Congress passes the 2026 budget into law: find out how state resources will be distributed, marking a pivotal moment in shaping the future of the nation. This comprehensive budget Artikels how billions of dollars will be allocated across various sectors, from education and healthcare to infrastructure and environmental initiatives. Understanding the intricacies of this budget is crucial for citizens, as it directly impacts the services and opportunities available in their communities.

This report delves into the specifics of the 2026 budget, exploring its key provisions and the implications for state resources. We’ll examine how funding for critical areas like schools, hospitals, and transportation projects will be affected. Furthermore, we’ll analyze the process behind the budget’s passage, highlighting significant votes and amendments. This analysis aims to provide a clear and accessible overview of this vital legislation and its effects on the states.

Overview of the 2026 Budget Law

The 2026 budget law, recently passed by Congress, Artikels the financial plan for the United States government for the fiscal year 2026. This comprehensive legislation dictates how federal funds will be allocated across various sectors, impacting everything from national defense to social programs and infrastructure projects. The budget’s passage involved significant debate and negotiation, reflecting the diverse priorities of lawmakers.

Key Provisions of the 2026 Budget Law

The 2026 budget law contains several key provisions that shape the financial landscape of the nation. These provisions address various aspects of government spending, taxation, and economic policy.

- Mandatory Spending Adjustments: The law includes adjustments to mandatory spending programs, such as Social Security and Medicare. These adjustments are aimed at ensuring the long-term solvency of these programs. For instance, the law includes a provision that gradually increases the eligibility age for full Social Security benefits by two months for individuals born in 1968 or later. This measure, according to the Congressional Budget Office, is projected to reduce Social Security spending by approximately 0.5% over the next decade.

- Discretionary Spending Caps: The budget sets caps on discretionary spending, which includes areas like defense, education, and transportation. These caps are designed to control overall government spending. The law sets the defense spending cap at $850 billion for 2026, a 2% increase from the previous year, while non-defense discretionary spending is capped at $780 billion, a slight decrease.

- Tax Policy Changes: The law incorporates several tax policy changes, including modifications to corporate tax rates and individual income tax brackets. These changes are intended to influence economic activity and government revenue. For example, the law extends the 2017 Tax Cuts and Jobs Act’s individual income tax cuts for an additional two years, which is estimated to reduce federal revenue by approximately $150 billion over that period.

- Infrastructure Investment: A significant portion of the budget is dedicated to infrastructure investment. This includes funding for roads, bridges, public transportation, and other critical infrastructure projects. This commitment aligns with the goal of improving the nation’s infrastructure and boosting economic growth. The budget allocates $120 billion for highway projects and $80 billion for public transit initiatives.

Major Spending Allocations in the Law

The 2026 budget law allocates significant funds across various sectors, reflecting the government’s priorities and the needs of the nation. The major spending allocations are broken down as follows:

- Defense: The largest portion of the budget is allocated to national defense. This includes funding for military operations, personnel, equipment, and research and development. The budget allocates $850 billion for the Department of Defense, a significant increase from previous years, reflecting concerns about global security and military readiness. This includes funds for modernizing the existing fleet of F-35 fighter jets and procuring new hypersonic missile systems.

- Social Security and Medicare: A substantial portion of the budget is dedicated to Social Security and Medicare, which provide financial assistance and healthcare to millions of Americans. The budget allocates approximately $1.6 trillion for these programs. This includes adjustments to Medicare payments to healthcare providers and investments in preventative care initiatives.

- Healthcare: The budget also includes significant funding for healthcare programs, including the Affordable Care Act (ACA) and other health initiatives. This allocation aims to improve access to healthcare, reduce healthcare costs, and promote public health. The budget allocates $500 billion for healthcare programs, including funds for expanding access to mental health services and addressing the opioid epidemic.

- Education: Funding for education includes programs aimed at improving educational outcomes, supporting students, and investing in research. The budget allocates $100 billion for the Department of Education, including funding for K-12 education, higher education, and research grants. This includes initiatives to improve teacher training and increase access to early childhood education programs.

- Infrastructure: The budget provides significant resources for infrastructure projects, addressing the nation’s aging infrastructure and supporting economic growth. The allocation includes funding for roads, bridges, public transportation, and other critical infrastructure projects. The budget allocates $200 billion for infrastructure projects. This includes funds for repairing and expanding the Interstate Highway System and modernizing the nation’s airports.

Process of Budget Passage: Key Votes and Amendments

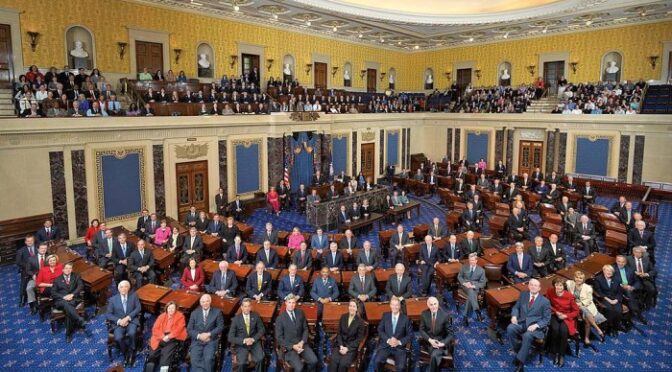

The passage of the 2026 budget law involved a complex process of negotiation, debate, and voting in both the House of Representatives and the Senate. The process included several key votes and amendments that shaped the final outcome.

- House of Representatives: The budget process began in the House of Representatives, where the House Budget Committee developed its version of the budget resolution. The House then debated and voted on the resolution, with numerous amendments proposed by individual members. The final House vote was close, with a margin of only a few votes, reflecting the partisan divisions in the chamber.

- Senate: After the House passed its version, the budget resolution moved to the Senate, where the Senate Budget Committee developed its own version. The Senate also debated and voted on the resolution, with senators proposing their amendments. The Senate vote was also close, with the final outcome depending on the support of several swing votes.

- Conference Committee: After both the House and the Senate passed their respective budget resolutions, a conference committee was formed to reconcile the differences between the two versions. The conference committee worked to negotiate a compromise budget resolution that could be accepted by both chambers.

- Final Passage: The final budget resolution was then voted on by both the House and the Senate. The resolution passed both chambers, paving the way for the enactment of the 2026 budget law. The final votes in both the House and the Senate were closely watched, as they reflected the balance of power in Congress and the priorities of the lawmakers.

- Amendments: Throughout the process, numerous amendments were proposed by members of both the House and the Senate. These amendments addressed a wide range of issues, from defense spending to social programs and tax policy. Some amendments were adopted, while others were rejected, reflecting the various viewpoints and priorities of the lawmakers. For example, an amendment to increase funding for renewable energy projects was adopted by the Senate, while an amendment to cut funding for the Environmental Protection Agency was rejected by the House.

Impact on State Resources

The passage of the 2026 budget has significant implications for how state resources are allocated, directly impacting various sectors. This analysis focuses on the effects on education, detailing funding adjustments and program-specific changes. Understanding these shifts is crucial for educators, students, and the broader community.

Education Funding

The 2026 budget introduces notable changes to education funding, encompassing both public schools and higher education institutions. These adjustments reflect evolving priorities and aim to address specific needs within the educational landscape. The changes represent an investment in the future, designed to improve the educational landscape.Comparing funding levels from 2024 to 2026 provides a clear picture of the budgetary shifts.

The following table illustrates the changes across different educational programs:

| Program | 2024 Funding | 2026 Funding | Percentage Change |

|---|---|---|---|

| K-12 Public Schools | $10 Billion | $10.5 Billion | 5% |

| State University System | $6 Billion | $6.3 Billion | 5% |

| Community Colleges | $3 Billion | $2.85 Billion | -5% |

| Special Education Programs | $1.5 Billion | $1.65 Billion | 10% |

Specific educational initiatives and programs are subject to funding adjustments. These changes are designed to align with current educational priorities.

- Increased Funding: Special Education Programs will receive a 10% increase, reflecting a commitment to supporting students with diverse learning needs. This increase aligns with the growing recognition of the importance of inclusive education.

- Decreased Funding: Community Colleges will see a 5% decrease in funding. This reduction may necessitate efficiency measures or a reallocation of resources within the community college system.

- Other Programs: K-12 public schools and the State University System will see a 5% increase.

Impact on State Resources

Source: publicdomainpictures.net

The 2026 budget significantly impacts state resources, and one of the most critical areas affected is healthcare. This section details how the budget allocates funds for healthcare, examining the repercussions for Medicare, Medicaid, and the broader healthcare landscape within the states. Understanding these changes is crucial for comprehending the financial and operational shifts ahead.

Healthcare Funding Allocation

The budget’s allocation for healthcare is a complex balancing act, with notable shifts in how funds are distributed across different programs.The budget proposes adjustments to both Medicare and Medicaid, impacting their funding levels.

- Medicare: The budget allocates funds to Medicare, but with proposed changes. These changes may include adjustments to reimbursement rates for certain services, potentially affecting provider revenue.

- Medicaid: Medicaid funding also undergoes scrutiny. There may be modifications to federal matching rates, influencing the financial burden on states. These changes could affect the types of services covered and eligibility requirements.

Changes to Healthcare Programs and Services

The 2026 budget introduces alterations to several healthcare programs and the services they provide. These adjustments reflect the government’s priorities and fiscal constraints.The budget could potentially impact access to specific healthcare services.

- Preventive Care: Changes may be implemented regarding the coverage of preventive services, such as screenings and vaccinations. These adjustments could affect patient health outcomes.

- Prescription Drug Costs: There might be initiatives aimed at managing prescription drug costs, which could include negotiating drug prices or expanding access to generic medications. This impacts the financial strain on individuals and the overall cost of healthcare.

- Mental Health Services: The budget could also focus on mental health services, with potential increases or decreases in funding for these critical areas.

Impact on Healthcare Providers

Hospitals and other healthcare providers are directly affected by the budget’s provisions. Funding changes, payment models, and regulatory adjustments influence their financial stability and ability to provide care.The budget may introduce changes to how healthcare providers are compensated for their services.

- Hospital Funding: The budget might modify how hospitals are reimbursed for services provided to Medicare and Medicaid beneficiaries. This could involve changes to payment rates, impacting hospital revenue. For instance, if the budget reduces Medicare reimbursement rates, hospitals may need to find ways to reduce costs or absorb the financial hit.

- Provider Reimbursement: Changes in provider reimbursement rates, such as those for physician services or specialist consultations, could also be implemented. This impacts the financial stability of healthcare providers.

- Impact on Healthcare Infrastructure: The budget might influence investment in healthcare infrastructure, such as funding for new hospitals, clinics, or technology upgrades. These investments are vital for expanding access to care and improving the quality of services.

Impact on State Resources

The passage of the 2026 budget significantly reshapes the landscape of state resource allocation, particularly in the realm of infrastructure. This budget aims to address long-standing needs, promote economic growth, and improve the quality of life for citizens across the nation. The following sections will detail how this budget will influence infrastructure funding and its distribution across different states.

Impact on State Resources: Infrastructure

The 2026 budget provides substantial funding for infrastructure projects, encompassing roads, bridges, public transportation, and other essential components of the nation’s infrastructure network. This investment is crucial for maintaining existing infrastructure, addressing deferred maintenance, and expanding capacity to accommodate future growth.The allocation of infrastructure funds across different states is determined by a combination of factors, including population size, geographical area, existing infrastructure conditions, and specific project needs.

The goal is to ensure a fair and equitable distribution of resources while prioritizing projects with the greatest impact on public safety, economic development, and overall quality of life. The allocation plan considers that larger states with significant populations may require more funding for extensive road networks, while states with vast geographical areas might need support for projects addressing transportation challenges across long distances.The budget prioritizes infrastructure projects based on their urgency, economic impact, and alignment with national goals.

Projects are categorized based on their importance and the need for immediate attention.Here’s a prioritized list of infrastructure projects, their locations, and proposed budget allocations:

- Project: Interstate Highway Rehabilitation Program

- Location: Nationwide (focused on high-traffic areas and aging infrastructure)

- Budget Allocation: $75 billion

- Description: This program focuses on repairing and upgrading existing interstate highways. This includes resurfacing roads, repairing bridges, and improving safety features such as guardrails and lighting. For example, in California, the budget would allow the repair of several major highways, including sections of I-5, addressing traffic congestion and enhancing safety.

- Project: High-Speed Rail Network Expansion

- Location: California, Florida, and Texas (initial phases)

- Budget Allocation: $60 billion

- Description: This initiative aims to develop and expand high-speed rail networks in strategic locations across the country. This includes constructing new rail lines, upgrading existing tracks, and purchasing high-speed trains. This expansion will reduce travel times, reduce traffic on roads and reduce carbon emissions. California’s high-speed rail project, for instance, will receive a substantial portion of this funding to connect major cities like Los Angeles and San Francisco.

- Project: Bridge Replacement and Repair Program

- Location: Nationwide (prioritizing structurally deficient bridges)

- Budget Allocation: $50 billion

- Description: This program targets bridges identified as structurally deficient or functionally obsolete. Funding will be used to replace or repair these bridges, improving safety and preventing potential failures. States like Pennsylvania, with a high number of aging bridges, will receive significant funds. The program will also support local bridge repair projects.

- Project: Public Transportation Modernization

- Location: Major metropolitan areas (e.g., New York, Chicago, Washington D.C.)

- Budget Allocation: $40 billion

- Description: This program aims to modernize and expand public transportation systems in major cities. This includes upgrading subway lines, purchasing new buses and trains, and improving accessibility. The New York City subway system will receive a portion of this funding to improve signaling systems and increase capacity.

- Project: Rural Road Improvement Initiative

- Location: Rural areas across the United States

- Budget Allocation: $35 billion

- Description: This initiative focuses on improving roads and infrastructure in rural areas. Funding will be used for road resurfacing, bridge repairs, and the construction of new roads where needed. This initiative helps improve the quality of life and accessibility for those in rural areas.

Impact on State Resources

The 2026 budget significantly impacts how state resources are allocated, particularly concerning environmental protection and the advancement of renewable energy initiatives. This section details the budget’s provisions, including new regulations, funding mechanisms, and programs designed to promote sustainability across the state. The goal is to balance economic growth with environmental responsibility, ensuring a healthier and more sustainable future for all citizens.

Environment and Energy

The budget’s environmental and energy sections reflect a strong commitment to combating climate change and fostering a cleaner, more sustainable environment. This includes strategic investments in renewable energy, stricter environmental regulations, and programs aimed at preserving natural resources.The budget allocates substantial funding to support renewable energy projects.

- Solar Energy Initiatives: A significant portion of the budget is dedicated to expanding solar energy infrastructure. This includes funding for large-scale solar farms and incentives for residential solar panel installations. For instance, the budget provides tax credits of up to $5,000 for homeowners who install solar panels, encouraging wider adoption of this clean energy source. This mirrors successful programs in states like California, which have seen a substantial increase in solar energy capacity due to similar incentives.

- Wind Energy Development: The budget also supports the development of wind energy projects, particularly in regions with high wind potential. Funds are allocated for research and development in wind turbine technology, as well as grants for wind farm construction. The aim is to increase the state’s wind energy capacity by 20% over the next five years, aligning with national goals for renewable energy.

- Energy Storage Solutions: Recognizing the intermittent nature of renewable energy sources, the budget includes funding for energy storage solutions, such as battery storage systems. This will help to stabilize the energy grid and ensure a reliable supply of electricity, even when the sun isn’t shining or the wind isn’t blowing.

New environmental regulations and programs are introduced.

- Carbon Emission Reduction Targets: The budget sets new, ambitious carbon emission reduction targets for various sectors, including transportation, manufacturing, and energy production. These targets are designed to align the state with international climate agreements and reduce the state’s carbon footprint.

- Clean Air Standards: The budget strengthens existing clean air standards and introduces new regulations to reduce air pollution from industrial sources. This includes stricter limits on emissions from factories and power plants, as well as incentives for businesses to adopt cleaner technologies.

- Water Conservation Measures: Recognizing the importance of water resources, the budget includes measures to promote water conservation. This includes funding for water-efficient infrastructure projects, incentives for homeowners to conserve water, and stricter regulations on water usage in agriculture and industry. The state’s Department of Environmental Protection will oversee these measures, ensuring compliance and providing support to affected communities.

- Environmental Remediation Programs: The budget allocates funds for environmental remediation programs, specifically targeting contaminated sites and brownfields. This includes cleaning up abandoned industrial sites and restoring them for productive use. This will not only improve environmental quality but also create jobs and stimulate economic development in affected areas.

The budget promotes sustainability through specific funding mechanisms.

- Green Bonds: The state will issue green bonds to finance environmental projects, such as renewable energy infrastructure and water conservation efforts. Green bonds are a financial tool that allows the state to raise capital specifically for environmentally friendly initiatives, attracting investors who prioritize sustainability.

- Environmental Trust Fund: A portion of the budget is allocated to an Environmental Trust Fund, which will provide grants and loans for environmental projects. The fund will support a variety of initiatives, including habitat restoration, pollution cleanup, and the development of sustainable technologies.

- Tax Incentives for Green Businesses: The budget provides tax incentives for businesses that invest in green technologies and adopt sustainable practices. This includes tax credits for companies that purchase renewable energy, implement energy-efficient upgrades, and reduce their waste generation.

- Public-Private Partnerships: The state will foster public-private partnerships to leverage private sector expertise and investment in environmental projects. This will allow the state to implement large-scale projects more efficiently and effectively, such as the construction of new wind farms or the development of advanced recycling facilities.

Impact on State Resources

The 2026 budget’s allocation of resources significantly impacts economic development across the state. This includes adjustments to existing programs, the introduction of new initiatives, and changes in tax policies designed to stimulate business growth and job creation. Understanding these impacts is crucial for businesses, residents, and policymakers alike.

Economic Development

The budget’s impact on economic development is multifaceted, touching upon various programs and incentives designed to foster growth and attract investment. The state aims to create a more robust and diversified economy by strategically allocating funds.

Tax Incentives and Business Support Programs

The budget introduces several tax incentives and support programs aimed at assisting businesses. These incentives are designed to encourage investment, innovation, and job creation within the state.

- Research and Development Tax Credits: The budget allocates increased funding for tax credits for companies investing in research and development. The goal is to stimulate innovation in key sectors such as technology and biotechnology. For example, a company investing \$1 million in R&D might be eligible for a tax credit of up to 15% of their investment, effectively reducing their tax burden and encouraging further investment.

- Small Business Support Grants: Grants are available to small businesses to help them expand, modernize, and create new jobs. The budget sets aside \$50 million for these grants, with priority given to businesses located in economically distressed areas. A small manufacturing business in a rural area could receive up to \$100,000 to purchase new equipment, boosting productivity and potentially doubling its workforce.

- Manufacturing Tax Breaks: To promote manufacturing, the budget provides tax breaks for companies that relocate or expand manufacturing operations within the state. These incentives include reduced property taxes and exemptions on certain types of equipment purchases. A manufacturing firm relocating its headquarters and production facilities to the state could save significantly on its tax bill over a five-year period.

- Workforce Training Initiatives: Significant investment is made in workforce training programs to ensure a skilled labor pool. This includes partnerships with community colleges and vocational schools to offer training in high-demand fields such as cybersecurity and renewable energy. The state plans to train 10,000 workers over the next three years, ensuring they are prepared for the jobs of the future.

Projected Impact on Job Creation and Economic Growth

The budget’s economic development initiatives are projected to have a substantial positive impact on job creation and overall economic growth. These projections are based on economic models and historical data, and aim to create a more prosperous state.

- Job Growth: The budget anticipates the creation of thousands of new jobs across various sectors. For example, the expansion of manufacturing tax breaks is projected to lead to the creation of approximately 5,000 new manufacturing jobs within the next three years. This projection is based on historical data showing the correlation between tax incentives and job growth in the manufacturing sector.

- Increased Investment: The tax incentives are designed to attract significant new investment from both domestic and international companies. The state expects an increase of \$1 billion in foreign direct investment over the next five years, fueled by the attractive tax climate and business support programs. This projection is supported by data from similar initiatives in other states that have successfully attracted investment.

- Economic Growth Rate: The budget projects a 2% increase in the state’s economic growth rate over the next five years, driven by increased business activity and job creation. This growth rate is based on economic models that take into account the impact of the tax incentives and support programs, as well as the expected increase in consumer spending and business investment.

- Sector-Specific Growth: Specific sectors, such as technology, manufacturing, and renewable energy, are expected to experience significant growth due to targeted incentives and support programs. For instance, the renewable energy sector is projected to create 3,000 new jobs over the next five years, driven by investments in solar and wind energy projects.

State-Specific Allocations

Source: publicdomainpictures.net

The 2026 budget allocates federal funding to states, with significant variations based on population, economic factors, and specific needs. Understanding these allocations is crucial for grasping the budget’s impact on communities nationwide. The distribution of resources reflects the federal government’s priorities and influences state-level initiatives.

States Receiving the Most and Least Funding

The distribution of federal funds is not uniform; some states receive substantially more than others. Factors such as population size, economic activity, and the presence of critical infrastructure projects play a significant role.

- States Expected to Receive the Most Funding: These typically include states with large populations, significant infrastructure needs, and a strong presence of federal facilities or programs. For example, California, Texas, and New York are often among the top recipients due to their large populations and diverse economies. These states often receive considerable funding for transportation, education, and social services.

- States Expected to Receive the Least Funding: Smaller states with lower populations and fewer significant federal projects usually receive less funding. States with robust economies and fewer infrastructure challenges might also receive less federal assistance. For instance, states like Wyoming, Vermont, and Delaware may receive less due to their smaller populations and economic structures.

Comparison of Budget Allocations to Different States

Comparing budget allocations across states reveals disparities and provides insights into how the federal government prioritizes different regions. The comparison considers population size and economic factors to provide a comprehensive view.

Here is a table illustrating the distribution of funds across select states:

| State | Total Allocation (Estimated) | Per Capita Allocation (Estimated) | Key Projects Funded |

|---|---|---|---|

| California | $85 Billion | $2,150 | Transportation infrastructure upgrades, renewable energy initiatives, education grants, and social services programs. |

| Texas | $70 Billion | $2,350 | Highway construction and maintenance, border security, disaster relief, and workforce development programs. |

| New York | $60 Billion | $3,000 | Public transportation improvements, affordable housing projects, healthcare initiatives, and environmental protection programs. |

| Florida | $55 Billion | $2,500 | Hurricane preparedness and response, infrastructure projects, education reform, and support for the elderly. |

| Wyoming | $5 Billion | $8,600 | National park maintenance, infrastructure projects, and support for the energy sector. |

Addressing the Unique Needs of Different States

The budget aims to address the specific needs of different states by tailoring allocations to regional priorities and challenges. This approach acknowledges that each state faces unique circumstances.

- Disaster Relief: States prone to natural disasters, such as Florida and Louisiana, often receive significant funding for disaster preparedness, response, and recovery. For example, the budget might include funds for rebuilding infrastructure damaged by hurricanes or providing assistance to residents affected by flooding.

- Infrastructure Development: States with aging infrastructure or rapid population growth, like California and Texas, may receive substantial allocations for transportation projects, including highway construction, bridge repairs, and public transit improvements. These investments aim to alleviate traffic congestion and improve connectivity.

- Economic Development: States with high unemployment rates or struggling economies might receive funding for workforce development programs, small business loans, and economic revitalization initiatives. For instance, states in the Midwest might benefit from investments in manufacturing and technology sectors.

- Healthcare and Social Services: States with large populations of elderly or low-income residents, such as New York and California, may receive significant funding for healthcare programs, affordable housing, and social services. These resources support access to healthcare, address homelessness, and provide essential services to vulnerable populations.

Transparency and Accountability Measures

The 2026 budget includes several key provisions designed to promote transparency in how state funds are spent and to ensure accountability among state agencies. These measures are crucial for maintaining public trust and ensuring that taxpayer dollars are used effectively and efficiently. The goal is to provide the public with clear visibility into the state’s financial operations and to establish mechanisms to prevent waste, fraud, and abuse.

Transparency in Spending

The budget mandates several steps to increase transparency. These include the public disclosure of all contracts exceeding a certain dollar amount and the detailed reporting of all expenditures.

- Publicly Accessible Contract Database: A searchable, online database will be established, making all state contracts above $50,000 readily available to the public. This database will include contract details, such as the vendor, the services or goods provided, the contract amount, and the duration of the contract. This allows citizens to monitor how state funds are being allocated to private companies and organizations.

- Detailed Expenditure Reports: All state agencies are required to publish quarterly reports detailing their expenditures. These reports will include a breakdown of spending by category, such as salaries, supplies, and travel. These reports must also include the names of vendors and the amounts paid to them. This level of detail helps citizens track how state resources are being used and identify potential areas of concern.

- Open Data Initiative: The state will launch an open data initiative, making a wide range of financial data available in machine-readable formats. This will allow the public and researchers to analyze state spending patterns and identify trends. The data will include budget allocations, actual expenditures, and revenue sources. This initiative aims to foster greater understanding of state finances and to promote data-driven decision-making.

Oversight Mechanisms

To ensure accountability, the budget incorporates several oversight mechanisms. These mechanisms are designed to monitor agency spending, investigate potential wrongdoing, and enforce compliance with budget regulations.

- Independent Inspector General: The budget allocates resources to strengthen the Office of the Inspector General (OIG). The OIG is responsible for investigating allegations of fraud, waste, and abuse within state agencies. The strengthened OIG will have increased staffing and authority to conduct investigations, including the power to subpoena witnesses and documents.

- Legislative Audit Committee: The Legislative Audit Committee will conduct regular audits of state agencies. These audits will examine the financial records and operations of agencies to ensure compliance with the budget and state laws. The committee will also review the effectiveness of programs and services to ensure that they are meeting their intended goals.

- Performance-Based Budgeting: The budget emphasizes performance-based budgeting, linking funding to specific outcomes and measurable results. Agencies will be required to develop performance metrics and report on their progress toward achieving those metrics. This approach ensures that agencies are held accountable for their performance and that resources are allocated to programs that are producing results.

Public Access to Information

The public has several avenues to access information about how state resources are being distributed.

- State Website: The state government website will serve as a central hub for financial information. The website will feature a dedicated section for budget-related information, including the full budget document, expenditure reports, contract data, and audit reports.

- Public Hearings: Public hearings will be held on the budget throughout the year. These hearings provide an opportunity for the public to comment on the budget and to ask questions of state officials. The hearings will be livestreamed and archived online, making them accessible to a wider audience.

- Freedom of Information Act (FOIA) Requests: The public can submit FOIA requests to obtain specific documents and information from state agencies. Agencies are required to respond to FOIA requests in a timely manner and to provide access to public records.

Potential Challenges and Opportunities

Implementing the 2026 budget presents both significant hurdles and promising avenues for advancement. Successfully navigating these aspects requires proactive planning, collaboration, and a willingness to adapt to evolving circumstances. The following sections detail potential challenges, opportunities, and the roles different stakeholders play in shaping the budget’s implementation.

Implementation Challenges

The 2026 budget’s successful implementation faces several potential obstacles. Addressing these challenges proactively is crucial to avoid delays, cost overruns, and ultimately, a failure to achieve the budget’s intended goals.

- Economic Fluctuations: Economic downturns or unexpected inflation could significantly impact revenue projections. If revenues fall short, program funding may need to be adjusted, potentially leading to cuts in essential services or the postponement of planned projects. For example, a sharp decline in consumer spending could reduce sales tax revenue, directly affecting state budgets.

- Supply Chain Disruptions: Continued disruptions to global supply chains could inflate the costs of goods and services, particularly for infrastructure projects. This could force states to re-evaluate project scopes or delay their completion, adding financial pressure and impacting timelines. Consider the impact on construction projects where delays in material delivery can halt progress and increase costs.

- Political Obstacles: Political disagreements between different branches of government or shifting priorities could hinder the efficient allocation of funds and the timely execution of projects. Legislative gridlock or changes in administrative leadership could lead to policy shifts and funding reallocation. This could affect the execution of projects or planned initiatives.

- Bureaucratic Inefficiencies: Complex bureaucratic processes, including lengthy approval procedures and outdated procurement systems, can delay the disbursement of funds and slow down project implementation. Streamlining these processes is essential to ensure that resources are used efficiently. A case in point is the time-consuming process of securing permits for environmental projects.

- Workforce Shortages: Shortages of skilled workers, particularly in sectors like construction and healthcare, could impede the progress of infrastructure projects and the delivery of essential services. Addressing these shortages through training programs and competitive salaries is essential. For example, the scarcity of nurses can strain healthcare budgets and affect service quality.

Opportunities for Innovation and Improvement

The 2026 budget also presents significant opportunities to drive innovation and improve government efficiency. By embracing new technologies, fostering collaboration, and adopting data-driven decision-making, states can maximize the impact of the budget.

- Technological Advancements: Investing in digital infrastructure and data analytics can streamline government operations, improve service delivery, and enhance transparency. The implementation of online portals for permitting processes or the use of data analytics to identify fraud can lead to significant improvements.

- Public-Private Partnerships: Collaborating with private sector entities can bring expertise, resources, and innovative solutions to address infrastructure needs and service delivery challenges. These partnerships can provide access to capital and technologies that may not be readily available within the government. For example, Public-Private Partnerships (PPPs) in the transportation sector have been used to build and maintain roads and bridges.

- Performance-Based Budgeting: Implementing performance-based budgeting, where funding is linked to measurable outcomes, can improve accountability and ensure that resources are allocated to the most effective programs. This approach enables governments to track the impact of their spending and make data-driven decisions.

- Focus on Sustainability: The budget can support environmentally friendly initiatives, promoting sustainable practices, and investing in renewable energy projects. These investments can create new jobs, reduce pollution, and improve public health. For example, investment in electric vehicle infrastructure.

- Community Engagement: Encouraging citizen participation in the budget process can foster a sense of ownership and ensure that the budget reflects the needs and priorities of the community. Public forums, online surveys, and citizen advisory boards can provide valuable input.

Stakeholder Influence on Budget Implementation

Various stakeholders play crucial roles in influencing the implementation of the 2026 budget. Their active involvement and collaboration are vital for ensuring the budget’s success and achieving its objectives.

- Legislators: Legislators are responsible for overseeing the budget implementation process, ensuring that funds are spent according to the approved plan, and addressing any issues that arise. They can hold agencies accountable through oversight hearings, audits, and legislative reviews.

- Executive Branch Agencies: Executive branch agencies are responsible for implementing the budget’s programs and projects. They must develop detailed implementation plans, manage resources effectively, and monitor progress.

- Local Governments: Local governments often play a key role in implementing state-funded programs and projects. They work in collaboration with state agencies to deliver services and manage resources at the local level.

- Non-Profit Organizations: Non-profit organizations often provide critical services funded by the budget, such as social services, healthcare, and education. Their expertise and collaboration are essential for reaching vulnerable populations and addressing community needs.

- Private Sector: The private sector can influence budget implementation through partnerships, contracts, and investment. Their expertise and resources can help deliver projects and services efficiently.

- Citizens and Advocacy Groups: Citizens and advocacy groups have a role in holding the government accountable and advocating for their priorities. Their input can influence budget decisions and ensure that programs meet community needs. Public participation and advocacy efforts can drive transparency and accountability in the budget process.

Last Recap

Source: journalistsresource.org

In conclusion, the 2026 budget represents a significant framework for the nation’s future, influencing resource allocation across various sectors. From education and healthcare to infrastructure and economic development, the budget’s provisions will shape the landscape of state services and opportunities. While challenges and opportunities undoubtedly exist, the budget’s transparency and accountability measures aim to ensure responsible resource management. By understanding the budget’s intricacies, citizens can better engage with their communities and advocate for the resources they need.

Popular Questions

What is the primary goal of the 2026 budget?

The primary goal of the 2026 budget is to allocate federal funds to various sectors, including education, healthcare, infrastructure, and more, aiming to address national priorities and support economic growth.

How can the public access information about the budget?

The public can access information through government websites, reports from the Congressional Budget Office (CBO), and news media coverage. Transparency measures within the budget also mandate public access to spending details.

What happens if the budget isn’t passed on time?

If the budget isn’t passed on time, Congress may pass a continuing resolution, which temporarily funds the government at existing levels. This prevents a government shutdown but can hinder new initiatives.

Who benefits most from the 2026 budget?

The benefits of the 2026 budget are widespread, with specific programs and states benefiting more depending on their priorities. Ultimately, the aim is to benefit all citizens through improved services and economic opportunities.

How can I influence the implementation of the budget?

You can influence the budget’s implementation by contacting your elected officials, participating in public forums, supporting advocacy groups, and staying informed about spending decisions.