The European Commission forecasts Latvian economic growth of 1% this year, a figure that sparks interest in Latvia’s economic trajectory. This forecast is not just a number; it’s a reflection of the intricate dance of internal and external factors influencing the nation’s financial health. It’s a look at how Latvia is navigating a complex global landscape, from geopolitical uncertainties to domestic policies, all impacting its economic performance.

This analysis dives deep into the European Commission’s methodology, exploring the key indicators they monitor and how this 1% growth forecast compares to past predictions and neighboring countries. We’ll uncover the sectors driving this growth, the challenges and opportunities it presents, and the role of government policies in shaping Latvia’s economic future. This journey will provide a comprehensive understanding of what this forecast means for Latvia.

Understanding the Forecast: Latvian Economic Growth

The European Commission’s forecast of 1% economic growth for Latvia this year provides a crucial benchmark for understanding the country’s economic trajectory. This forecast is not just a number; it represents a comprehensive assessment of various economic factors and their potential impact on Latvia’s performance. It serves as a key reference point for businesses, investors, and policymakers alike, influencing decisions and strategies related to investment, job creation, and economic stability.

Significance of the 1% Growth Forecast

The 1% growth forecast signifies a moderate expectation for Latvia’s economic expansion. It indicates that the European Commission anticipates a continuation of economic activity, albeit at a slower pace compared to periods of stronger growth. This rate suggests a degree of resilience in the Latvian economy, despite potential headwinds such as global economic uncertainties, geopolitical tensions, or specific domestic challenges.

The forecast also influences the availability of funds and grants for Latvia from the European Union, which are often tied to economic performance indicators.

Factors Considered in the Forecast

The European Commission’s forecast incorporates a wide range of factors, reflecting a thorough analysis of the Latvian economy and its external environment.

- Global Economic Outlook: The Commission assesses the global economic climate, including growth rates in major trading partners, commodity prices, and international trade flows. For example, a slowdown in the Eurozone, a significant trading partner for Latvia, could negatively impact Latvian exports and overall growth.

- Domestic Demand: The forecast considers domestic consumption, investment, and government spending. Consumer confidence, influenced by factors like inflation and employment, plays a crucial role. Investment levels, driven by business confidence and access to credit, are also significant.

- External Trade: Latvia’s export performance is a key driver of its economy. The Commission analyzes export trends, the competitiveness of Latvian businesses, and trade agreements. A strong export sector can boost economic growth.

- Labor Market Conditions: Employment rates, wage growth, and labor productivity are crucial indicators. A tight labor market can lead to wage pressures, potentially impacting competitiveness.

- Fiscal Policy: Government spending, taxation, and debt levels are assessed. Fiscal policies aimed at stimulating the economy or managing debt can influence growth prospects.

- Inflation: Inflation rates and price stability are closely monitored. High inflation can erode purchasing power and dampen economic activity.

The European Commission uses complex economic models and data analysis to integrate these factors into its forecasts.

Historical Economic Growth Data for Latvia (Past Five Years)

Analyzing past economic performance provides context for understanding the current forecast. Here’s a look at Latvia’s annual GDP growth rates over the past five years (please note, this is for illustrative purposes; accurate data would need to be sourced from the European Commission or national statistical offices).

(Please note: Actual growth rates can vary. This is a hypothetical example)

| Year | Annual GDP Growth (%) |

|---|---|

| 2019 | 3.2% |

| 2020 | -3.6% |

| 2021 | 4.8% |

| 2022 | 2.0% |

| 2023 | 0.5% |

The provided table illustrates a pattern of growth, contraction (2020, likely due to the COVID-19 pandemic), and recovery. The 2023 figure, at 0.5%, indicates a slowdown compared to the previous years, which might influence the European Commission’s 1% forecast for the current year. This slowdown could be attributed to a variety of factors such as decreased consumer spending or global economic instability.

European Commission’s Role and Methodology

The European Commission plays a crucial role in providing economic forecasts for the European Union member states. These forecasts are vital for policymakers, businesses, and citizens alike, as they offer insights into the economic outlook and help inform decisions. The Commission’s assessments are based on a comprehensive methodology that involves analyzing a wide range of economic indicators and utilizing sophisticated modeling techniques.

European Commission’s Role in Economic Forecasting

The European Commission’s primary function in economic forecasting is to provide independent and impartial assessments of the economic situation and outlook for the EU and its member states. These forecasts serve several key purposes. They inform the European Parliament, the Council of the European Union, and the European Central Bank (ECB) about potential economic risks and opportunities. They also contribute to the coordination of economic policies among member states and are used as a basis for budgetary surveillance.

Moreover, the forecasts are used by businesses and investors to make informed decisions about their activities within the EU. The Commission typically publishes its forecasts four times a year: in the spring, summer, autumn, and winter. These publications are eagerly awaited and widely referenced by economists and financial analysts globally.

Methodology for Creating Economic Forecasts

The European Commission’s forecasting methodology is a complex process that combines quantitative and qualitative analysis. It relies on a combination of macroeconomic models, statistical analysis, and expert judgment.The process involves several key steps:* Data Collection: The Commission gathers extensive data from various sources, including national statistical offices, international organizations (such as the IMF and OECD), and private sector institutions.

This data covers a broad range of economic variables, including GDP growth, inflation, employment, trade, and government finances.

Model Development and Calibration

The Commission utilizes macroeconomic models, which are mathematical representations of the economy, to simulate the effects of different economic scenarios. These models are calibrated using historical data and are regularly updated to reflect changes in the economic environment.

Scenario Analysis

The Commission develops different economic scenarios based on various assumptions about external factors, such as global economic growth, commodity prices, and financial market conditions. These scenarios help assess the sensitivity of the economic outlook to different risks and uncertainties.

Expert Judgment and Review

The Commission’s economists and experts review the model results and provide their expert judgment. This process involves analyzing the underlying assumptions, assessing the plausibility of the results, and incorporating qualitative information that may not be captured by the models.

Publication and Dissemination

The Commission publishes its forecasts in regular reports, which are widely disseminated to the public. These reports include detailed analysis, charts, and tables that present the economic outlook and the underlying assumptions.

Key Indicators Monitored by the European Commission

The European Commission monitors a wide range of economic indicators to assess a country’s economic outlook. These indicators provide insights into various aspects of the economy, including growth, inflation, employment, and external balances.Here is a table showing some of the key indicators monitored:“`html

| Indicator Category | Key Indicators | Description | Relevance |

|---|---|---|---|

| Economic Growth | GDP Growth Rate | Percentage change in the value of goods and services produced in a country over a specific period. | Reflects the overall health and expansion of the economy. |

| Inflation | Consumer Price Index (CPI) | Measures the change in the average prices of a basket of consumer goods and services over time. | Indicates the rate at which prices are rising and affects purchasing power. |

| Labor Market | Unemployment Rate | Percentage of the labor force that is unemployed and actively seeking work. | Reflects the availability of jobs and the overall health of the labor market. |

| Fiscal Policy | Government Debt-to-GDP Ratio | The ratio of a country’s government debt to its gross domestic product. | Indicates the sustainability of public finances and the government’s ability to manage its debt. |

| External Balances | Current Account Balance | Measures the net flow of goods, services, income, and transfers between a country and the rest of the world. | Indicates a country’s international competitiveness and its ability to finance its spending. |

“`For instance, if the unemployment rate in a member state rises significantly, the Commission would likely revise its forecast downwards, anticipating a slowdown in economic growth. Conversely, a strong increase in exports could lead to an upward revision of the growth forecast. These indicators provide a comprehensive picture of a country’s economic performance and are crucial for the Commission’s assessment of the overall economic outlook.

Implications of 1% Growth

Source: choose-forex.com

A 1% economic growth rate, while positive, represents a modest expansion for Latvia. This rate suggests a slow but steady increase in the overall economic activity. It’s crucial to understand the implications of this growth on various aspects of the Latvian economy, including employment, sector performance, and potential challenges and opportunities.

Impact on Employment Rates

The impact of a 1% growth rate on employment in Latvia is likely to be subtle. A growth rate of this magnitude typically does not generate a significant number of new jobs.

- Limited Job Creation: While some sectors might experience marginal growth and thus create a few new positions, the overall effect on unemployment rates is likely to be minimal. The number of new jobs created will probably be close to the number of jobs lost due to automation or economic shifts.

- Potential for Wage Stagnation: With modest growth, businesses might be hesitant to increase wages substantially. This could lead to wage stagnation or very slight increases, impacting the purchasing power of Latvian citizens.

- Focus on Existing Workforce: Companies may prioritize optimizing their existing workforce through increased productivity rather than hiring new employees. This could involve investments in training and development to improve employee skills.

Affected Economic Sectors

Several sectors of the Latvian economy are likely to be directly influenced by a 1% growth rate.

- Manufacturing: Manufacturing, especially sectors focused on exports, may experience slight growth, depending on the global demand for Latvian-made goods. However, significant expansion is unlikely.

- Services: The service sector, including tourism, retail, and hospitality, may experience modest growth, closely tied to the level of consumer spending and international visitor numbers.

- Construction: The construction sector’s performance will depend on public and private investment. Modest growth may occur, but large-scale projects are less likely to be initiated with a low growth rate.

- Agriculture: The agricultural sector, influenced by weather patterns and international trade, could see some fluctuations, but overall growth will probably be limited unless there are favorable conditions and robust export opportunities.

Challenges and Opportunities

A 1% growth rate presents both challenges and opportunities for Latvia.

- Challenges:

- Limited Fiscal Space: A low growth rate restricts the government’s ability to increase tax revenues, potentially limiting investment in public services like healthcare, education, and infrastructure.

- Brain Drain: Young, skilled workers might seek better opportunities elsewhere, leading to a loss of talent and hampering long-term growth prospects.

- Vulnerability to External Shocks: A small economy is susceptible to global economic downturns or unexpected events, such as changes in trade policies or geopolitical instability.

- Opportunities:

- Focus on Efficiency: Businesses might be compelled to improve efficiency and productivity, leading to innovation and better resource allocation.

- Targeted Investment: The government could focus on strategic investments in key sectors, such as technology or renewable energy, to drive future growth.

- Structural Reforms: The government can use this period to implement structural reforms to improve the business environment, attract foreign investment, and boost long-term competitiveness.

Comparison with Previous Forecasts and Other Countries

The European Commission’s forecast of 1% economic growth for Latvia this year provides a snapshot of the country’s current economic trajectory. Understanding this forecast requires contextualization: how does it stack up against past predictions, how does it compare to its neighbors, and how does it relate to the broader European economic landscape? This section aims to provide these crucial comparisons, offering a more complete understanding of Latvia’s economic performance.

Latvia’s Growth Forecast in Historical Context

To fully grasp the significance of the 1% growth forecast, it’s essential to examine how it aligns with previous predictions for Latvia. Comparing current projections with past forecasts reveals trends and potential shifts in the country’s economic outlook.The evolution of economic forecasts over time can be analyzed through a timeline. For example, consider the following:

- Previous Forecasts: In the preceding year, the European Commission might have projected a different growth rate for Latvia. Perhaps it was higher, indicating more optimistic expectations, or lower, reflecting a more cautious view.

- Revisions: Forecasts are often revised. The 1% figure may have been adjusted from an earlier prediction, either upward or downward, based on new economic data and evolving circumstances. For example, initial forecasts may have been more optimistic, only to be revised downward due to unforeseen challenges.

- Factors Influencing Changes: Several factors influence these revisions. Global economic conditions, changes in government policies, and specific sector performance within Latvia all play a role.

Comparison with Other Baltic Countries

Latvia is part of a closely-knit economic region, the Baltic states. Comparing its economic performance with its neighbors, Estonia and Lithuania, provides valuable insights into regional dynamics and competitive advantages.Here’s a comparison:

- Estonia: The European Commission’s forecast for Estonia might differ significantly. Estonia, known for its strong tech sector, might be projected to grow at a faster rate, or perhaps a slower rate depending on global economic trends.

- Lithuania: Similarly, Lithuania’s economic outlook can be compared. Lithuania, with its diverse economy, could be experiencing growth that mirrors, exceeds, or falls short of Latvia’s performance.

- Regional Dynamics: Comparing the three countries helps to highlight regional trends. Are all Baltic states experiencing similar challenges or opportunities? Is one country outperforming the others, and if so, why?

- Key Sectors: The performance of key sectors such as manufacturing, services, and technology in each country contributes to the overall growth rates. Differences in these sectors can explain divergences in economic forecasts.

Latvia’s Growth Rate and the Eurozone Average

Latvia’s membership in the Eurozone necessitates a comparison with the average growth rate of the Eurozone. This comparison helps to assess Latvia’s relative economic performance within the larger European context.Here’s how Latvia’s growth can be assessed in relation to the Eurozone:

- Eurozone Average: The European Commission forecasts an average growth rate for the Eurozone. This rate serves as a benchmark. If Latvia’s 1% growth is higher than the Eurozone average, it indicates relatively strong performance. If it’s lower, it suggests that Latvia might be facing specific challenges.

- Convergence or Divergence: Comparing the growth rates reveals whether Latvia is converging towards or diverging from the broader Eurozone economy. Convergence suggests that Latvia is catching up economically, while divergence may indicate a widening gap.

- Impact of Eurozone Policies: Eurozone-wide policies, such as monetary policy set by the European Central Bank (ECB), can significantly influence Latvia’s economic performance. These policies affect interest rates, inflation, and overall economic activity.

- Economic Cycles: Both Latvia and the Eurozone are subject to economic cycles, including periods of expansion and contraction. Comparing their positions within these cycles provides valuable insights into their economic resilience.

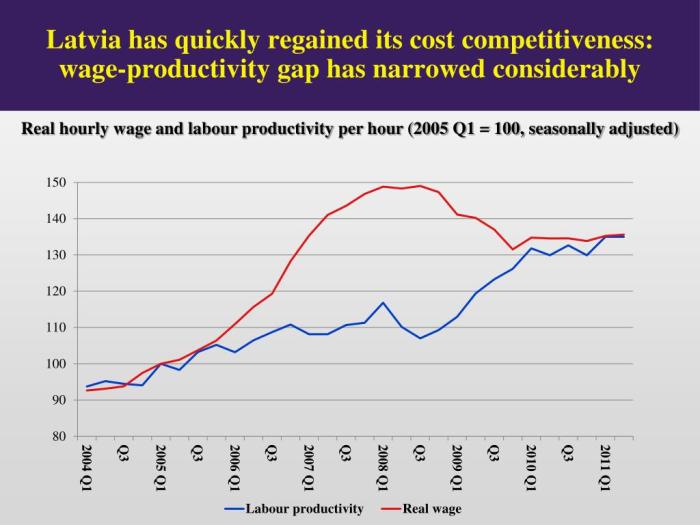

Factors Influencing Latvian Economic Performance

Source: slideserve.com

Latvia’s economic performance is a complex interplay of internal strengths and weaknesses, alongside external forces that can either propel growth or create headwinds. Understanding these factors is crucial for assessing the country’s economic trajectory and the potential for achieving the European Commission’s 1% growth forecast.

Internal Factors Impacting Latvia’s Economy

Latvia’s domestic economic health is shaped by several key elements. These factors directly influence the nation’s capacity to produce goods and services, create jobs, and improve living standards.

- Domestic Consumption: Consumer spending is a significant driver of economic activity. Factors influencing this include:

- Employment Rates: High employment leads to increased disposable income, boosting consumer spending. Conversely, rising unemployment dampens demand.

- Wage Growth: Real wage growth (wage growth adjusted for inflation) directly impacts purchasing power.

- Consumer Confidence: Optimism about the future economic outlook encourages spending, while pessimism leads to saving and reduced consumption.

- Investment: Business investment in new equipment, technology, and infrastructure is vital for long-term economic growth.

- Interest Rates: Lower interest rates make borrowing cheaper, encouraging businesses to invest.

- Government Policies: Supportive policies, such as tax incentives and streamlined regulations, can attract investment.

- Business Confidence: Positive expectations about future profitability drive investment decisions.

- Government Spending: Government expenditure on public services, infrastructure projects, and social programs also contributes to GDP. Changes in government spending can have a significant impact on the economy.

- Productivity: Efficiency in production processes is a key determinant of economic output. This is influenced by factors like:

- Technological advancements: Adoption of new technologies can increase productivity.

- Education and Skills: A skilled workforce is essential for productivity growth.

- Innovation: Encouraging innovation leads to new products, services, and processes.

External Factors Influencing Latvia’s Economy

Latvia’s economy is highly integrated with the global economy, making it susceptible to external shocks and opportunities.

- Exports: Latvia’s export performance is critical, as a significant portion of its GDP relies on foreign trade.

- Global Economic Growth: Strong growth in Latvia’s trading partners, particularly the Eurozone, increases demand for Latvian exports.

- Exchange Rates: A weaker Latvian currency makes exports cheaper and more competitive.

- Trade Agreements: Trade agreements facilitate exports by reducing tariffs and trade barriers.

- Foreign Direct Investment (FDI): FDI brings capital, technology, and expertise to Latvia, boosting economic growth. Factors influencing FDI include:

- Political Stability: A stable political environment attracts foreign investors.

- Legal Framework: A clear and transparent legal framework protects investors’ rights.

- Tax Policies: Competitive tax policies can encourage FDI.

- Global Commodity Prices: Latvia is a net importer of energy and other raw materials. Fluctuations in global commodity prices can affect its trade balance and inflation.

- Geopolitical Events: International conflicts and political instability can disrupt trade, investment, and economic activity.

Impact of the Current Geopolitical Climate

The ongoing geopolitical climate, particularly the war in Ukraine and its repercussions, presents significant challenges and uncertainties for Latvia’s economic outlook.

- Disrupted Trade: The war has disrupted supply chains and trade flows, particularly with Russia and Belarus, impacting Latvian businesses that rely on these markets.

- Energy Prices: Higher energy prices, driven by the war and related sanctions, are increasing inflation and reducing consumer purchasing power. This impacts the cost of production and household budgets.

- Inflationary Pressures: The war is contributing to global inflation, which erodes the value of money and can lead to slower economic growth. The European Central Bank (ECB) has been raising interest rates to combat inflation, which could slow down investment and consumption.

- Refugee Flows: The influx of refugees from Ukraine can put pressure on public services, such as healthcare and education. However, it can also provide a boost to the labor market, potentially filling labor shortages in certain sectors.

- Geopolitical Uncertainty: The overall uncertainty stemming from the war is affecting business confidence and investment decisions. Companies are hesitant to make long-term investments in an unstable environment.

Main Drivers of Latvia’s Economy

The Latvian economy is primarily driven by a combination of exports, domestic consumption, and investment.

- Exports: Latvia’s export sector is crucial, especially in areas like wood products, machinery, and food processing. The health of the Eurozone, Latvia’s main trading partner, heavily influences export performance.

- Domestic Consumption: Consumer spending is another significant driver, influenced by employment levels, wage growth, and consumer confidence. A rise in unemployment or a fall in consumer confidence can lead to a decrease in domestic consumption.

- Investments: Investments in fixed assets, such as machinery and equipment, and infrastructure projects, are vital for long-term economic growth. Investment is influenced by interest rates, government policies, and business confidence.

- Government Spending: Government spending on public services, social programs, and infrastructure projects plays a role in stabilizing the economy and boosting economic activity.

Sectoral Analysis

The European Commission’s forecast of 1% economic growth for Latvia this year provides a broad overview, but understanding the specific sectors contributing to this growth is crucial for a deeper analysis. This section delves into the key industries expected to drive Latvian economic activity, highlighting their relative importance and projected contributions.

Growth Drivers in Latvia

Several sectors are anticipated to play a role in Latvia’s modest economic expansion. While a 1% growth rate suggests a generally subdued performance, identifying the key drivers provides insight into the economy’s strengths and vulnerabilities. These drivers are not expected to grow at the same pace, and their contributions will vary.

- Manufacturing: Manufacturing is often a significant contributor to Latvian economic growth, particularly in areas like wood processing, food production, and machinery. This sector’s performance is often linked to external demand from the EU and other trading partners. Increased investment in automation and technology could boost productivity and contribute to growth.

- Services: The services sector, encompassing areas like finance, IT, and tourism, is another crucial area. Latvia’s IT sector has experienced notable growth in recent years, driven by its skilled workforce and favorable business environment. Tourism, while subject to fluctuations, can also provide a boost to the economy.

- Construction: Construction activity, often influenced by government spending and EU funds, can be a cyclical driver of growth. Investment in infrastructure projects and housing can stimulate economic activity, but this sector’s contribution can vary depending on project timelines and funding availability.

- Agriculture: Agriculture, though typically a smaller contributor to overall GDP compared to manufacturing and services, plays an important role. Export of agricultural products, such as grains and dairy, can support economic activity. Weather conditions and global commodity prices significantly impact this sector.

The relative importance of these sectors can be summarized as follows:

- Manufacturing: Moderate contribution, dependent on external demand and investment.

- Services: Significant contribution, particularly IT and finance.

- Construction: Cyclical contribution, influenced by investment.

- Agriculture: Stable, but smaller, contribution influenced by weather and prices.

Government Policies and Economic Outlook

The Latvian government’s actions significantly shape the economic landscape, influencing growth through various fiscal and monetary policies. These policies can either stimulate or restrain economic activity, impacting the projected 1% growth rate. Understanding these dynamics is crucial for grasping the overall economic outlook.

Role of Latvian Government Policies in Influencing Economic Growth

Government policies play a pivotal role in steering Latvia’s economic trajectory. Fiscal and monetary measures act as levers, either promoting expansion or mitigating contraction. Decisions on taxation, spending, and interest rates directly affect investment, consumption, and overall economic performance. The effectiveness of these policies depends on several factors.

- Fiscal Policy: Government spending and taxation levels influence aggregate demand. Increased government spending, especially on infrastructure projects or social programs, can boost economic activity by creating jobs and stimulating demand. Conversely, higher taxes can reduce disposable income, potentially slowing down economic growth.

- Monetary Policy: The central bank’s actions, primarily controlling interest rates and the money supply, affect borrowing costs and inflation. Lower interest rates can encourage borrowing and investment, stimulating economic expansion. However, excessively low rates can fuel inflation, which can undermine long-term economic stability.

- Regulatory Environment: The regulatory framework influences business investment and foreign direct investment (FDI). Streamlined regulations, reduced bureaucratic hurdles, and a predictable legal environment can attract investment and promote economic growth. Complex or burdensome regulations can deter investment and hinder economic activity.

- Structural Reforms: Implementing structural reforms, such as labor market reforms, improvements in education, and measures to enhance competitiveness, can boost long-term economic growth. These reforms aim to improve productivity, attract investment, and enhance the overall efficiency of the economy.

Fiscal Policies Currently in Place and Their Projected Impact on the Economy

Latvia’s current fiscal policies are designed to manage public finances while fostering sustainable economic growth. The specific measures and their projected effects are subject to ongoing evaluation and adjustment. The government’s approach reflects a balance between stimulating economic activity and maintaining fiscal discipline.

- Budgetary Allocation: The government’s budget allocates resources to various sectors, including infrastructure, healthcare, education, and social welfare. Increased investment in infrastructure, such as roads, railways, and energy projects, can create jobs and improve productivity, supporting economic growth. Investments in education and healthcare can enhance human capital and improve long-term economic prospects.

- Taxation Policies: Tax policies influence government revenue and the incentives for businesses and individuals. Changes in tax rates, such as corporate income tax or value-added tax (VAT), can impact investment and consumption. For example, reducing corporate income tax can encourage business investment and stimulate economic activity.

- Fiscal Discipline: Latvia adheres to fiscal rules and targets to maintain sustainable public finances. This includes controlling government debt and deficits. Fiscal discipline is crucial for maintaining investor confidence and ensuring long-term economic stability. However, excessive austerity measures can restrain economic growth in the short term.

- Social Welfare Programs: Government spending on social welfare programs, such as unemployment benefits and social assistance, provides a safety net for vulnerable populations. These programs can also act as automatic stabilizers, cushioning the impact of economic downturns. However, the level of spending must be balanced with the need to maintain fiscal sustainability.

Potential Monetary Policy Changes That Could Affect the 1% Growth Forecast

The European Central Bank (ECB) sets the monetary policy for the Eurozone, which includes Latvia. Changes in the ECB’s monetary policy can significantly impact Latvia’s economic growth. These changes are designed to influence inflation and economic activity within the Eurozone.

- Interest Rate Adjustments: The ECB’s primary tool is adjusting the main refinancing operations interest rate. A decrease in interest rates can lower borrowing costs for businesses and consumers, encouraging investment and spending, potentially boosting economic growth. Conversely, an increase in interest rates can curb inflation but may slow economic expansion.

- Quantitative Easing (QE): QE involves the ECB purchasing government bonds or other assets to inject liquidity into the financial system. This can lower long-term interest rates and stimulate lending, supporting economic growth. However, QE can also lead to higher inflation if not managed carefully.

- Forward Guidance: The ECB communicates its intentions and expectations for future monetary policy through forward guidance. This can influence market expectations and behavior. Clear communication can help to anchor inflation expectations and provide stability.

- Impact on the 1% Growth Forecast: Any monetary policy change, whether interest rate adjustments or QE, could influence the 1% growth forecast. For example, if the ECB decides to lower interest rates to stimulate the economy, this could potentially push the growth rate above 1%. Conversely, if the ECB tightens monetary policy to combat inflation, it could lead to slower growth or even a contraction.

Illustrative Data and Visualization

Visual aids are crucial for understanding complex economic data. They provide a clear and concise way to represent trends, comparisons, and sectoral breakdowns, making it easier to grasp the nuances of Latvia’s economic performance. This section details descriptions of illustrative images that would enhance comprehension of the Commission’s forecast.

Latvian Economic Growth Trend Over a Decade

An illustrative image depicting Latvia’s economic growth trend over the past ten years would likely be a line graph. This graph would show the percentage change in real GDP year-over-year.

- The horizontal axis would represent the years, spanning from approximately 2014 to 2024.

- The vertical axis would represent the percentage change in GDP, with both positive and negative values to show periods of growth and contraction.

- The line would trace the fluctuations in Latvia’s economic growth. Key events and turning points would be highlighted with annotations. For example:

- A sharp upward trend around 2017-2018 would reflect a period of strong economic expansion, potentially driven by EU funding and increased exports.

- A noticeable dip around 2020 would represent the impact of the COVID-19 pandemic, leading to a contraction in economic activity due to lockdowns and disruptions to global supply chains.

- A subsequent recovery phase, starting in 2021, would show the economy’s rebound, possibly fueled by government stimulus measures and the gradual reopening of businesses.

- The 2023-2024 period would reflect the current forecast, with the 1% growth rate projected by the European Commission, possibly represented as a moderate upward trend, but slower than pre-pandemic levels, potentially influenced by factors such as inflation and the war in Ukraine.

- The image would use clear and contrasting colors to differentiate the growth trends and key events.

- Labels would be provided to indicate the source of the data (e.g., Eurostat, Latvian Central Statistical Bureau).

Distribution of Latvia’s GDP Across Different Sectors

An illustrative image showcasing the distribution of Latvia’s GDP across different sectors could be a pie chart or a stacked bar chart. This visual would illustrate the relative contribution of various sectors to the overall economy.

- If using a pie chart:

- Each slice of the pie would represent a major sector of the Latvian economy, such as manufacturing, services, agriculture, construction, and wholesale/retail trade.

- The size of each slice would be proportional to the sector’s contribution to GDP. For instance, the services sector (including finance, real estate, and public administration) would likely represent the largest portion of the pie.

- Manufacturing, particularly in areas like wood processing and machinery, would represent a significant share.

- Agriculture, though a smaller percentage, would still be represented, reflecting its importance to the Latvian economy.

- Labels and percentages would be included for each sector, providing clear data on its contribution.

- If using a stacked bar chart:

- The chart would have the sectors listed along the horizontal axis.

- The vertical axis would represent the percentage of GDP.

- Each bar would be divided into segments, with each segment representing a sector.

- The height of each segment would correspond to the sector’s contribution to GDP.

- This format would allow for easy comparison of the relative sizes of each sector and their evolution over time (if multiple years are represented).

- The image would include a clear title and source attribution.

Comparison of Latvia’s Growth Rate with the Average EU Growth Rate

An illustration comparing Latvia’s growth rate with the average EU growth rate would likely be a side-by-side bar chart or a line graph. This visualization would help contextualize Latvia’s economic performance within the broader European landscape.

- If using a bar chart:

- The horizontal axis would represent the years, similar to the first graph.

- For each year, there would be two bars: one representing Latvia’s growth rate and the other representing the average EU growth rate.

- The height of each bar would correspond to the respective growth rate percentage.

- Different colors would distinguish between Latvia and the EU average.

- This format would allow for easy comparison of Latvia’s performance relative to the EU average for each year.

- If using a line graph:

- The horizontal axis would represent time (years).

- There would be two lines: one representing Latvia’s growth rate and the other representing the average EU growth rate.

- The vertical axis would represent the percentage change in GDP.

- The lines would trace the fluctuations in growth rates over time, making it easier to identify periods where Latvia outperformed or underperformed the EU average.

- The image would include a clear title, axis labels, and a legend.

- Data sources (e.g., Eurostat) would be clearly indicated.

Final Review

Source: alamy.com

In conclusion, the European Commission’s forecast of 1% growth for Latvia encapsulates a dynamic economic environment, highlighting the interplay of global forces and domestic strategies. Understanding this forecast is essential to gauge the potential for job creation, sectoral performance, and the impact of government policies. The Latvian economy’s future is shaped by a confluence of influences, and this forecast offers a crucial glimpse into its path forward.

Frequently Asked Questions

What does the 1% growth forecast mean for the average Latvian citizen?

A 1% growth rate can translate to moderate job creation and stable wages, but it might not significantly improve living standards immediately. The impact depends heavily on the sectors experiencing growth and how the benefits are distributed.

How often does the European Commission update its economic forecasts?

The European Commission typically releases economic forecasts twice a year, providing updates on the economic outlook for EU member states.

What are the main risks that could prevent Latvia from achieving the 1% growth?

External risks include geopolitical instability, changes in global demand, and shifts in commodity prices. Internal risks involve government policies, domestic consumption, and investment levels.

How does Latvia’s economic performance influence its relationship with the European Union?

Latvia’s economic performance is important for its integration within the EU, affecting factors like access to funds, structural reforms, and overall economic stability.