The entertainment world mourns the loss of the legendary Kessler twins, who passed away at the age of

89. Beyond their dazzling performances and iconic status, a complex legal process now unfolds: settling their estate and distributing their legacy. This article delves into the lives of the twins, their remarkable achievements, and the intricate details of how their inheritance will be handled.

From their groundbreaking dance routines to their captivating stage presence, the Kessler twins left an indelible mark on the entertainment industry. This article will examine their professional journey, highlighting key moments and significant performances. Furthermore, it will explore the legal framework surrounding inheritance, offering insights into the steps involved, potential challenges, and the specific implications for the twins’ estate. We’ll examine the assets, potential beneficiaries, and the likely outcomes of this final act in their extraordinary lives.

Overview of the Kessler Twins’ Lives and Passing

Source: abendzeitung-muenchen.de

The entertainment world mourns the loss of the Kessler Twins, Alice and Ellen Kessler, who passed away at the age of 89. Known for their synchronized dance routines, elegant stage presence, and enduring careers, the twins left an indelible mark on European entertainment. Their passing marks the end of an era, prompting reflections on their significant contributions to music, dance, and popular culture.

Professional Accomplishments and Public Image

The Kessler Twins cultivated a public image of sophistication, grace, and unparalleled synchronicity. They were celebrated for their precise dance moves, often performing in elaborate costumes that accentuated their identical appearance. Beyond their performances, they were admired for their multilingualism and their ability to navigate diverse cultural landscapes, contributing to their international appeal. Their professional accomplishments spanned decades and various media, establishing them as icons of European entertainment.

Timeline of the Twins’ Lives

The following timeline Artikels key events in the lives of Alice and Ellen Kessler:* 1936: Born in Nerchau, Germany.

1952

Began their professional career as dancers.

1955

Debuted in Paris at the “Lido” cabaret.

1959

Represented West Germany in the Eurovision Song Contest.

1960s-1970s

Achieved widespread success across Europe, appearing in numerous television shows and films.

1980s-2000s

Continued to perform and maintain a significant presence in the entertainment industry.

2024

Alice and Ellen Kessler pass away at the age of 89.

Notable Performances and Achievements

The Kessler Twins’ career was marked by numerous memorable performances and significant achievements. These included:* Appearances at the Lido de Paris, a renowned cabaret, establishing their reputation.

- Representing West Germany in the Eurovision Song Contest, exposing them to a vast international audience.

- Numerous television show appearances across various European countries, including Germany, Italy, and France.

- Leading roles in several films, demonstrating their versatility beyond dance.

- Successful stage performances in various musical productions.

Impact on the Entertainment Industry

“The Kessler Twins were more than just dancers; they were a phenomenon. Their dedication to precision, their captivating stage presence, and their ability to transcend linguistic and cultural barriers made them true pioneers. They embodied elegance and artistry, leaving a legacy that will continue to inspire generations of performers.”

Understanding the Inheritance Process

Source: cedscdn.it

The passing of the Kessler Twins brings to the forefront the often-complex process of inheritance. Settling an estate involves a series of legal and administrative steps, designed to ensure assets are distributed according to the deceased’s wishes, as Artikeld in their will, or according to the laws of intestacy if no will exists. Understanding this process is crucial for beneficiaries, executors, and anyone involved in the estate.

General Steps in Settling an Estate

The settlement of an estate typically follows a structured process. This involves several key stages, each with specific requirements and potential challenges.

- Probate: This is the legal process of validating the will (if one exists) and appointing an executor to manage the estate. The executor is responsible for identifying and gathering assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries.

- Asset Valuation: Determining the value of all assets, including real estate, investments, bank accounts, and personal property, is a critical step. This often involves professional appraisals and financial assessments.

- Debt and Tax Payment: The estate must pay any outstanding debts, including mortgages, loans, and credit card bills. Estate taxes, if applicable, are also paid at this stage.

- Asset Distribution: Once debts and taxes are settled, the remaining assets are distributed to the beneficiaries according to the will or the laws of intestacy.

- Estate Closure: After all assets are distributed, and all legal requirements are met, the estate is formally closed by the court.

Common Legal Challenges During Inheritance

Inheritance cases are frequently complicated by legal challenges. These disputes can arise from various sources, potentially delaying the distribution of assets and incurring significant legal costs.

- Will Contests: Challenges to the validity of the will are common. These can be based on claims of undue influence, lack of testamentary capacity (the deceased’s ability to understand the will), or improper execution of the will.

- Disputes Over Asset Valuation: Disagreements over the value of assets, especially real estate or unique items, can lead to protracted legal battles.

- Creditor Claims: Disputes can arise from creditors who believe they are owed money by the estate. This can delay the settlement process until the claims are resolved.

- Family Disputes: Emotional family dynamics often exacerbate legal issues. Beneficiaries may disagree on how assets should be distributed, leading to legal action.

Potential Implications of the Twins’ Specific Circumstances

The unique circumstances of the Kessler Twins, including their long careers and potentially complex financial affairs, could significantly impact the estate settlement.

- Complexity of Assets: Their careers may have generated diverse income streams, including royalties, performance rights, and investments, making asset valuation and distribution more complex.

- International Assets: If the twins held assets internationally, the estate settlement could involve multiple jurisdictions, adding complexity and potentially increasing legal costs.

- Business Interests: Any business ventures or partnerships they were involved in would need to be addressed as part of the estate.

- Public Attention: The high-profile nature of the case could attract media attention, potentially leading to increased scrutiny and complicating the process.

The Role of a Will and Potential Disputes

A valid will is the cornerstone of estate planning, outlining how assets should be distributed. However, even with a will, disputes can arise.

- Will Interpretation: Ambiguities in the will’s language can lead to disputes over its meaning and intent.

- Beneficiary Disputes: Beneficiaries may disagree with the distribution Artikeld in the will, particularly if they feel they have been unfairly treated.

- Claims of Undue Influence: Beneficiaries might claim that the will was created under duress or because of undue influence exerted by another party.

- Missing Assets: Disputes can arise if assets are not accounted for in the will, leading to questions about their ownership or distribution.

Potential Beneficiaries and Possible Shares

This table provides a hypothetical overview of potential beneficiaries and possible shares, assuming a simplified scenario. The actual distribution will depend on the will’s specific provisions and any applicable laws. It is essential to remember that this is a fictional example, and the actual distribution will depend on the specifics of the Kessler Twins’ will.

| Beneficiary | Relationship | Possible Asset | Possible Share |

|---|---|---|---|

| Surviving Family Members (e.g., Nieces/Nephews) | Family | Real Estate, Investments, Personal Property | Variable, depending on the will’s provisions. Could be divided equally or based on specific instructions. |

| Charitable Organizations | Chosen by the Twins | Cash, Investments | Percentage or specific amounts designated in the will. |

| Long-Term Caregivers/Assistants | Non-Family | Cash, Specific Items | Potentially specific bequests, as Artikeld in the will. |

| Legal Representatives/Executor | Professionals | Estate Funds | Fees and expenses, as per legal and financial agreements. |

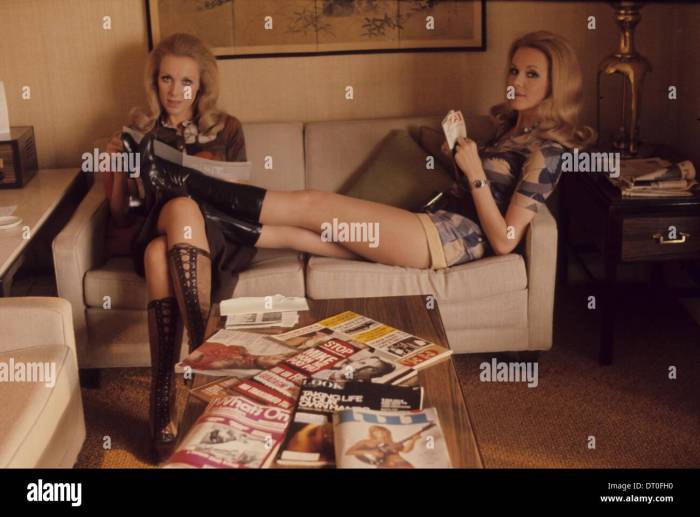

Assets, Liabilities, and Potential Outcomes

Source: alamy.com

The passing of the Kessler Twins necessitates a comprehensive examination of their estate, encompassing their assets, any outstanding debts, and the potential outcomes for their beneficiaries. This process is crucial for ensuring a fair and legally sound distribution of their possessions and wealth. Understanding the interplay of assets, liabilities, and tax implications is paramount in navigating the complexities of inheritance.

Identifying Assets

The Kessler Twins, having enjoyed long and successful careers, likely accumulated a diverse portfolio of assets. These assets form the foundation of their estate and will be subject to the inheritance process.

- Real Estate: This could include residential properties, such as apartments, houses, or vacation homes. Given their lifestyle, it is plausible they owned properties in multiple locations.

- Financial Investments: This would encompass stocks, bonds, mutual funds, and other investment vehicles. Their financial advisors would have managed these investments over time.

- Bank Accounts: Checking and savings accounts held at various financial institutions would be included.

- Personal Property: This broad category includes items like vehicles (cars, possibly vintage models), jewelry, artwork, antiques, and other collectibles. Given their celebrity status, valuable items of this nature are highly probable.

- Intellectual Property: Royalties from their performances, recordings, and any other intellectual property rights would also constitute assets.

- Business Interests: If the twins had any business ventures or ownership stakes in companies, these would be part of the estate.

Methods for Dividing Assets

The division of assets depends heavily on the presence and stipulations of a will. Without a will, the assets will be distributed according to the laws of intestacy in the jurisdiction where they resided.

- Will with Specific Bequests: If a will exists, it likely Artikels specific bequests, naming the beneficiaries and the assets they are to receive. For example, a particular piece of jewelry or a sum of money could be designated for a specific person.

- Will with Residuary Clause: The will would also contain a residuary clause, which addresses the remaining assets after specific bequests are fulfilled. This clause designates how the rest of the estate is to be divided among the beneficiaries.

- Intestacy (Without a Will): If no valid will exists, the distribution follows the laws of the jurisdiction. Typically, this means assets are divided among surviving spouses, children, and other close relatives according to a predetermined formula.

- Asset Valuation and Liquidation: Before distribution, assets must be valued. Some assets, like real estate, require professional appraisals. Others may need to be liquidated (sold) to generate cash for distribution or to satisfy debts.

Impact of Debts and Taxes

Debts and taxes significantly influence the inheritance process, potentially reducing the value of the assets available to beneficiaries.

- Outstanding Debts: Any outstanding debts owed by the Kessler Twins, such as mortgages, credit card debt, or personal loans, must be settled before assets can be distributed. The estate will be responsible for paying these debts.

- Estate Taxes: Depending on the size of the estate and the applicable tax laws, estate taxes may be levied. These taxes are calculated on the gross value of the estate before distribution. The tax rate can vary depending on the jurisdiction and the value of the estate.

- Income Taxes: Income generated by the estate during the probate process, such as interest earned on bank accounts or dividends from investments, may be subject to income tax.

- Calculating Net Distributable Assets:

Net Distributable Assets = (Total Assets – Debts – Taxes)

This formula determines the actual value available for distribution to the beneficiaries.

Potential Outcomes for Beneficiaries

The final distribution of assets can vary significantly depending on the factors mentioned above.

- Beneficiary Receives Designated Asset: If a specific asset is bequeathed to a beneficiary, they will receive that asset. For example, a beneficiary might receive a piece of artwork.

- Beneficiary Receives Cash or Investments: Beneficiaries may receive a specified sum of money or a portion of the investment portfolio. This is common when the estate is relatively liquid.

- Beneficiary Receives a Share of the Residuary Estate: Beneficiaries named in the residuary clause will receive a percentage or a portion of the remaining assets after specific bequests and debts are addressed.

- Beneficiary Receives Nothing (Due to Debt or Tax): In some cases, if the estate is heavily indebted or subject to significant taxes, beneficiaries may receive little or nothing.

- Contested Will: If there is a dispute over the validity of the will or the distribution of assets, the beneficiaries may face legal challenges that can delay or alter the outcome.

Detailed Description of a Potential Valuable Item for Auction

Given the Kessler Twins’ careers and lifestyle, it is plausible they possessed valuable items. A potential item for auction might be a custom-made, diamond-encrusted bracelet.

- Description: The bracelet is crafted from platinum and features a series of individually set, flawless, round-cut diamonds. The diamonds are of exceptional clarity and brilliance. The bracelet is a substantial piece, designed to be a statement of elegance. The clasp is subtly integrated, bearing a small engraving of the twins’ initials intertwined.

- Provenance: The bracelet was likely commissioned by the Kessler Twins in the late 1960s or early 1970s. It was a custom piece created by a renowned jeweler, known for their work with celebrities. The bracelet was often worn by the twins during their performances and public appearances. Documentation would include a certificate of authenticity from the jeweler and photographs of the twins wearing the bracelet at various events.

- Significance: This bracelet is more than just a piece of jewelry; it is a symbol of their fame and the era in which they thrived. The item’s provenance and craftsmanship elevate its value. It represents a significant part of the Kessler Twins’ legacy and will be of interest to collectors of jewelry, memorabilia, and items associated with entertainment history. This item could potentially fetch a significant price at auction, potentially in the hundreds of thousands of dollars, given its historical significance, the quality of the materials, and its association with the iconic Kessler Twins.

Final Summary

The Kessler twins’ legacy extends beyond their artistic contributions; it now includes the complexities of inheritance. This exploration has illuminated the process of settling their estate, from identifying assets and liabilities to understanding the potential distribution among beneficiaries. As the final curtain falls on their remarkable lives, the intricacies of their inheritance serve as a poignant reminder of the enduring impact of their talent and the lasting influence of their careers.

The settlement process will undoubtedly be watched closely by fans and legal experts alike, a final chapter in the story of two extraordinary women.

Key Questions Answered

What is probate?

Probate is the legal process of administering a deceased person’s estate, including validating the will, identifying assets, paying debts and taxes, and distributing assets to beneficiaries.

What happens if the Kessler twins had no will?

If the Kessler twins did not have a will (died intestate), their estate would be distributed according to the laws of intestacy in their jurisdiction. This typically means assets are divided among surviving family members, following a pre-defined legal hierarchy.

Are taxes involved in the inheritance process?

Yes, inheritance often involves estate taxes and potentially income taxes on any assets that generate income after the twins’ passing. The specific tax implications depend on the size of the estate, the jurisdiction, and the assets involved.

Who might be potential beneficiaries?

Potential beneficiaries could include immediate family members, relatives, friends, or any charitable organizations they may have supported, as designated in their will or by default rules.