamics that drive them, and the impact of global forces. We’ll uncover how supply and demand dictate prices, how technology reshapes industries, and how regulations attempt to maintain fairness and stability. Prepare to gain a deeper understanding of the forces that shape our economic world.

Types of Markets

Markets are fundamental to modern economies, serving as platforms where buyers and sellers interact to exchange goods, services, and assets. These interactions determine prices and allocate resources. Understanding the various types of markets is crucial for anyone seeking to comprehend how economies function.

Types of Markets: Detailed Explanation

Different markets cater to specific needs and involve various participants. Here’s an overview of several key market types:

- Financial Markets: These markets facilitate the buying and selling of financial assets. They are essential for channeling funds from savers to borrowers, enabling investment and economic growth.

- Money Market: Deals with short-term debt instruments, typically with maturities of one year or less. Examples include Treasury bills, commercial paper, and certificates of deposit.

- Capital Market: Focuses on long-term financial instruments, such as stocks and bonds. This market enables companies to raise capital for long-term investments.

- Foreign Exchange Market (Forex): This is where currencies are traded. It’s the largest and most liquid financial market globally, with transactions occurring around the clock.

- Derivatives Market: This market involves financial instruments whose value is derived from an underlying asset, such as commodities, stocks, or currencies. Examples include futures, options, and swaps.

- Retail Markets: These are markets where goods and services are sold directly to consumers. Retail markets are highly diverse, encompassing everything from groceries and clothing to electronics and automobiles. Examples include supermarkets, department stores, and online retailers.

- Labor Markets: These markets involve the exchange of labor services for wages. The supply of labor comes from individuals seeking employment, while the demand for labor comes from employers. Factors like education, skills, and geographical location influence labor market dynamics.

- Commodity Markets: These markets trade in raw materials or primary agricultural products. Commodities are often standardized and interchangeable. Examples include oil, gold, wheat, and corn.

- Real Estate Markets: This market involves the buying, selling, and leasing of properties, including land, buildings, and housing. Prices are influenced by factors like location, property condition, and market demand.

Primary vs. Secondary Markets: Characteristics Comparison

Primary and secondary markets play distinct roles in the financial system. The primary market is where new securities are issued, while the secondary market is where existing securities are traded. Here’s a comparison:

| Primary Market | Secondary Market |

|---|---|

| Involves the initial sale of securities to investors by the issuer (e.g., a company). | Involves the trading of existing securities between investors. |

| The issuer receives the proceeds from the sale of securities. | The issuer does not receive the proceeds from the trading of securities. |

| Examples include Initial Public Offerings (IPOs) and follow-on offerings. | Examples include stock exchanges (e.g., NYSE, NASDAQ) and over-the-counter (OTC) markets. |

| Prices are typically determined by the issuer and investment banks during the offering process. | Prices are determined by supply and demand in the market. |

The Role of Intermediaries in Various Market Structures

Intermediaries play a crucial role in facilitating transactions and reducing transaction costs within various market structures. Their functions and importance vary depending on the specific market.

- Financial Markets: Investment banks act as intermediaries in primary markets, underwriting and selling new securities. In secondary markets, brokers and dealers facilitate trading. Other intermediaries include clearinghouses, which reduce counterparty risk, and custodians, who hold assets for safekeeping.

- Retail Markets: Retailers act as intermediaries between manufacturers and consumers. They provide convenience, selection, and customer service. Wholesalers and distributors also play a role in the supply chain, moving goods from manufacturers to retailers.

- Labor Markets: Employment agencies and recruiters act as intermediaries, matching job seekers with employers. They screen candidates, conduct interviews, and facilitate the hiring process.

- Commodity Markets: Brokers and exchanges facilitate trading in commodity markets. These intermediaries provide market access, price discovery, and risk management tools.

Market Dynamics

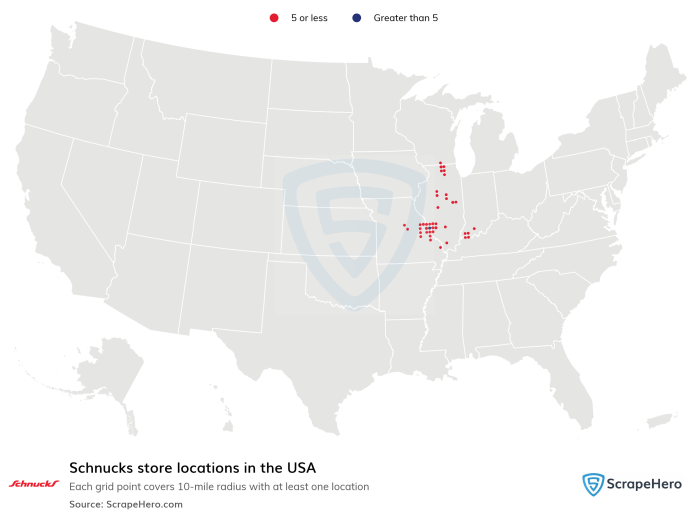

Source: scrapehero.com

Market dynamics refer to the forces and factors that influence the behavior of markets. Understanding these dynamics is crucial for businesses and individuals to make informed decisions about pricing, production, and consumption. This section will delve into the core principles that drive market changes.

Supply and Demand’s Influence on Prices

The interaction of supply and demand is the fundamental mechanism that determines prices in a market economy. When the quantity demanded by consumers equals the quantity supplied by producers, the market reaches equilibrium. Deviations from this equilibrium, caused by shifts in either supply or demand, lead to price adjustments.The relationship between supply, demand, and price can be summarized as follows:

Demand

The willingness and ability of consumers to purchase a good or service at a given price. As the price of a good increases, the quantity demanded typically decreases (and vice versa), creating a downward-sloping demand curve.

Supply

The willingness and ability of producers to offer a good or service at a given price. As the price of a good increases, the quantity supplied typically increases (and vice versa), creating an upward-sloping supply curve.

Price

The monetary value of a good or service, determined by the interaction of supply and demand.When demand exceeds supply, a shortage occurs, pushing prices upward. Conversely, when supply exceeds demand, a surplus occurs, leading to downward price pressure. The point where supply and demand intersect is known as the equilibrium price, where the market clears.Several factors can shift the supply curve:

- Changes in the cost of production: Increases in input costs (raw materials, labor, energy) shift the supply curve to the left, decreasing supply at any given price. Decreases in input costs shift the supply curve to the right, increasing supply. For example, if the price of steel, a key component in car manufacturing, increases, the supply of cars will decrease, leading to higher car prices.

- Technological advancements: Improvements in technology can lower production costs and increase efficiency, shifting the supply curve to the right. For example, the development of automated assembly lines has increased the supply of manufactured goods.

- Changes in the number of sellers: An increase in the number of sellers in a market increases supply, shifting the supply curve to the right. A decrease in the number of sellers shifts the supply curve to the left. For instance, the entry of new competitors into the mobile phone market has increased the overall supply of mobile phones.

- Changes in the prices of related goods: If a producer can switch production between two goods, the price of one good can affect the supply of the other. For example, if the price of wheat increases, farmers may shift resources from producing corn to producing wheat, decreasing the supply of corn.

- Government policies: Taxes, subsidies, and regulations can influence the cost of production and therefore affect the supply curve. For example, a tax on a good increases production costs, shifting the supply curve to the left. Subsidies, on the other hand, reduce production costs, shifting the supply curve to the right.

- Natural disasters or other unforeseen events: Events like hurricanes, droughts, or pandemics can disrupt production and decrease supply, shifting the supply curve to the left. For example, a hurricane that damages oil refineries can reduce the supply of gasoline, leading to higher prices.

Impact of Consumer Preferences on Market Trends

Consumer preferences, which encompass tastes, attitudes, and desires, significantly influence market trends. These preferences are dynamic and can be affected by factors like advertising, cultural trends, and economic conditions. Changes in consumer preferences can lead to shifts in demand, which in turn impact prices and the types of goods and services that are produced.Here’s how consumer preferences can reshape markets:

- Changing tastes: If consumers develop a preference for organic food, the demand for organic products will increase, leading to higher prices and increased production of organic goods. Conversely, a decline in interest in a particular product will decrease demand, potentially leading to lower prices and reduced production.

- Fashion and trends: The fashion industry is a prime example of how consumer preferences drive market trends. When a particular style or brand becomes popular, demand skyrockets, causing prices to rise and encouraging businesses to capitalize on the trend. As the trend fades, demand and prices fall.

- Technological advancements: New technologies often create new consumer preferences. The advent of smartphones, for instance, created a demand for mobile apps and related services.

- Marketing and advertising: Effective marketing campaigns can shape consumer preferences by creating awareness, influencing perceptions, and building brand loyalty. Successful advertising can significantly increase demand for a product or service.

- Health and environmental concerns: Growing awareness of health and environmental issues has led to increased demand for eco-friendly products, plant-based foods, and sustainable practices.

- Economic conditions: During economic downturns, consumers may shift their preferences towards more affordable alternatives, impacting the demand for luxury goods and services.

Market Equilibrium and Its Significance

Market equilibrium represents a state of balance where the quantity demanded equals the quantity supplied. At this point, there is no inherent pressure for prices to change. Understanding market equilibrium is crucial for analyzing market behavior and predicting price movements.Key aspects of market equilibrium:

- Equilibrium price: The price at which the quantity demanded equals the quantity supplied. This is the price that “clears the market,” meaning that all goods supplied are sold, and there are no shortages or surpluses.

- Equilibrium quantity: The quantity of goods or services bought and sold at the equilibrium price.

- Efficiency: Market equilibrium is considered efficient because it maximizes the total welfare of both consumers and producers. Consumers benefit from purchasing goods at prices they are willing to pay, and producers benefit from selling goods at prices that cover their costs.

- Stability: In a stable market, the equilibrium point tends to be self-correcting. If the price is above the equilibrium, a surplus will arise, leading to price decreases. If the price is below the equilibrium, a shortage will arise, leading to price increases.

- Shifts in equilibrium: Changes in supply or demand will shift the equilibrium point. For example, an increase in demand (e.g., due to a successful advertising campaign) will shift the demand curve to the right, leading to a higher equilibrium price and quantity.

- Real-world examples: Consider the market for gasoline. If a major oil-producing country experiences political instability, the supply of gasoline decreases, leading to a higher equilibrium price and a lower equilibrium quantity. Alternatively, if a new, more fuel-efficient car technology is introduced, the demand for gasoline may decrease, resulting in a lower equilibrium price and quantity.

The concept of market equilibrium is a fundamental principle in economics and is used to analyze a wide range of market phenomena, from the pricing of agricultural products to the valuation of financial assets.

Global Markets

The global marketplace is a complex and interconnected web of economic activity, where goods, services, capital, and labor move across national borders. Understanding this landscape is crucial for businesses seeking to expand internationally, as well as for investors and policymakers. It’s a dynamic environment shaped by various factors, including technological advancements, geopolitical events, and evolving consumer preferences.

Key Players and Major Trends

The global marketplace is dominated by a diverse array of players, including multinational corporations (MNCs), governments, and international organizations. These entities interact in various ways, influencing market dynamics. Some key trends significantly impact the global marketplace.

- Multinational Corporations (MNCs): These companies operate in multiple countries, often with significant financial resources and influence. Examples include Apple, Toyota, and Nestlé. They drive global trade, investment, and innovation.

- Governments: Governments play a crucial role in shaping the global marketplace through trade policies, regulations, and economic initiatives. They also negotiate trade agreements and manage their countries’ economic relations with others.

- International Organizations: Organizations like the World Trade Organization (WTO), the International Monetary Fund (IMF), and the World Bank facilitate global trade, provide financial assistance, and promote economic stability.

- E-commerce Growth: The rapid expansion of e-commerce platforms like Amazon, Alibaba, and Shopify has facilitated cross-border trade, enabling businesses to reach global consumers more easily. This has led to increased competition and a shift in consumer behavior.

- Supply Chain Disruptions: Events like the COVID-19 pandemic and geopolitical conflicts have exposed vulnerabilities in global supply chains, leading to increased costs, delays, and a push for greater diversification and resilience.

- Sustainability and ESG (Environmental, Social, and Governance): Consumers and investors are increasingly focused on sustainability and ethical business practices. Companies are under pressure to adopt ESG principles, which affects their operations and supply chains.

- Technological Advancements: Artificial intelligence (AI), automation, and blockchain technology are transforming industries, creating new opportunities and challenges for businesses operating globally.

Effects of International Trade Agreements on Specific Industries

International trade agreements significantly influence various industries by reducing trade barriers, promoting competition, and creating new market opportunities. Here are some examples:

- North American Free Trade Agreement (NAFTA)/United States-Mexico-Canada Agreement (USMCA): NAFTA, and its successor USMCA, eliminated tariffs and other trade barriers between the United States, Canada, and Mexico.

- Automotive Industry: The automotive industry saw increased integration of supply chains across the three countries, with vehicles and components moving freely. This led to lower production costs and increased competitiveness, but also caused some job displacement in certain regions.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): The CPTPP is a trade agreement among 11 countries in the Asia-Pacific region.

- Agriculture: The CPTPP reduced tariffs on agricultural products, benefiting exporters of commodities such as beef, dairy, and grains. This created new market access opportunities for farmers and agribusinesses.

- European Union (EU): The EU is a political and economic union of 27 member states located primarily in Europe.

- Financial Services: The EU’s single market allows financial institutions to operate across member states with a single license. This increased competition and efficiency in the financial services sector.

Challenges and Opportunities in Emerging Markets

Entering emerging markets presents both significant challenges and substantial opportunities for businesses. These markets often exhibit high growth potential, but also involve unique risks.

- Challenges:

- Political and Economic Instability: Emerging markets can experience political instability, corruption, and fluctuating economic conditions, which can impact investment decisions and business operations.

- Infrastructure Deficiencies: Inadequate infrastructure, such as poor transportation networks, unreliable power supplies, and limited access to technology, can increase costs and hinder business efficiency.

- Regulatory and Legal Hurdles: Complex and inconsistent regulations, bureaucratic processes, and weak enforcement of legal frameworks can create difficulties for businesses.

- Cultural and Language Barriers: Differences in culture, language, and business practices can make it challenging to understand consumer preferences, build relationships, and manage local operations.

- Competition: Emerging markets often have intense competition from both local and international businesses, requiring companies to differentiate their products or services.

- Opportunities:

- High Growth Potential: Emerging markets often experience rapid economic growth, creating significant demand for goods and services.

- Untapped Consumer Markets: These markets often have large and growing populations with increasing disposable incomes, representing a significant consumer base.

- Lower Labor Costs: Labor costs in emerging markets are often lower than in developed countries, reducing production costs and increasing competitiveness.

- Innovation and Adaptation: Emerging markets can be fertile grounds for innovation, as businesses adapt their products and services to meet local needs and preferences.

- Investment Incentives: Governments in emerging markets often offer investment incentives, such as tax breaks and subsidies, to attract foreign investment.

Market Regulation and Policy

Market regulation and policy are essential components of a functioning economy. Governments and other regulatory bodies implement rules and interventions to ensure fair practices, protect consumers, and promote overall economic stability. The level and type of regulation vary significantly across different markets and jurisdictions, reflecting differing philosophies about the role of government and the nature of market failures. This section will delve into the role of government in regulating markets, examining various regulatory approaches, market failures, and the impact of monetary policy.

The Role of Government in Regulating Markets

The government plays a crucial role in regulating markets to address potential failures and promote economic efficiency. This involves setting rules, enforcing regulations, and intervening when necessary. The extent of government intervention is a subject of ongoing debate, with different approaches offering varying benefits and drawbacks.Here’s a comparison of different regulatory approaches:

| Regulatory Approach | Description | Advantages | Disadvantages |

|---|---|---|---|

| Deregulation | Reducing or eliminating government regulations and controls on markets. |

|

|

| Self-Regulation | Industry-led standards and practices, often overseen by industry associations. |

|

|

| Government Regulation | Direct government control and oversight of markets, including laws, rules, and enforcement. |

|

|

Market Failures and Government Interventions

Market failures occur when the free market fails to allocate resources efficiently, leading to suboptimal outcomes. These failures provide a rationale for government intervention.Here are some examples of market failures and the interventions designed to address them:

- Monopolies: A single firm controls a market, leading to higher prices and reduced output. Governments can intervene through antitrust laws, breaking up monopolies, or regulating their behavior. For example, the U.S. government’s actions against Standard Oil in the early 20th century, which led to its breakup, aimed to foster competition and prevent the company from abusing its market power.

- Externalities: The actions of one party affect others, but these effects are not reflected in market prices. Negative externalities, such as pollution, can be addressed through regulations (e.g., emission standards), taxes (e.g., carbon tax), or subsidies (e.g., for renewable energy). The implementation of the Clean Air Act in the United States, which set air quality standards and regulated emissions from various sources, is a significant example of government intervention to address negative externalities.

- Information Asymmetry: One party has more information than another, leading to potential exploitation. Regulations requiring disclosure of information (e.g., in financial markets) and consumer protection laws aim to level the playing field. The Securities and Exchange Commission (SEC) in the U.S. mandates that companies disclose financial information to investors to reduce information asymmetry.

- Public Goods: Goods that are non-excludable and non-rivalrous are often under-provided by the market. Governments can provide these goods directly (e.g., national defense) or subsidize their provision (e.g., public education).

The Impact of Monetary Policy on Financial Markets

Monetary policy, conducted by central banks, significantly influences financial markets. Central banks use various tools, such as interest rate adjustments and open market operations, to control the money supply and credit conditions.Here’s how monetary policy affects financial markets:

- Interest Rates: Changes in interest rates directly impact borrowing costs and investment decisions. Lower interest rates generally stimulate economic activity by encouraging borrowing and investment, which can lead to higher stock prices. Higher interest rates, on the other hand, can cool down the economy by making borrowing more expensive, potentially leading to lower stock prices. For example, when the Federal Reserve lowered interest rates during the 2008 financial crisis, it aimed to stimulate lending and prevent a deeper economic downturn.

- Open Market Operations: Central banks buy or sell government bonds to influence the money supply. Buying bonds injects money into the economy, lowering interest rates and increasing liquidity, which can boost asset prices. Selling bonds does the opposite, tightening monetary conditions. The European Central Bank’s quantitative easing program, which involved purchasing government bonds to inject liquidity into the Eurozone economy, is a prominent example of open market operations.

- Inflation Expectations: Monetary policy affects inflation expectations, which in turn influence market behavior. If the central bank is perceived as credible in its commitment to price stability, inflation expectations will remain anchored, and financial markets will be more stable. However, if inflation expectations become unanchored, it can lead to market volatility and uncertainty.

- Currency Values: Monetary policy also affects currency values. Lowering interest rates can make a currency less attractive to foreign investors, potentially leading to currency depreciation. Conversely, raising interest rates can attract foreign investment and strengthen a currency.

Market Research and Analysis

Source: staticflickr.com

Understanding your market is crucial for any business, whether you’re launching a new product, expanding into a new region, or simply trying to stay ahead of the competition. Market research and analysis provide the insights needed to make informed decisions, mitigate risks, and capitalize on opportunities. This section Artikels the process of conducting effective market research, analyzing the data, and interpreting key market indicators.

Framework for Conducting Effective Market Research

Effective market research involves a systematic approach to gather and analyze information about a target market. It helps businesses understand customer needs, preferences, and behaviors, as well as the competitive landscape. This framework provides a structured approach to ensure the research is comprehensive and yields actionable results.

- Define the Research Objectives: Clearly identify the goals of the research. What specific questions need to be answered? Are you trying to understand customer preferences, assess market size, or evaluate the competition? For example, a company launching a new energy drink might want to determine the target demographic, preferred flavors, and optimal pricing strategy.

- Determine the Research Design: Choose the appropriate research methodology. This includes selecting between qualitative and quantitative methods. Qualitative research, such as focus groups and in-depth interviews, provides rich, descriptive data. Quantitative research, like surveys and statistical analysis, provides numerical data and insights. A combination of both approaches often yields the most comprehensive results.

- Identify the Target Audience: Clearly define the specific group of people the research will focus on. This could involve demographics (age, gender, income), psychographics (lifestyle, values), or behavioral characteristics (purchasing habits). Consider the energy drink example again: the target audience might be young adults (18-35) who are active and health-conscious.

- Choose Data Collection Methods: Select the most suitable methods for gathering data. These can include:

- Surveys: Distribute questionnaires online, via mail, or in person.

- Interviews: Conduct one-on-one interviews or focus groups to gather in-depth insights.

- Observations: Observe consumer behavior in real-world settings (e.g., in a store).

- Secondary Research: Utilize existing data from industry reports, government publications, and online databases.

- Develop the Research Instruments: Create questionnaires, interview guides, and observation protocols. Ensure the questions are clear, unbiased, and relevant to the research objectives. The questionnaire for the energy drink might ask about flavor preferences, consumption frequency, and willingness to pay.

- Collect the Data: Implement the data collection plan. This involves administering surveys, conducting interviews, and gathering secondary data. Ensure the data collection process is consistent and follows ethical guidelines.

- Analyze the Data: Process and analyze the collected data. This involves summarizing the data, identifying patterns, and drawing conclusions. Statistical analysis, data visualization, and qualitative analysis techniques are commonly used.

- Interpret the Findings: Draw meaningful conclusions from the analysis. What do the data reveal about the target market, competition, and potential opportunities? For example, the analysis might reveal that the target audience prefers natural flavors and is willing to pay a premium for them.

- Report the Findings: Present the research findings in a clear and concise report. Include key insights, recommendations, and supporting data. This report should be accessible to all stakeholders and provide actionable information.

Process for Analyzing Market Data to Identify Opportunities and Threats

Analyzing market data effectively allows businesses to uncover opportunities for growth and proactively address potential threats. This process involves a series of steps to extract meaningful insights from the collected data.

- Data Compilation and Organization: Gather and organize all relevant market data from various sources, including primary research, secondary research, and internal data. This includes sales figures, customer demographics, competitor analysis, and economic indicators. Data organization might involve creating spreadsheets, databases, or data visualization tools.

- Data Cleaning and Validation: Ensure the accuracy and reliability of the data. This involves identifying and correcting errors, removing duplicates, and validating data against known benchmarks. Cleaning the data is crucial to prevent skewed results.

- Descriptive Analysis: Summarize the data using descriptive statistics, such as averages, medians, and standard deviations. This provides a basic understanding of the market. For instance, calculate the average purchase value of customers in a specific demographic segment.

- Segmentation Analysis: Divide the market into distinct segments based on shared characteristics, such as demographics, psychographics, or purchasing behavior. Segmenting the market helps tailor marketing efforts and identify specific opportunities. An example is dividing the energy drink market into segments based on age groups.

- Competitive Analysis: Evaluate the competitive landscape by analyzing the strengths and weaknesses of competitors. This includes assessing their market share, pricing strategies, product offerings, and marketing tactics. This analysis might reveal a gap in the market or a threat from a new competitor.

- Trend Analysis: Identify patterns and trends in the market data over time. This involves tracking changes in sales, customer preferences, and market share. Trend analysis can help predict future market developments and identify emerging opportunities or threats.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to synthesize the findings and identify key strategic implications. This involves assessing the internal strengths and weaknesses of the business and the external opportunities and threats in the market.

- Opportunity Identification: Based on the analysis, identify potential opportunities for growth. These might include new product development, market expansion, or strategic partnerships. For example, the analysis might reveal an opportunity to launch a low-sugar version of the energy drink.

- Threat Assessment: Identify potential threats to the business, such as changing consumer preferences, increased competition, or economic downturns. This allows businesses to develop mitigation strategies. An example is the growing popularity of healthier alternatives to energy drinks.

- Scenario Planning: Develop different scenarios based on potential market developments. This helps businesses prepare for various possibilities and make proactive decisions.

How to Interpret Market Indicators and Economic Forecasts

Market indicators and economic forecasts provide valuable insights into the overall health of the economy and specific market sectors. Understanding these indicators and forecasts is crucial for making informed business decisions.

- Economic Indicators:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country. Growth in GDP indicates economic expansion.

- Inflation Rate: Measures the rate at which the general level of prices for goods and services is rising. High inflation can erode purchasing power.

- Unemployment Rate: Measures the percentage of the labor force that is unemployed. High unemployment can reduce consumer spending.

- Interest Rates: Set by central banks and influence borrowing costs. Changes in interest rates can impact investment and consumer spending.

- Consumer Confidence Index: Measures consumer optimism about the economy. High consumer confidence often leads to increased spending.

- Retail Sales: Measures the value of sales at retail stores. Provides insights into consumer spending patterns.

- Market Indicators:

- Stock Market Indices: Such as the S&P 500 or the Dow Jones Industrial Average, reflect the overall performance of the stock market. Rising stock prices often indicate economic optimism.

- Industry-Specific Indices: Track the performance of specific sectors, such as technology or healthcare. These indices provide insights into the performance of individual industries.

- Housing Starts: Measures the number of new residential construction projects. Housing starts are an indicator of economic activity in the construction sector.

- Commodity Prices: Such as oil or metals, can influence production costs and consumer prices. Rising commodity prices can signal inflation.

- Economic Forecasts:

- GDP Growth Forecasts: Predict the future rate of economic growth. Forecasts from reputable sources like the IMF or World Bank can provide guidance.

- Inflation Rate Forecasts: Predict future inflation rates. These forecasts help businesses plan for price changes.

- Interest Rate Forecasts: Predict future interest rate movements. These forecasts can influence investment decisions.

- Industry-Specific Forecasts: Predict future trends and developments within specific industries. These forecasts can help businesses identify opportunities and threats.

- Interpreting the Data:

- Assess the Overall Economic Climate: Evaluate the current economic conditions by analyzing key indicators and forecasts. Is the economy expanding or contracting? Is inflation rising or falling?

- Identify Potential Risks and Opportunities: Determine how economic and market trends might affect the business. For example, rising interest rates could increase borrowing costs, while a growing economy might create opportunities for expansion.

- Consider the Industry Context: Analyze how the overall economic trends are likely to impact the specific industry. Some industries are more sensitive to economic fluctuations than others.

- Use Multiple Sources: Rely on data from multiple sources to gain a comprehensive understanding of the market. Compare forecasts from different organizations.

- Monitor Changes Regularly: Continuously monitor market indicators and economic forecasts. The market is dynamic, and conditions can change rapidly.

- Example: Imagine an energy drink company. If GDP growth forecasts are positive, consumer confidence is high, and unemployment is low, the company can expect strong sales. However, if inflation is rising and commodity prices (e.g., sugar) are increasing, the company may need to adjust its pricing strategy. Furthermore, if a leading economic forecast predicts a recession, the company might consider diversifying its product line to appeal to a broader consumer base.

Market Strategies

Businesses utilize a variety of market strategies to achieve their objectives, such as increasing market share, boosting brand awareness, and maximizing profitability. These strategies are carefully planned and implemented based on market research, competitor analysis, and an understanding of the target audience. Effective market strategies are dynamic and adaptable, evolving to meet changing market conditions and consumer preferences.

Pricing Strategies

Pricing is a crucial element of any market strategy, influencing consumer perception, sales volume, and overall profitability. Several pricing strategies are employed by businesses, each with its own advantages and disadvantages. The selection of the optimal pricing strategy depends on factors like the product’s cost, the competitive landscape, and the target market’s willingness to pay.Here’s a breakdown of common pricing strategies:

| Strategy Name | Description | Advantages | Disadvantages |

|---|---|---|---|

| Cost-Plus Pricing | Calculating the total cost of producing a product or service and adding a markup to determine the selling price. | Simple to calculate and implement; ensures profitability if costs are accurately estimated. | Doesn’t consider market demand or competitor pricing; may result in prices that are too high or too low. |

| Competitive Pricing | Setting prices based on the prices of competitors’ products or services. | Easy to implement; helps businesses remain competitive in the market. | May not reflect the unique value of a product or service; can lead to price wars. |

| Value-Based Pricing | Setting prices based on the perceived value of the product or service to the customer. | Focuses on customer needs and preferences; can lead to higher profit margins. | Requires a deep understanding of customer perception and willingness to pay; can be difficult to implement. |

| Premium Pricing | Setting a high price to convey a sense of quality, exclusivity, or luxury. | Creates a strong brand image; can attract customers who are willing to pay more for perceived value. | Requires a strong brand and a perceived value that justifies the high price; may limit the customer base. |

| Penetration Pricing | Setting a low initial price to attract a large customer base and gain market share quickly. | Quickly gains market share; discourages competition. | May result in lower profit margins; can be difficult to raise prices later. |

| Price Skimming | Setting a high initial price and gradually lowering it over time. | Captures early adopters willing to pay a premium; maximizes profits from each segment of the market. | May alienate early adopters if prices are lowered too quickly; can attract competitors. |

Successful Marketing Campaign Examples

Successful marketing campaigns are characterized by their ability to resonate with the target audience, communicate a clear message, and achieve specific marketing objectives. Several campaigns across various market segments have demonstrated exceptional effectiveness.

- Dove: Real Beauty Campaign: Dove’s campaign, which launched in 2004, challenged conventional beauty standards by featuring real women of diverse ages, sizes, and ethnicities. This campaign resonated deeply with women who felt misrepresented by traditional advertising. The campaign’s success led to increased brand loyalty and sales, and it continues to evolve and adapt to contemporary discussions about beauty and body image.

- Old Spice: The Man Your Man Could Smell Like: Old Spice’s 2010 campaign, featuring actor Isaiah Mustafa, revolutionized the brand’s image. The humorous and engaging commercials, targeted towards women who often make household purchasing decisions, were a viral sensation. This campaign significantly increased sales and market share for Old Spice, revitalizing the brand and establishing a strong presence in the men’s grooming market. The campaign’s success highlights the importance of understanding the target audience and using creative content to capture their attention.

- Apple: “Think Different” Campaign: Apple’s “Think Different” campaign, launched in 1997, aimed to reposition the brand as a symbol of innovation and creativity. The campaign featured black-and-white images of iconic figures like Albert Einstein, Martin Luther King Jr., and Mahatma Gandhi, accompanied by the tagline “Think Different.” This campaign helped Apple build a strong brand identity and cultivate a loyal customer base. This campaign is a prime example of how a brand can successfully associate itself with values and aspirations that resonate with its target audience.

- Coca-Cola: “Share a Coke” Campaign: Coca-Cola’s “Share a Coke” campaign, which began in Australia in 2011 and spread globally, personalized the product by printing popular names on Coca-Cola bottles and cans. This campaign encouraged consumers to share a Coke with friends and family, increasing brand engagement and driving sales. The campaign’s success demonstrates the power of personalization and creating a sense of connection with consumers.

Market Segmentation and Targeting

Market segmentation and targeting are fundamental aspects of effective marketing strategies. They involve dividing a broad consumer market into subgroups (segments) based on shared characteristics, and then focusing marketing efforts on specific segments (target markets) that are most likely to respond positively to the product or service.The importance of market segmentation and targeting can be explained through these key points:

- Improved Efficiency: By focusing on specific segments, businesses can allocate their marketing resources more efficiently, avoiding wasted efforts on consumers who are unlikely to be interested in their offerings.

- Enhanced Customer Satisfaction: Tailoring marketing messages and product features to the specific needs and preferences of target segments increases customer satisfaction and loyalty.

- Increased Profitability: Focusing on the most profitable segments allows businesses to maximize their return on investment.

- Competitive Advantage: By understanding the needs of their target segments better than competitors, businesses can develop products and services that offer a unique value proposition, leading to a competitive advantage.

- Effective Product Development: Market segmentation provides valuable insights for product development, helping businesses create products and services that meet the specific needs of their target customers. This leads to higher success rates for new product launches.

Emerging Market Trends

Source: pxhere.com

The business world is constantly evolving, with new trends reshaping how companies operate and how consumers behave. Understanding these emerging trends is crucial for businesses to stay competitive and capitalize on new opportunities. This section will explore some of the most significant shifts currently impacting the market landscape, focusing on the influence of technology, the rise of e-commerce, and the growing importance of sustainability.

Impact of Technological Advancements on Market Landscapes

Technology continues to be a driving force behind market transformation, creating both challenges and opportunities for businesses. From artificial intelligence to blockchain, new technologies are changing how products are developed, marketed, and delivered. These advancements are also impacting the way consumers interact with businesses.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to personalize customer experiences, automate tasks, and improve decision-making. Companies are leveraging AI-powered chatbots for customer service, using ML algorithms for targeted advertising, and employing AI in supply chain optimization. For example, Netflix uses AI to recommend movies and shows to its users, resulting in increased user engagement and retention.

- Cloud Computing: Cloud computing provides businesses with scalable and cost-effective IT infrastructure. This allows companies to quickly adapt to changing market demands and access data from anywhere. The flexibility and scalability of cloud services have made it easier for startups and small businesses to compete with larger enterprises.

- Blockchain Technology: Blockchain technology is used to enhance transparency, security, and efficiency in various industries. It is particularly impactful in supply chain management, where it can track products from origin to consumer, reducing fraud and improving traceability. For instance, Walmart uses blockchain to track its food products, enhancing food safety and reducing the time it takes to trace the source of contaminated food.

- Internet of Things (IoT): The IoT connects everyday devices to the internet, creating opportunities for data collection and analysis. This data can be used to improve product design, optimize operations, and personalize customer experiences. Smart home devices, connected cars, and wearable technology are all examples of the IoT in action.

Rise of E-commerce and its Effects on Traditional Retail

E-commerce has dramatically altered the retail landscape, offering consumers unprecedented convenience and choice. The growth of online shopping has forced traditional brick-and-mortar stores to adapt or risk becoming obsolete. The shift toward e-commerce has significant implications for businesses, consumers, and the overall economy.

- Changing Consumer Behavior: Consumers are increasingly comfortable shopping online, driven by factors such as convenience, price comparison, and wider product selection. The ability to shop 24/7 from anywhere in the world has made e-commerce a dominant force.

- Impact on Traditional Retail: Traditional retailers are facing increased competition from online stores. Many are responding by investing in their online presence, offering in-store pickup options, and creating unique in-store experiences to attract customers. The closure of many physical stores across the world highlights the challenges faced by traditional retail.

- Omnichannel Strategies: Businesses are adopting omnichannel strategies to provide a seamless shopping experience across multiple channels, including online, mobile, and in-store. This allows customers to interact with a brand in various ways, enhancing customer loyalty and driving sales.

- Logistics and Supply Chain Challenges: The growth of e-commerce has placed significant demands on logistics and supply chains. Businesses must optimize their fulfillment processes, manage shipping costs, and ensure timely delivery to meet customer expectations. The rise of companies like Amazon, which offer fast and reliable delivery, has set a new standard for e-commerce.

Sustainability Influencing Consumer Behavior and Market Dynamics

Sustainability is no longer a niche concern; it is a mainstream trend influencing consumer behavior and market dynamics. Consumers are increasingly aware of environmental and social issues, and they are making purchasing decisions based on a company’s commitment to sustainability. This has led to the rise of eco-friendly products, ethical sourcing practices, and corporate social responsibility initiatives.

- Growing Consumer Demand for Sustainable Products: Consumers are actively seeking products that are environmentally friendly, ethically sourced, and produced with minimal waste. This demand is driving innovation in areas such as renewable energy, sustainable packaging, and organic products.

- Impact on Corporate Strategy: Companies are integrating sustainability into their business strategies to meet consumer demand and reduce their environmental impact. This includes implementing sustainable manufacturing processes, using renewable energy, and investing in social responsibility programs.

- Rise of the Circular Economy: The circular economy model focuses on reducing waste and maximizing the use of resources. This involves designing products for durability, reuse, and recyclability. Companies are adopting circular economy principles to reduce their environmental footprint and create new business opportunities.

- Examples of Sustainable Initiatives:

- Patagonia: The outdoor apparel company is known for its commitment to environmental activism and sustainable practices, including using recycled materials and donating a percentage of its sales to environmental causes.

- Tesla: The electric vehicle manufacturer is leading the way in sustainable transportation, reducing reliance on fossil fuels and promoting cleaner energy sources.

- Unilever: The consumer goods giant has committed to sustainable sourcing of its raw materials, reducing its carbon footprint, and improving the lives of its employees and communities.

Closure

In conclusion, the world of markets is a dynamic and multifaceted ecosystem, influenced by a complex interplay of factors. From understanding the core principles of supply and demand to navigating the complexities of global trade and technological advancements, a grasp of market dynamics is essential for anyone seeking to understand the modern world.

By examining the different facets of markets, from their foundational principles to the latest trends, we gain valuable insights into the forces shaping our economies and the opportunities and challenges that lie ahead. The ability to adapt and innovate within this ever-changing landscape will be key to future success.

Common Queries

What is the difference between a market and an industry?

An industry is a group of companies that produce similar goods or services, while a market is where those goods and services are bought and sold. An industry can exist within multiple markets, and a single market can encompass multiple industries.

How do economic indicators influence market trends?

Economic indicators, such as GDP growth, inflation rates, and unemployment figures, provide valuable insights into the overall health of the economy. These indicators can influence investor confidence, consumer spending, and ultimately, market trends, signaling potential shifts in demand and investment opportunities.

What are the key benefits of market segmentation?

Market segmentation allows businesses to tailor their marketing efforts to specific customer groups, leading to increased efficiency, improved customer satisfaction, and higher profitability. By understanding the unique needs and preferences of different segments, businesses can create more effective marketing campaigns and build stronger customer relationships.

How does globalization affect markets?

Globalization increases competition, opens up new markets for businesses, and provides consumers with access to a wider variety of goods and services. However, it can also lead to job displacement, increased economic inequality, and challenges related to international trade and regulation.