In a surprising move, Borisov’s government has announced its readiness to waive the dividend tax and the 2% contribution to the pension fund. This decision has sent ripples through the Bulgarian economy, sparking debate and speculation about its potential impact. The announcement, coming amidst shifting political and economic landscapes, raises critical questions about its motivations, effects on investors and businesses, and long-term implications for the country’s financial future.

This bold policy shift requires a deep dive into the political and economic context. We will explore the potential benefits and drawbacks, examining the likely reactions from various stakeholders, and analyzing the practical challenges that lie ahead. This analysis aims to provide a comprehensive understanding of the announcement and its potential impact on Bulgaria.

Understanding the Announcement

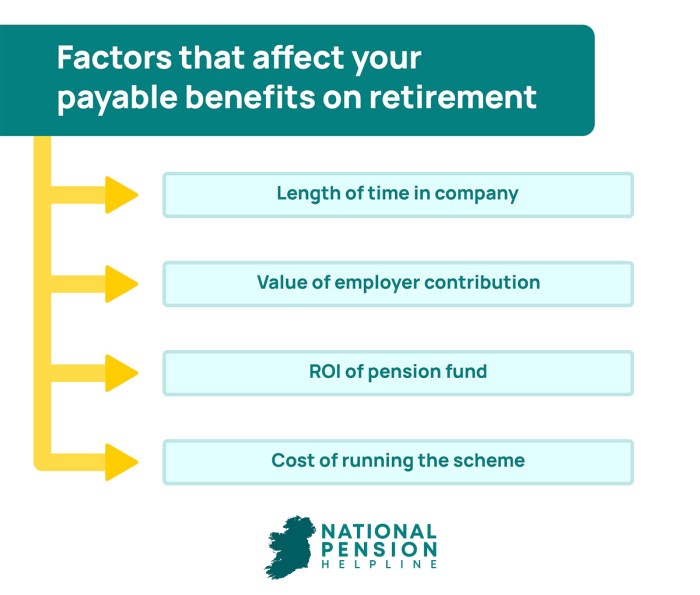

Source: nationalpensionhelpline.ie

The announcement by Borisov regarding the waiving of the dividend tax and the 2% contribution to the pension fund requires careful consideration. It is important to understand the political and economic context in which this decision was made, as well as the potential implications for various stakeholders. The following sections will break down the announcement and its significance.

Political and Economic Context

The political and economic climate in Bulgaria is a critical factor in understanding Borisov’s announcement. Bulgaria, as a member of the European Union, faces economic pressures and opportunities influenced by both internal dynamics and external factors. The country has been working to attract foreign investment and stimulate economic growth, particularly after periods of economic slowdown. The political landscape is often characterized by coalition governments, shifting alliances, and varying levels of public trust in political institutions.

These factors can influence policy decisions, including those related to taxation and pension contributions.

Significance of Waiving the Dividend Tax

Waiving the dividend tax can have several implications. The dividend tax is a tax levied on the profits distributed by companies to their shareholders.

- Impact on Investors: Removing this tax makes Bulgaria a more attractive destination for both domestic and foreign investors. Investors will receive higher after-tax returns on their investments, which can incentivize them to reinvest in Bulgarian companies or invest in the first place. For example, consider a company that currently distributes €100,000 in dividends, with a 5% dividend tax. Eliminating this tax means shareholders receive the full €100,000, boosting their potential for reinvestment.

- Impact on Companies: The decision can potentially encourage companies to distribute more of their profits as dividends, rather than retaining earnings. This can benefit shareholders directly. However, it could also reduce the funds available for company reinvestment and expansion.

- Impact on Government Revenue: The government will experience a reduction in tax revenue in the short term. The government needs to assess whether the increased economic activity generated by this change will offset this loss through other taxes (such as corporate taxes or VAT).

Impact of the 2% Contribution to the Pension Fund

The 2% contribution to the pension fund is a critical element of Borisov’s announcement. The implications are:

- Impact on Pensioners: A reduction in pension contributions, especially if not offset by other measures, could impact the long-term sustainability of the pension system. It might lead to lower pension benefits in the future, affecting the financial security of current and future retirees.

- Impact on Employers: If employers are expected to absorb the cost of the 2% contribution, it could increase their labor costs. This might lead to decreased hiring, lower wages, or reduced investment in other areas.

- Impact on the Labor Market: Depending on who bears the cost, the change could affect employment levels and wage rates. If the burden falls on employees, it reduces their take-home pay. If it falls on employers, it could affect their hiring decisions.

Potential Motivations Behind Borisov’s Decision

Borisov’s decision could be driven by a variety of motivations. These could include:

- Economic Growth: A primary motivation might be to stimulate economic growth. By attracting investment and freeing up capital, the government hopes to create jobs and increase overall economic activity.

- Political Strategy: The announcement could be a strategic move to gain political support. Tax cuts and increased disposable income for investors and workers can be popular measures, particularly during election cycles.

- Addressing Business Concerns: The decision might reflect a response to concerns from the business community about the tax burden and the competitiveness of Bulgarian companies. Reducing taxes could make the business environment more favorable.

- Long-Term Fiscal Planning: It is important to assess whether the government has a long-term plan for managing the fiscal implications of these changes, including how it intends to address any shortfall in pension funding or revenue.

Impact on Investors and Businesses

Source: 365financialanalyst.com

The proposed elimination of the dividend tax and the 2% pension contribution presents a significant shift in the financial landscape, potentially reshaping investor behavior and offering new opportunities and challenges for businesses across various sectors. Understanding these impacts is crucial for making informed financial decisions.

Investor Behavior Changes

Waiving the dividend tax is likely to influence investor choices. This change could lead to increased investment in dividend-paying stocks and potentially boost overall market activity.

- Increased Demand for Dividend-Paying Stocks: Investors may favor companies that distribute dividends, as they will receive the full amount without the deduction. This could drive up the prices of these stocks. For example, if a company currently pays a $1 dividend per share, and the tax is waived, investors will receive the full $1, making the investment more attractive compared to a scenario where a portion is taxed.

- Shift in Investment Strategies: Investors might re-evaluate their portfolios to include more dividend-yielding assets. This could involve selling assets that don’t provide income or reallocating capital from other investment avenues.

- Impact on Retirement Planning: Retirees and those planning for retirement, who often rely on dividends for income, could see an immediate benefit, potentially leading to increased spending or reinvestment.

- Attraction of Foreign Investment: Removing the dividend tax could make the country more attractive to foreign investors seeking income from dividends, leading to increased capital inflows.

Potential Benefits for Businesses

Businesses stand to gain from the proposed changes in several ways. The availability of capital and investor confidence can be enhanced.

- Increased Investment and Capital Availability: With investors more inclined to invest in dividend-paying stocks, companies might find it easier to raise capital through equity offerings.

- Improved Investor Confidence: A favorable tax environment can boost investor confidence, leading to higher valuations and a more stable market for company shares.

- Enhanced Competitiveness: Businesses in the country could become more competitive, particularly those that rely on attracting investment, like those in the financial services sector.

- Stimulation of Economic Activity: The increased capital flow and investor confidence could stimulate economic activity, leading to job creation and expansion across various industries.

Sectoral Impact Comparison

The impact of waiving the dividend tax will not be uniform across all sectors. Some industries are likely to benefit more than others. The table below provides a comparison.

| Sector | Potential Benefits | Potential Risks | Examples |

|---|---|---|---|

| Financial Services | Increased investment in financial institutions; potentially higher trading volumes and activity. | Increased competition; potential for increased scrutiny from regulators. | Banks, investment firms, insurance companies. |

| Real Estate | Increased investment in Real Estate Investment Trusts (REITs) due to their dividend payouts. | Potential for market bubbles if valuations increase too quickly. | REITs, property developers. |

| Technology | Attraction of investment if companies begin to offer dividends. | Could lose some attractiveness if they don’t pay dividends, especially compared to sectors that do. | Tech companies, software developers. |

| Manufacturing | Potential for increased capital investment and expansion due to easier access to funding. | Exposure to changes in investor sentiment; dependence on broader economic conditions. | Manufacturing companies. |

Potential Negative Consequences

While the changes offer several benefits, some potential negative consequences should be considered.

- Increased Market Volatility: An influx of investment can sometimes lead to increased market volatility, especially if there is a sudden shift in investor sentiment.

- Risk of Asset Bubbles: The increased demand for dividend-paying stocks could lead to inflated asset prices in certain sectors, creating the risk of asset bubbles.

- Tax Revenue Implications: The government may face reduced tax revenue from the dividend tax, which could impact public finances. This can be mitigated through increased economic activity.

- Impact on Non-Dividend Paying Companies: Companies that do not pay dividends might become less attractive to investors, potentially affecting their ability to raise capital.

Implications for the Bulgarian Economy

The proposed changes to dividend tax and pension contributions will likely have a ripple effect across the Bulgarian economy. Understanding these implications is crucial for assessing the overall impact of the policy shift. Several key areas need careful consideration, including government revenue, economic growth, and the sustainability of social programs.

Effects on Government Revenue

Changes in tax policy, such as waiving the dividend tax, directly affect government revenue streams. The magnitude of this impact depends on various factors, including the size of dividend payouts and the overall economic climate.

- Short-Term Consequences:

- Reduced Tax Receipts: The immediate effect will be a decrease in tax revenue collected from dividend distributions. This is a direct consequence of eliminating the tax.

- Potential for Increased Investment: Some argue that removing the tax could encourage reinvestment of profits within businesses, leading to a temporary increase in corporate activity. However, the extent of this effect is uncertain.

- Budgetary Adjustments: The government may need to adjust its budget to account for the loss of revenue, potentially by reducing spending in other areas or increasing borrowing.

- Long-Term Consequences:

- Economic Growth: If the policy stimulates investment and economic growth, it could lead to increased tax revenue from other sources, potentially offsetting the initial loss from dividend tax. For example, if companies reinvest profits and expand, they may hire more employees, leading to higher income tax revenue.

- Increased Corporate Activity: The policy may incentivize businesses to retain earnings and invest them back into the company, which could foster innovation and expansion. This, in turn, can contribute to increased employment and overall economic activity.

- Fiscal Sustainability: The long-term fiscal sustainability of the policy depends on its impact on economic growth. If the policy fails to stimulate growth, the government may face ongoing revenue shortfalls, putting pressure on public finances.

Influence on Economic Growth

The waiving of the dividend tax and changes to pension contributions can significantly influence economic growth by affecting investment, consumption, and overall business confidence.

- Short-Term Consequences:

- Potential for Investment Increase: Companies might be more inclined to reinvest profits, leading to increased investment in new projects, equipment, and expansion. This could boost economic activity.

- Impact on Consumer Spending: If individuals receive more disposable income due to changes in pension contributions, it could lead to a short-term increase in consumer spending.

- Market Sentiment: The policy announcement could improve business confidence, encouraging companies to invest and expand. This can create a positive feedback loop.

- Long-Term Consequences:

- Sustained Economic Expansion: If the policy successfully stimulates investment and innovation, it could lead to sustained economic growth over the long term. This is dependent on various factors, including the global economic environment and the specific industries involved.

- Changes in the Business Landscape: The policy might encourage the formation of new businesses and the growth of existing ones, particularly in sectors where investment is crucial. This can lead to a more dynamic and competitive economy.

- Increased Employment: Economic growth driven by investment and expansion can lead to increased employment opportunities, benefiting the workforce and contributing to higher living standards.

Potential Impact on Social Programs

Changes to government revenue and economic growth can have a direct impact on the funding and sustainability of social programs, such as healthcare, education, and social security.

- Short-Term Consequences:

- Potential for Budgetary Pressure: A reduction in government revenue, if not offset by increased economic activity, could put pressure on the funding of social programs.

- Adjustments to Program Funding: The government may need to make adjustments to program funding, potentially through cuts in some areas or reallocations of resources.

- Impact on Social Security: Changes to pension contributions could have an immediate impact on the funding of the pension system, potentially affecting the benefits received by retirees.

- Long-Term Consequences:

- Sustainability of Social Programs: The long-term sustainability of social programs depends on the overall health of the economy. If the policy stimulates economic growth, it could generate more tax revenue, supporting these programs.

- Impact on Public Services: Reduced funding for social programs could affect the quality and availability of public services, such as healthcare and education.

- Need for Reform: The government may need to consider reforms to social programs to ensure their long-term viability, particularly if the policy leads to revenue shortfalls.

Reactions and Perspectives

The announcement regarding the potential waiving of the dividend tax and the 2% pension contribution is likely to trigger a diverse range of reactions across Bulgarian society. These reactions will come from various political factions, economic experts, the general public, and international organizations, each with their own perspectives and potential concerns. Understanding these different viewpoints is crucial for assessing the potential impacts of the proposed changes.

Political Party Reactions

The reactions from Bulgaria’s political parties will vary significantly, reflecting their differing ideologies and priorities. This will be influenced by the ruling party’s political alignment and opposition parties’ strategies.

- Ruling Party (e.g., GERB, if applicable): The ruling party, if it initiated the proposal, will likely frame the changes as a positive step towards stimulating the economy and attracting investment. They may emphasize the potential benefits for businesses and individual investors, highlighting job creation and economic growth. They might point to similar measures implemented in other countries and their positive outcomes. For example, they could cite the tax cuts implemented in Ireland during the Celtic Tiger era as a comparable example.

- Opposition Parties (e.g., BSP, etc.): Opposition parties are likely to criticize the proposal, potentially framing it as benefiting only the wealthy at the expense of social programs. They might raise concerns about the potential impact on the state budget and the sustainability of the pension system. The opposition could use examples of countries where similar measures led to increased income inequality.

- Smaller Parties and Coalitions: Parties with a focus on specific sectors or demographics (e.g., environmental parties, labor unions) may have more nuanced reactions. Environmental parties might voice concerns about potential environmental consequences if the tax cuts lead to increased industrial activity. Labor unions could express worries about the long-term viability of the pension system.

Economists and Financial Experts’ Views

Economists and financial experts will likely offer a more technical assessment of the proposed changes, focusing on the potential economic consequences.

- Proponents: Some economists might argue that waiving the dividend tax and pension contributions will incentivize investment, leading to increased business activity and economic expansion. They might highlight the potential for increased foreign direct investment (FDI) and the positive impact on the stock market.

- Skeptics: Other experts may express skepticism, citing concerns about the potential for reduced government revenue and the sustainability of the pension system. They might question whether the tax cuts will actually translate into increased investment and job creation, or whether they will primarily benefit shareholders and business owners. They may also point out that such measures can create instability in times of economic downturns, citing the Greek debt crisis as an example.

- Neutral Observers: Some economists will likely adopt a more cautious approach, emphasizing the need for a thorough analysis of the potential impacts before making definitive judgments. They may call for more detailed economic modeling and analysis to assess the likely outcomes.

General Public Responses

The general public’s reaction will likely be mixed, depending on their individual circumstances and perspectives.

- Investors and Business Owners: Individuals and businesses that directly benefit from the proposed changes are likely to welcome them, viewing them as a positive development that will increase their income and profitability.

- Pensioners and Workers: Pensioners and workers might express concerns about the long-term impact on the pension system and the potential for reduced social benefits. They might fear that the changes will exacerbate income inequality and put additional strain on social safety nets.

- General Public: The general public’s reaction will likely be influenced by the media coverage and the arguments put forward by different political parties and interest groups. Public opinion could shift significantly depending on how the proposed changes are presented and debated.

International Body Reactions

International bodies such as the International Monetary Fund (IMF) and the European Commission (EC) will likely monitor the developments closely. Their reactions will be shaped by their mandates and priorities.

- IMF: The IMF may express concerns about the potential impact on Bulgaria’s fiscal stability and debt levels. They might recommend that the government carefully assess the long-term implications of the proposed changes and ensure that they are consistent with the country’s macroeconomic goals. The IMF often advises caution when it comes to significant tax cuts, especially in countries with existing fiscal challenges.

- European Commission: The EC will likely assess the proposed changes in the context of Bulgaria’s obligations as a member of the European Union. They might be concerned about the impact on the EU budget if the tax cuts reduce Bulgaria’s contributions. The EC will also likely scrutinize the proposal’s compatibility with EU competition rules and its potential effects on the single market.

Comparison with Previous Policies

Source: org.ls

The announcement regarding the dividend tax waiver and the suspension of the 2% pension contribution needs to be viewed in the context of Bulgaria’s economic history. Understanding how this policy compares to past measures, Borisov’s prior stances, and international practices provides crucial insight into its potential impact.

Similar Measures Implemented in the Past

Bulgaria has a history of adjusting tax policies to stimulate economic activity. These adjustments, however, have varied in their scope and duration.

- Temporary Tax Cuts: In the past, Bulgaria has implemented temporary cuts in corporate tax rates or value-added tax (VAT) to boost investment and consumption during economic downturns. These were often short-lived and designed to provide immediate relief.

- Tax Incentives for Specific Sectors: Targeted tax incentives, such as those for foreign investors or businesses in certain regions, have been used to attract investment and create jobs. These policies were designed to address specific economic challenges.

- Changes to Social Security Contributions: There have been prior adjustments to social security contributions, including changes to the rates paid by employers and employees. These changes aimed to balance the pension system’s funding and support economic competitiveness.

Contrast with Borisov’s Previous Economic Stances

Borisov’s economic policies have evolved over time, reflecting changes in economic conditions and political priorities. Comparing the current announcement with his previous stances reveals potential shifts in his approach.

- Fiscal Conservatism: Historically, Borisov’s governments have emphasized fiscal conservatism, prioritizing budget balance and debt reduction. This announcement, involving a tax cut and reduced pension contributions, may appear to contradict this stance, potentially increasing the budget deficit.

- Focus on Infrastructure Development: Prior to this, a significant focus was put on large-scale infrastructure projects, such as highways and railways. This contrasted with the current emphasis on tax relief and potential for private sector stimulus.

- Emphasis on EU Funds: Earlier administrations heavily relied on European Union funds for infrastructure and economic development. This shift may indicate a greater emphasis on domestic sources of growth.

Similarities and Differences with Policies in Other Countries

Examining how other countries have addressed similar economic challenges can help assess the potential outcomes of this policy.

- Tax Cuts for Investment: Many countries, including those in the European Union, have implemented tax cuts or incentives to encourage investment and stimulate economic growth. The effectiveness of these measures depends on various factors, including the overall economic climate and the specific design of the policy.

- Pension Reform: Numerous countries have undertaken pension reforms to address demographic changes and ensure the long-term sustainability of their pension systems. These reforms have often involved adjustments to contribution rates, retirement ages, and benefit levels.

- Fiscal Stimulus Packages: During economic downturns, many governments have implemented fiscal stimulus packages, including tax cuts and increased government spending, to boost demand and support economic recovery. The size and composition of these packages vary depending on the severity of the economic crisis and the specific priorities of the government.

Contrasting Opinions of Key Stakeholders

The announcement is likely to generate diverse opinions among key stakeholders, reflecting differing perspectives on its potential benefits and drawbacks.

Business Leaders: Generally supportive, viewing the tax cuts as a way to boost investment and competitiveness.

Trade Unions: Likely to express concerns about the impact on the pension fund and potential erosion of social benefits.

Economists: Divided, with some supporting the measure as a stimulus and others expressing concerns about fiscal sustainability.

Opposition Parties: Likely to criticize the policy, potentially questioning its effectiveness and fiscal responsibility.

Potential for Implementation and Challenges

Implementing these proposed tax changes, waiving the dividend tax and the 2% pension contribution, presents a complex undertaking. Success hinges on a well-defined implementation plan and the ability to navigate potential hurdles. This section will Artikel the practical steps involved, the challenges that may arise, and how these changes could be received by different stakeholders.

Practical Steps for Implementation

The implementation of these tax changes requires a series of coordinated steps involving various governmental bodies and institutions.The process includes:

- Legislative Amendments: The initial step involves drafting and enacting the necessary amendments to the relevant tax laws, specifically the Income Taxes on Natural Persons Act (ZDFL) and the Social Security Code. This process requires parliamentary approval, including debates, committee reviews, and ultimately, a vote.

- Regulatory Guidelines: Following legislative approval, the Ministry of Finance and the National Revenue Agency (NRA) must issue detailed regulatory guidelines and interpretations to clarify how the new rules will be applied in practice. This will address specific scenarios, exemptions, and compliance procedures.

- IT System Updates: The NRA’s IT systems, used for tax collection and administration, must be updated to reflect the new tax rates and rules. This involves significant programming, testing, and deployment efforts.

- Communication and Education: A comprehensive communication strategy is crucial to inform taxpayers, businesses, and the public about the changes. This includes publishing materials, holding public forums, and providing online resources.

- Training of Tax Officials: Tax officials at the NRA and other relevant agencies need to be trained on the new regulations to ensure consistent and accurate application.

- Monitoring and Evaluation: A system for monitoring the impact of the tax changes is necessary. This involves collecting data on revenue, investment, and economic activity, as well as regular evaluation of the effectiveness of the policy.

Potential Challenges to Implementing the Policy

Several challenges could impede the smooth implementation of the proposed tax changes.These challenges include:

- Political Opposition: The proposed changes may face opposition from political parties or interest groups that disagree with the policy. This could delay or even derail the implementation process.

- Revenue Loss: Waiving the dividend tax and the 2% pension contribution will result in a reduction in government revenue. Managing this revenue loss without impacting public services or increasing debt will be a significant challenge.

- Administrative Complexity: While seemingly straightforward, the changes could create administrative complexities, particularly for businesses with complex ownership structures or cross-border operations. The NRA must be prepared to handle these complexities efficiently.

- Tax Avoidance: There is a risk that some taxpayers may attempt to exploit loopholes in the new rules to avoid paying taxes. The NRA needs to have effective mechanisms to detect and prevent tax avoidance.

- Public Perception: The changes could be perceived negatively by some segments of the population, particularly if they are seen as benefiting the wealthy or undermining the sustainability of the pension system.

Reception of the Changes

The reception of these tax changes will likely vary depending on the stakeholder.Here’s how different groups might react:

- Investors: Investors, particularly those who receive dividends, are likely to welcome the waiving of the dividend tax, as it increases their after-tax returns. This could encourage investment and boost economic activity.

- Businesses: Businesses, especially those with significant dividend payouts, could see the changes as a positive step. However, they may be concerned about the potential impact on public finances and the sustainability of the pension system.

- Employees: Employees may have mixed reactions. While some may benefit from increased investment and economic growth, others might be concerned about the potential impact on the pension system.

- Pensioners: Pensioners could be concerned about the sustainability of the pension system if the 2% contribution is removed, potentially leading to lower future benefits.

- Government: The government will likely view the changes as a strategic move to stimulate the economy. However, it will also need to carefully manage the potential revenue loss and address any negative impacts on public services.

Visual Representation of Potential Challenges

Imagine a visual representation: a flowchart illustrating the potential challenges. The central node is labeled “Tax Changes Implementation.” Arrows emanate from this node, pointing to various challenge categories. Each arrow is accompanied by a brief description.The arrows and descriptions could include:

- Political Opposition: Arrow pointing to a symbol of a divided parliament, with the description “Delays and amendments due to differing political views.”

- Revenue Loss: Arrow pointing to a bar graph depicting a decline in government revenue, with the description “Reduced funding for public services and potential debt increase.”

- Administrative Complexity: Arrow pointing to a complex network of interconnected forms and processes, with the description “Increased burden on businesses and the NRA.”

- Tax Avoidance: Arrow pointing to a shadowy figure attempting to slip through a crack, with the description “Exploitation of loopholes, requiring robust enforcement.”

- Public Perception: Arrow pointing to a divided group of people with varying expressions, with the description “Concerns about fairness and impact on the pension system.”

This visual representation highlights the multifaceted nature of the challenges associated with implementing the proposed tax changes. It illustrates the complexities that must be addressed to ensure successful implementation.

Future Scenarios and Predictions

The announcement regarding the potential waiving of dividend tax and the 2% pension contribution opens up several possible future pathways for the Bulgarian economy, its investors, and the political landscape. These scenarios range from optimistic booms to cautious adjustments, each with its own set of challenges and opportunities. Understanding these potential outcomes is crucial for stakeholders to prepare for the shifts that may lie ahead.

Potential Long-Term Economic Outlook

The long-term economic outlook hinges on several factors, including investor response, business behavior, and the government’s ability to manage potential risks.The anticipated outcomes are:

- Increased Investment and Economic Growth: If the policy changes stimulate investment, as intended, the Bulgarian economy could experience accelerated growth. This could lead to:

- Higher employment rates.

- Increased tax revenues (potentially offsetting the lost revenue from the dividend tax).

- Improved living standards for the population.

This scenario is similar to what happened in Ireland during the early 2000s when they significantly lowered corporate tax rates, attracting foreign investment and experiencing rapid economic growth, often referred to as the “Celtic Tiger” period. However, this growth was also followed by a significant financial crisis, underscoring the need for careful management.

- Moderate Growth with Cautious Investor Behavior: A more conservative outlook suggests moderate economic growth. Investors might adopt a wait-and-see approach, and businesses might be hesitant to make significant changes until they observe the policy’s long-term effects. This could result in:

- Gradual increases in investment.

- A more measured pace of job creation.

- A more controlled impact on inflation.

This scenario is akin to the economic response observed in certain Eastern European countries after joining the European Union, where growth was steady but not explosive, reflecting a cautious integration into the global economy.

- Economic Stagnation or Decline: A less favorable outcome could involve economic stagnation or even a decline. This might occur if the policy changes fail to attract significant investment, if other economic headwinds arise (e.g., global recession, political instability), or if the government mismanages the fiscal implications of the policy. This could lead to:

- Decreased investment and business activity.

- Rising unemployment.

- A decrease in tax revenues.

A relevant example is the experience of Greece during its debt crisis, where austerity measures and economic instability led to a prolonged period of economic contraction.

Potential Political Consequences

The political ramifications of this policy are significant and could influence the government’s stability and future policy decisions.

- Increased Popular Support: If the policy leads to economic improvements, the government could see a surge in popularity. Increased employment, higher wages, and a general sense of economic well-being could boost public confidence. This could:

- Strengthen the government’s position.

- Increase its chances of re-election.

- Provide a mandate for further reforms.

This outcome is similar to what occurred in many Western European countries after the post-World War II economic boom, where governments that oversaw economic prosperity enjoyed prolonged periods of political stability.

- Political Polarization and Social Unrest: If the policy’s benefits are not widely shared or if it leads to economic hardship for certain groups, it could exacerbate political divisions and potentially lead to social unrest.

- Criticism from opposition parties.

- Public protests and demonstrations.

- Increased social inequalities.

The implementation of austerity measures in many countries following the 2008 financial crisis provides an example of this. These measures, intended to stabilize economies, often led to public backlash and political instability.

- Policy Reversals and Adjustments: The government may need to adjust or even reverse the policy if the initial outcomes are unfavorable. This could happen if:

- The fiscal impact of the policy becomes unsustainable.

- Public opinion turns against the policy.

- Unexpected economic challenges emerge.

The constant revisions to tax policies in many countries, often in response to changing economic conditions and political pressures, exemplify this scenario.

Possible Influence on Other Policies

The decision to waive the dividend tax and the 2% contribution to the pension fund is likely to influence other government policies.

- Fiscal Policy Adjustments: The government will likely need to make adjustments to its fiscal policy to compensate for the lost revenue. This could involve:

- Spending cuts in other areas.

- Increases in other taxes.

- Increased borrowing.

For example, if the dividend tax waiver significantly reduces tax revenue, the government might need to cut spending on public services, infrastructure projects, or social programs, leading to political trade-offs and potential social unrest.

- Pension System Reforms: The policy could prompt further reforms to the pension system. The government might need to address the long-term sustainability of the pension fund, potentially through:

- Raising the retirement age.

- Increasing contributions from other sources.

- Reducing benefits.

Many European countries have undertaken pension reforms in recent decades due to aging populations and unsustainable funding models, often involving a combination of these measures.

- Investment and Business Regulations: The government might adjust investment and business regulations to further incentivize investment and economic activity. This could involve:

- Streamlining business registration processes.

- Reducing bureaucracy.

- Offering tax incentives for specific industries or investments.

Countries like Singapore have successfully used regulatory reforms and investment incentives to attract foreign investment and boost economic growth.

End of Discussion

Borisov’s proposal to eliminate the dividend tax and pension contributions represents a significant gamble with the Bulgarian economy. While the potential benefits for investors and businesses are clear, the long-term consequences, particularly for government revenue and social programs, remain uncertain. The success of this policy hinges on careful implementation, navigating political opposition, and adapting to the evolving economic landscape. Ultimately, the announcement’s legacy will be determined by its impact on Bulgaria’s economic growth, social welfare, and political stability.

Questions and Answers

What is a dividend tax, and why is waiving it significant?

A dividend tax is a tax levied on the profits distributed to shareholders of a company. Waiving this tax could make investing in Bulgarian companies more attractive, potentially boosting investment and economic activity by increasing investor returns.

What is the 2% contribution to the pension fund, and what does it fund?

The 2% contribution is a portion of earnings allocated to the national pension fund. This fund is used to pay retirement benefits to pensioners. Waiving this contribution means that businesses may have more funds available, but the pension fund could see a decrease in income.

Who benefits most from this policy change?

Potentially, investors, shareholders, and businesses that distribute dividends could benefit directly. Additionally, if the policy stimulates economic growth, the broader economy could also see positive effects. However, the exact distribution of benefits would depend on the specific implementation and the economic response.

Are there any risks associated with waiving these taxes and contributions?

Yes. A primary risk is the potential reduction in government revenue, which could impact funding for social programs, infrastructure, and other essential services. There are also concerns about the long-term sustainability of the pension fund if contributions are reduced.

How might this policy affect foreign investment in Bulgaria?

By making Bulgarian companies more attractive to investors, this policy could potentially increase foreign investment. However, the overall impact would depend on various factors, including the broader economic climate, investor confidence, and the specific terms of the policy.