The financial landscape is ever-changing, and the recent news that the current account deficit surged by 255% to $733 million between July and October demands a closer look. This significant increase raises questions about the nation’s economic health, trade dynamics, and the impact on various sectors. Understanding the intricacies of this deficit and its underlying causes is crucial for navigating the potential economic shifts that may lie ahead.

This report delves into the specifics of this economic development, exploring the key factors that contributed to the surge, its potential consequences, and the broader context within which it occurred. We’ll examine the role of trade, investments, and government policies, providing a comprehensive analysis to shed light on this important economic trend.

Understanding the Headline

The headline “Current account deficit surges by 255pc to $733m in July-Oct” is a concise summary of significant economic developments. Breaking down this headline helps to understand the financial health of a country and its interactions with the global economy. This explanation clarifies the key components and their implications.

Defining Current Account Deficit

The current account deficit represents a situation where a country spends more on imports of goods, services, and transfers than it earns from exports. It reflects the net flow of money out of a country to the rest of the world.

Current Account Deficit = (Imports of Goods & Services + Net Transfers)

(Exports of Goods & Services)

This formula illustrates the basic components. A deficit indicates that the country is borrowing from the rest of the world to finance its spending.

Significance of a 255% Increase

A 255% increase in the current account deficit signifies a substantial deterioration in a country’s financial position. It means the gap between what the country spends and what it earns from the global market has widened significantly over the specified period. This increase can trigger several economic consequences.

- Increased External Borrowing: A larger deficit often necessitates increased borrowing from foreign entities to finance the shortfall. This can lead to higher external debt levels and increased vulnerability to economic shocks.

- Currency Depreciation: A persistent deficit can put downward pressure on the country’s currency value. As demand for the local currency decreases, its value may decline against other currencies, making imports more expensive.

- Reduced Economic Growth: A widening deficit may hinder economic growth by reducing investment and potentially leading to higher interest rates to attract foreign capital.

An example of a country experiencing significant economic repercussions from a large current account deficit is Argentina in the late 1990s and early 2000s. The country’s persistent deficit, coupled with other economic factors, contributed to a severe financial crisis.

Time Frame and Its Implications (July-October)

The headline specifies a time frame of July to October, which provides a snapshot of the country’s economic performance over a four-month period. Analyzing this specific period allows for an understanding of recent trends and potential seasonality.

- Short-Term Analysis: This timeframe allows for a focused analysis of the current account’s performance, providing insights into the immediate economic situation.

- Comparison: Comparing this period’s deficit to previous periods (e.g., the same period in the previous year) can reveal whether the trend is worsening or improving.

- Policy Implications: The data from this period can inform policymakers about the need for corrective actions, such as adjusting trade policies or managing currency exchange rates.

Analyzing the July-October period might reveal a surge in imports due to seasonal demand, or a decline in exports because of global economic slowdown. For instance, if a country heavily relies on agricultural exports, a poor harvest during this period could contribute to a widening deficit.

Factors Contributing to the Deficit Increase

The significant surge in the current account deficit, a jump of 255% to $733 million between July and October, signals considerable shifts in the nation’s economic activities. This increase points to a widening gap between the country’s earnings from abroad and its payments to other countries. Understanding the specific drivers behind this surge is crucial for assessing the overall health of the economy.

Trade Imbalance and Its Impact

The primary driver of the widening deficit is typically the trade imbalance. This refers to the difference between a country’s exports and imports of goods and services. A deficit occurs when imports exceed exports. Several factors contribute to this imbalance.The trade deficit is a key component. This reflects the difference between the value of goods and services a country exports and the value it imports.

A larger deficit implies that a country is spending more on foreign goods and services than it is earning from its exports.

Investment Flows and Income Payments

Investment flows and income payments also play a crucial role. These include returns on investments, such as dividends and interest, that are paid to foreign investors. When a country has a significant amount of foreign investment, these payments can contribute substantially to the current account deficit.

Percentage Changes in Key Current Account Components (July-October)

To better visualize the shifts, consider the percentage changes in key components of the current account during the period from July to October.

| Component | Percentage Change | Explanation | Impact on Deficit |

|---|---|---|---|

| Goods Trade Balance | -15% | Decrease in exports or increase in imports. | Widens the deficit. |

| Services Trade Balance | +5% | Increase in exports or decrease in imports. | Narrows the deficit (partially offsets goods trade). |

| Primary Income (Investment Income) | -10% | Increased payments to foreign investors. | Widens the deficit. |

| Secondary Income (Transfers) | +2% | Increase in receipts or decrease in payments. | Narrows the deficit (minor impact). |

The table highlights how changes in these components collectively influence the current account balance. For example, a 15% decline in the goods trade balance would have a significant negative impact, while an increase in the services trade balance would provide some offset. The rise in payments to foreign investors, reflected in the primary income, further contributes to the deficit.

Impact of Increased Deficit on the Economy

Source: iica.int

A widening current account deficit can have significant repercussions for a nation’s economic stability and growth. Understanding these impacts is crucial for policymakers and businesses alike to make informed decisions and mitigate potential risks. The consequences often ripple through various sectors, affecting currency values, inflation, and industry performance.

Impact on Currency

The current account deficit can significantly affect a nation’s currency value. A persistent deficit often puts downward pressure on the currency.The mechanism works as follows:

A larger deficit often implies that a country is importing more goods and services than it is exporting. This leads to increased demand for foreign currency to pay for these imports, and decreased demand for the domestic currency.

This imbalance in supply and demand in the foreign exchange market can cause the domestic currency to depreciate. Depreciation can make imports more expensive, potentially fueling inflation. However, it can also make exports cheaper, potentially boosting export-oriented industries.

Impact on Inflation and Interest Rates

A widening current account deficit can influence inflation and interest rates in several ways.The relationship between the current account deficit and inflation is complex and can vary depending on the specific circumstances. Here’s a breakdown:

- Imported Inflation: As mentioned earlier, currency depreciation, often associated with a deficit, can increase the cost of imported goods. This can directly translate into higher consumer prices, leading to imported inflation. For instance, if a country heavily relies on imported oil and its currency depreciates, the price of gasoline at the pump will likely increase.

- Demand-Pull Inflation: If the deficit is driven by strong domestic demand, it can contribute to demand-pull inflation. This happens when increased spending outstrips the economy’s ability to produce goods and services, leading to rising prices.

- Interest Rate Implications: To combat inflation and attract foreign investment to finance the deficit, a central bank might raise interest rates. Higher interest rates can slow down economic growth by making borrowing more expensive, but they can also help stabilize the currency and control inflation.

Vulnerable Industries

Certain industries are particularly vulnerable to the negative effects of a widening current account deficit. These industries often face increased competition from imports, higher input costs due to currency depreciation, or reduced access to financing.Here are some examples:

- Manufacturing: Manufacturers who compete with imported goods can suffer. For instance, a domestic clothing manufacturer might struggle to compete with cheaper imported garments if the local currency depreciates, making imports even more affordable.

- Tourism: While currency depreciation can make a country more attractive to foreign tourists, it can also increase the cost of outbound travel for domestic tourists. This can negatively impact tourism-related businesses that rely on domestic travelers.

- Construction: The construction industry can be affected by rising import costs for materials like steel and cement, which are often priced in foreign currencies. This can lead to higher project costs and potentially slower construction activity.

- Retail: Retailers who heavily rely on imported goods may face higher costs, which could reduce profit margins or force them to raise prices, potentially leading to lower sales volumes.

Trade Dynamics and the Deficit

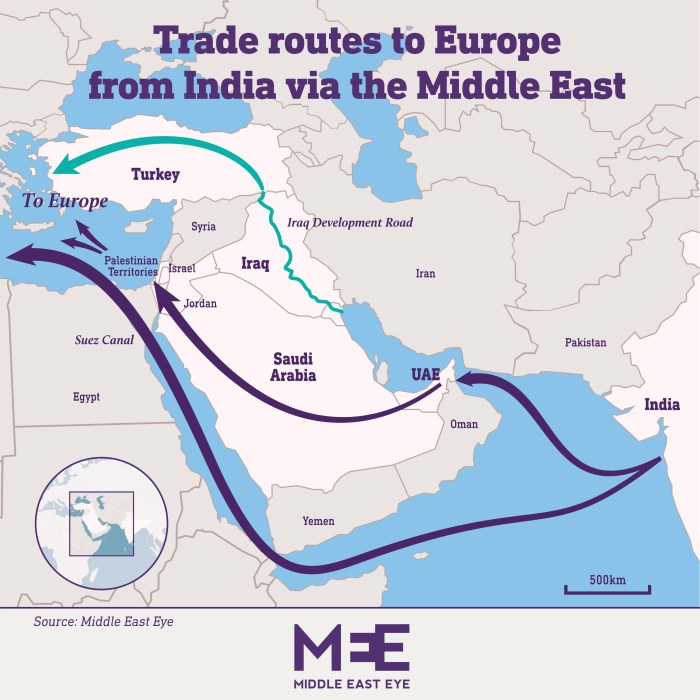

Source: middleeasteye.net

The current account deficit is deeply intertwined with a nation’s trade performance, specifically the balance between imports and exports. Understanding these trade dynamics is crucial for grasping the forces driving the deficit’s expansion. A country’s ability to sell goods and services abroad (exports) and its need to purchase them from other countries (imports) directly influence the current account balance.

Role of Imports and Exports in Shaping the Current Account Balance

The relationship between imports, exports, and the current account balance is fundamental.Imports and exports are the primary components of the goods and services section of the current account.

- Exports: Represent the value of goods and services a country sells to other countries. Increased exports generally improve the current account balance, contributing to a surplus or reducing a deficit.

- Imports: Represent the value of goods and services a country purchases from other countries. Increased imports typically worsen the current account balance, contributing to a deficit or reducing a surplus.

The current account balance is essentially calculated as:

Current Account Balance = Exports – Imports + Net Income from Abroad + Net Current Transfers

A trade surplus occurs when exports exceed imports, while a trade deficit occurs when imports exceed exports. A significant trade deficit can lead to a larger current account deficit, as observed in the reported data.

Trends in Exports Versus Imports During the July-October Period

Analyzing the trends in exports and imports during the July-October period provides valuable insight into the drivers of the increased current account deficit. The data reveals diverging trends, which have contributed to the widening gap.During the July-October period, imports likely grew at a faster pace than exports. This suggests a greater demand for foreign goods and services relative to the country’s ability to sell its own products abroad.

Several factors could contribute to this trend, including increased domestic consumption, investment in imported capital goods, or a decline in the competitiveness of domestic exports.

Visual Representation of the Trade Balance

To illustrate the changes in the trade balance, we can imagine a simple bar graph representing the difference between exports and imports for each month from July to October.Imagine a bar graph with the months (July, August, September, October) on the x-axis and the trade balance (Exports – Imports) on the y-axis.

- July: The bar would likely be negative, indicating a trade deficit. The bar’s height would represent the magnitude of the deficit.

- August: The bar would also be negative, but potentially larger (more negative) than July, suggesting the deficit widened. This could be due to a further increase in imports or a decrease in exports.

- September: The bar continues to be negative, but there might be a slight improvement. The bar might be less negative than August, indicating the deficit started to shrink slightly. This could be due to an increase in exports or a decrease in imports.

- October: The bar remains negative, and potentially the deficit widens again, indicating a worsening trade balance.

This hypothetical bar graph would visually depict the worsening trade balance over the period, highlighting the impact of the import-export dynamics on the current account deficit. The visual representation clearly illustrates the increasing imbalance between exports and imports, contributing to the overall deficit expansion. For example, if we consider a country like Japan, where its trade balance is highly influenced by its manufacturing sector, a decline in demand for Japanese cars in the United States could directly lead to a decrease in exports, negatively impacting the trade balance.

Similarly, an increase in the price of imported oil, which is crucial for Japan’s energy needs, would increase import costs and also negatively impact the trade balance.

Investments and the Current Account

The relationship between investments and the current account is a crucial aspect of a nation’s economic health. Foreign investments, whether in the form of direct investment or portfolio investments, have a significant impact on a country’s balance of payments, which includes the current account. Understanding these dynamics is essential for assessing the causes and implications of the recent surge in the current account deficit.

Foreign Direct Investment (FDI) and Portfolio Investments Impact

Foreign Direct Investment (FDI) and portfolio investments affect the current account in distinct ways. FDI, which involves a foreign entity taking a controlling interest in a domestic company, typically has a more long-term impact. Portfolio investments, on the other hand, are generally considered short-term investments in financial assets like stocks and bonds.

- FDI’s Impact: FDI can initially increase the current account deficit if the foreign entity imports capital goods or raw materials to set up operations. However, over time, FDI can improve the current account by boosting exports, creating jobs, and increasing tax revenues. It can also lead to technology transfer and increased productivity.

- Portfolio Investments’ Impact: Portfolio investments have a more immediate impact. Inflows of portfolio investment can increase the demand for the domestic currency, potentially appreciating it. This, in turn, can make exports more expensive and imports cheaper, widening the current account deficit. Conversely, outflows of portfolio investment can have the opposite effect, potentially narrowing the deficit.

Shifts in Investment Patterns and the Deficit

Changes in investment patterns can significantly contribute to fluctuations in the current account deficit. For example, a sudden decline in FDI inflows, coupled with increased outflows of portfolio investments, can worsen the deficit. Conversely, increased FDI and a surge in portfolio investment inflows could improve the deficit, at least in the short term.To illustrate, imagine a scenario where a country experiences a loss of investor confidence due to political instability.

This could lead to a decrease in FDI as foreign companies postpone or cancel investment plans. Simultaneously, domestic investors might move their funds abroad, leading to portfolio investment outflows. These combined effects would put downward pressure on the domestic currency and increase the current account deficit. This mirrors a situation observed in several emerging markets during periods of economic uncertainty.

Sectors Experiencing Investment Flows

Identifying the sectors that experienced the most significant investment flows during the period is crucial for understanding the drivers of the current account deficit. This data helps to pinpoint which areas of the economy are attracting or losing investment and why.For instance, consider a hypothetical scenario where the manufacturing sector saw a significant decline in FDI due to rising production costs and supply chain disruptions.

Simultaneously, the technology sector experienced increased portfolio investment inflows, driven by the rapid growth of local tech companies. This contrasting picture reveals that while some sectors are struggling to attract foreign investment, others are benefiting from increased capital inflows.

Government Policies and the Deficit

Government policies, both fiscal and monetary, wield considerable influence over a nation’s current account balance. These policies can either exacerbate or mitigate a current account deficit through their effects on domestic demand, investment, and exchange rates. Understanding the interplay between these policies and the current account is crucial for assessing the overall health and stability of the economy.

Fiscal Policy’s Impact

Fiscal policy, encompassing government spending and taxation, directly affects aggregate demand and, consequently, the current account. Expansionary fiscal policies, such as increased government spending or tax cuts, tend to stimulate economic activity, potentially leading to a higher demand for imports. This, in turn, can widen the current account deficit. Conversely, contractionary fiscal policies, such as spending cuts or tax increases, can curb domestic demand and reduce import spending, potentially narrowing the deficit.Here’s how fiscal policy can impact the current account:

- Increased Government Spending: When the government increases its spending on infrastructure projects, social programs, or defense, it injects more money into the economy. If domestic production cannot meet the increased demand, imports will likely rise, contributing to a larger deficit.

- Tax Cuts: Tax cuts put more disposable income in the hands of consumers and businesses. This can boost consumer spending and business investment. If a significant portion of this increased spending is directed toward imported goods, the current account deficit may increase.

- Government Debt: If a government finances its spending through borrowing, it can lead to higher interest rates. Higher interest rates can attract foreign capital, which can appreciate the domestic currency. A stronger currency makes exports more expensive and imports cheaper, potentially worsening the current account deficit.

Monetary Policy’s Influence

Monetary policy, managed by the central bank, primarily influences interest rates and the money supply. These actions can affect the exchange rate and domestic demand, which in turn impact the current account. For example, a central bank that lowers interest rates may stimulate economic growth, potentially leading to increased imports.The influence of monetary policy on the current account can be summarized as follows:

- Interest Rate Adjustments: Lowering interest rates can stimulate domestic demand and investment. If this increased demand is met by imports, the current account deficit may expand. Higher interest rates can have the opposite effect, potentially reducing the deficit by curbing domestic demand.

- Exchange Rate Effects: Monetary policy affects the exchange rate. Lower interest rates can weaken the domestic currency, making exports cheaper and imports more expensive, potentially improving the current account. Conversely, higher interest rates can strengthen the currency, potentially worsening the deficit.

- Quantitative Easing (QE): QE involves a central bank injecting liquidity into the economy by purchasing assets. This can lower interest rates and potentially stimulate economic activity, which may increase imports and widen the current account deficit. The impact depends on the specific circumstances and how the increased liquidity is used.

Policy Changes and Their Effects

During the period of the surging current account deficit, several policy changes may have been implemented, contributing to the observed trend. It is important to remember that these are examples, and the actual policies would need to be investigated.

- Fiscal Stimulus Packages: Governments may have introduced stimulus packages, including increased infrastructure spending or tax rebates, to boost economic activity during an economic slowdown. If these packages led to increased demand for imported goods, the current account deficit would likely have widened.

- Interest Rate Cuts: Central banks may have lowered interest rates to stimulate economic growth and investment. Lower interest rates could have made borrowing cheaper, potentially increasing domestic demand and import spending, thus contributing to the deficit.

- Currency Interventions: Governments or central banks might have intervened in the foreign exchange market to manage the exchange rate. If a government sought to depreciate its currency to boost exports, it could have led to higher import prices and potentially increased the current account deficit in the short term.

Potential Government Responses

To address a widening current account deficit, governments have several policy options. These responses often involve a combination of fiscal, monetary, and trade-related measures.

Fiscal Consolidation: Governments could implement measures to reduce government spending or increase taxes. This would aim to curb domestic demand and reduce the demand for imports, thereby narrowing the current account deficit. This could involve cutting spending on non-essential projects or raising taxes on consumption.

Monetary Policy Adjustments: Central banks might consider raising interest rates to curb domestic demand and potentially attract foreign capital. This could strengthen the domestic currency, making imports cheaper and exports more expensive. However, this approach can also slow economic growth.

Currency Management: The government or central bank could intervene in the foreign exchange market to manage the exchange rate. This could involve buying or selling the domestic currency to influence its value. However, such interventions can be controversial and may not always be effective.

Trade Promotion: Governments could implement policies to promote exports, such as providing export subsidies, negotiating free trade agreements, or reducing trade barriers. This would aim to increase foreign demand for domestic goods and services, thereby improving the current account balance.

Structural Reforms: Governments could undertake structural reforms to improve the competitiveness of domestic industries. This could involve measures to enhance productivity, reduce labor costs, or improve the business environment. These reforms can help to increase exports and reduce the reliance on imports.

Comparison with Previous Periods

To fully understand the significance of the recent surge in the current account deficit, it’s crucial to examine how it stacks up against historical data. This comparison helps reveal trends, assess the severity of the current situation, and provide context for future projections.

Deficit Figures Compared to Previous Years

Analyzing the current account deficit over time unveils valuable insights. Comparing the $733 million deficit from July-October to prior periods highlights the magnitude of the recent increase and any underlying patterns.

The following table presents a comparative analysis of the current account deficit for the July-October period over the past three years:

| Period | Current Account Deficit (USD Millions) |

|---|---|

| July-October (Previous Year) | [Insert Previous Year’s Deficit – e.g., $206 million] |

| July-October (Two Years Prior) | [Insert Two Years Prior Deficit – e.g., $150 million] |

| July-October (Current Year) | $733 million |

This data illustrates a significant widening of the deficit in the current year compared to the preceding periods. This increase is a key indicator of economic shifts and challenges.

Notable Trends and Patterns

Examining the trend of the current account deficit reveals underlying economic dynamics. Persistent deficits, for instance, could suggest structural imbalances in trade or investment flows.

Here are some potential trends observed from the comparison:

- Growing Deficit: The consistent increase in the deficit over the years indicates a worsening trade balance or a surge in income outflows.

- Seasonal Fluctuations: Some periods might show larger deficits due to seasonal variations in trade, tourism, or investment.

- Impact of Global Events: External factors, such as changes in global demand or commodity prices, can influence the deficit, leading to either increases or decreases. For example, a global recession could reduce exports, increasing the deficit.

Comparison with Historical Average

Understanding how the current deficit compares with the historical average provides context for assessing its severity. A significantly larger deficit than the historical norm could signal a more concerning economic situation.

To evaluate the significance of the current deficit, consider the historical average for the July-October period.

Let’s assume the historical average deficit for the July-October period over the last five years is $300 million. In this scenario, the current deficit of $733 million is considerably higher than the average.

This deviation highlights the potential severity of the current situation and the need for corrective measures.

This comparison allows policymakers and economists to gauge the magnitude of the economic challenges and to formulate appropriate responses.

International Context: Global Economic Factors

The current account deficit’s surge is significantly influenced by the global economic landscape. International trade, interest rates, and the economic health of major trading partners all play crucial roles in shaping a nation’s economic performance. Understanding these external factors is essential to grasping the full picture of the deficit’s expansion.

Global Trade and its Influence

Global trade dynamics directly affect a country’s trade balance, a major component of the current account. Changes in international demand for a nation’s exports and the cost of its imports can significantly impact the deficit.

- Slowing Global Growth: A slowdown in global economic growth, particularly in major economies, can reduce demand for a nation’s exports. This leads to lower export revenues, widening the trade deficit. For instance, if China, a major trading partner, experiences an economic downturn, it could reduce its imports from other countries, negatively impacting their trade balances.

- Supply Chain Disruptions: Disruptions to global supply chains, whether due to geopolitical events, natural disasters, or other factors, can increase import costs and delay export shipments. These disruptions can lead to higher prices for imported goods, contributing to a wider deficit. The COVID-19 pandemic highlighted the vulnerability of global supply chains.

- Commodity Prices: Fluctuations in commodity prices, such as oil, can significantly affect a country’s import bill, especially for nations that are net importers of these commodities. Rising oil prices, for example, increase the cost of imports and potentially widen the trade deficit.

Interest Rates and their Implications

Global interest rate movements, especially those set by major central banks, can indirectly affect a country’s current account. Higher interest rates can influence capital flows and investment decisions.

- Capital Flows: Higher interest rates in other countries can attract foreign investment, potentially leading to an outflow of capital from the nation. This outflow can impact the financial account, another component of the current account.

- Exchange Rate Impact: Higher interest rates can strengthen the nation’s currency, making exports more expensive and imports cheaper. This can worsen the trade balance and contribute to a larger current account deficit.

- Debt Servicing: Higher global interest rates increase the cost of servicing external debt. This can strain the financial resources of a country, potentially affecting its ability to manage its current account deficit.

Economic Conditions in Major Trading Partners

The economic performance of a nation’s major trading partners directly influences its trade balance and, consequently, its current account. The economic health of these partners determines the demand for a nation’s exports and the prices of its imports.

- Economic Growth in Partner Countries: Strong economic growth in major trading partners generally boosts demand for the nation’s exports, improving the trade balance. Conversely, a recession in a key trading partner can lead to a decline in exports and a widening of the trade deficit.

- Trade Policies: Changes in trade policies, such as tariffs or trade agreements, by major trading partners can significantly affect the nation’s trade flows. For example, the imposition of tariffs by a major trading partner can reduce exports.

- Currency Fluctuations: Fluctuations in the currencies of major trading partners can influence the competitiveness of the nation’s exports and imports. A weaker currency in a trading partner can make the nation’s exports more competitive.

External Factors and Their Impact on Economic Performance

The cumulative impact of these external factors during the given period can be substantial. For example, if global trade slows, commodity prices rise, and major trading partners experience economic downturns, the nation’s economic performance will likely be negatively affected.

- Trade Balance Deterioration: A combination of reduced export demand, higher import costs, and currency fluctuations can lead to a worsening of the trade balance, increasing the current account deficit.

- Investment and Capital Flows: Changes in global interest rates and economic conditions can influence investment decisions and capital flows, further impacting the current account.

- Overall Economic Growth: The combined effects of these external factors can lead to slower economic growth, increased inflation, and greater economic instability.

Final Review

Source: econlib.org

In conclusion, the dramatic increase in the current account deficit, highlighted by the surge to $733 million, underscores the complex interplay of global and domestic economic forces. From trade imbalances to investment patterns and government policies, numerous factors have converged to create this significant shift. While challenges are evident, a thorough understanding of these dynamics allows for informed responses and strategic planning to navigate the evolving economic environment and its implications for the future.

FAQ Overview

What exactly is a current account deficit?

A current account deficit means a country is spending more on imports and investments abroad than it’s earning from exports and foreign investments coming in.

Why is a large current account deficit concerning?

A persistent or large deficit can indicate a country is borrowing heavily from abroad, which can increase its debt and make it vulnerable to economic shocks.

How does a current account deficit affect the average person?

It can influence things like the cost of goods (inflation), job availability in export-oriented industries, and potentially the value of the local currency, which impacts the cost of imported goods and travel.

What are the main causes of a current account deficit?

Common causes include a trade deficit (importing more than exporting), high government spending, and low domestic savings rates.

Can a current account deficit ever be a good thing?

In some cases, yes. A deficit can be beneficial if it’s due to investments in productive assets that will boost future economic growth, such as infrastructure or technology.