The Kampala Capital City Authority (KCCA) faces the constant challenge of urban development, requiring careful management of projects and finances. Historically, project financial appraisal methods presented limitations, hindering KCCA’s ability to effectively allocate resources and achieve its strategic goals. This is where the PIM Centre of Excellence (CoE) steps in, bringing a fresh approach to project management.

The PIM CoE was established to directly address these challenges, aiming to improve the accuracy and efficiency of financial assessments for KCCA projects. This involves comprehensive training programs, the implementation of new methodologies and tools, and the integration of advanced software systems. The result is a transformation in how KCCA approaches project financial appraisal, leading to measurable improvements in project outcomes.

Introduction

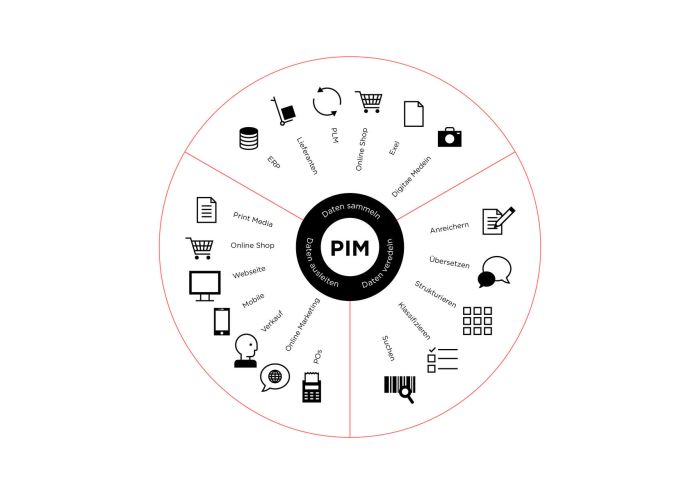

Source: dachcom.de

Kampala Capital City Authority (KCCA) plays a pivotal role in shaping the urban landscape of Uganda’s capital city. Responsible for providing essential services and overseeing development projects, KCCA strives to improve the quality of life for Kampala’s residents. However, managing projects and financial resources effectively has presented significant challenges, necessitating the implementation of robust financial appraisal methods.Effective project financial appraisal is crucial for KCCA to make informed decisions about resource allocation and ensure the successful execution of development initiatives.

This introduction sets the stage by examining KCCA’s role, the challenges it faces, the limitations of past practices, and the strategic importance of adopting enhanced appraisal techniques.

KCCA’s Role in Urban Development

KCCA’s mandate extends across a broad spectrum of urban development functions. It is the primary entity responsible for infrastructure development, including roads, drainage systems, and public buildings. Furthermore, KCCA manages essential services such as waste management, public health, and education. The authority also plays a critical role in urban planning, ensuring sustainable growth and development within the city.

Challenges in Project and Financial Resource Management

KCCA faces numerous challenges in managing its projects and financial resources, impacting its ability to deliver effective services. These challenges often stem from various factors:

- Limited Funding: KCCA frequently operates with constrained budgets, requiring careful prioritization of projects and efficient resource allocation. Securing adequate funding from both local revenue and external sources can be a complex process.

- Project Delays and Cost Overruns: Many projects experience delays and exceed their initial budgets. This can be attributed to factors like procurement issues, inadequate planning, and unforeseen circumstances.

- Capacity Constraints: The authority may face capacity limitations in terms of skilled personnel, particularly in areas such as project management, financial analysis, and procurement.

- Coordination Issues: Effective coordination among various departments and stakeholders is essential for project success. However, communication breakdowns and bureaucratic processes can hinder progress.

These challenges underscore the need for rigorous financial appraisal to ensure that projects are viable, efficiently managed, and deliver the intended benefits.

Limitations of Previous Project Financial Appraisal Methods

Prior to the implementation of enhanced methods, KCCA’s project financial appraisal processes had certain limitations:

- Inadequate Risk Assessment: Previous methods might not have fully incorporated risk assessment, potentially leading to inaccurate forecasts and insufficient contingency planning.

- Limited Sensitivity Analysis: The appraisal process may not have adequately considered the impact of changes in key variables, such as inflation or interest rates, on project profitability.

- Simplified Cost-Benefit Analysis: Cost-benefit analyses might have been overly simplified, potentially overlooking crucial factors that could affect project viability.

- Insufficient Data Analysis: There could have been a lack of comprehensive data analysis to support financial projections and assess project performance.

These limitations contributed to potential inaccuracies in project evaluations, affecting decision-making and project outcomes.

Strategic Importance of Effective Project Financial Appraisal

Effective project financial appraisal is of paramount importance to KCCA’s success for several reasons:

- Informed Decision-Making: Rigorous appraisal provides the data and analysis necessary to make informed decisions about which projects to undertake and how to allocate resources.

- Improved Project Viability: By carefully evaluating costs, benefits, and risks, KCCA can increase the likelihood that projects will be financially viable and deliver the expected returns.

- Efficient Resource Allocation: Effective appraisal helps ensure that resources are allocated to the most promising projects, maximizing the impact of investments.

- Enhanced Accountability: Transparent and well-documented appraisal processes promote accountability and help to build public trust.

- Attracting Investment: Sound financial appraisal can make KCCA projects more attractive to potential investors and funding agencies.

By adopting enhanced project financial appraisal methods, KCCA can improve its ability to plan, manage, and execute projects effectively, ultimately contributing to the sustainable development of Kampala.

The PIM Centre of Excellence (CoE)

The establishment of the Project Information Management (PIM) Centre of Excellence (CoE) marks a significant step in enhancing the Kampala Capital City Authority’s (KCCA) project management capabilities. This CoE is designed to serve as a central hub for expertise, best practices, and knowledge sharing related to project information management, ultimately improving the efficiency and effectiveness of KCCA’s projects.

The PIM CoE’s Core Mission and Strategic Alignment

The core mission of the PIM CoE is to improve the success rate of KCCA projects by providing the necessary resources, training, and support for effective project information management. This mission is directly aligned with KCCA’s strategic goals, particularly those related to infrastructure development, service delivery, and urban planning. By centralizing project information and expertise, the CoE contributes to more informed decision-making, better resource allocation, and ultimately, the successful completion of projects that benefit the citizens of Kampala.

For example, KCCA’s strategic plan might Artikel objectives like “Improve infrastructure delivery” or “Enhance service provision”. The PIM CoE directly supports these objectives by ensuring that projects are well-managed, data-driven, and aligned with the city’s overall development strategy.

Key Objectives of the PIM CoE

The PIM CoE is designed to achieve several key objectives to improve project outcomes.

- Standardization of Project Management Processes: The CoE will establish and enforce standardized project management methodologies, templates, and guidelines across all KCCA projects. This includes developing standard operating procedures (SOPs) for project initiation, planning, execution, monitoring, and closure. Standardization ensures consistency, reduces errors, and improves project predictability.

- Capacity Building and Training: A core function of the CoE is to provide training and development programs for KCCA staff involved in project management. This training will cover various aspects of PIM, including project planning, risk management, data analysis, and the use of project management software. Regular training sessions and workshops will be conducted to keep staff updated on best practices and emerging trends.

- Centralized Repository of Project Information: The CoE will create and maintain a centralized repository of all project-related information, including documents, data, and reports. This repository will be easily accessible to authorized personnel and will facilitate efficient information sharing and collaboration. This centralized system is crucial for informed decision-making and project tracking.

- Performance Monitoring and Evaluation: The CoE will implement a robust system for monitoring and evaluating project performance. This includes tracking key performance indicators (KPIs), conducting regular project audits, and generating reports on project progress and outcomes. The data collected will be used to identify areas for improvement and to inform future project planning.

- Knowledge Sharing and Best Practice Dissemination: The CoE will facilitate the sharing of knowledge and best practices among project teams. This will include organizing regular forums, workshops, and seminars to promote collaboration and learning. The CoE will also document and disseminate lessons learned from past projects to prevent the recurrence of mistakes and to replicate successes.

Stakeholders and Their Roles in the PIM CoE

The PIM CoE involves various stakeholders, each with specific roles and responsibilities. Effective collaboration among these stakeholders is essential for the CoE’s success.

- KCCA Leadership: KCCA leadership provides strategic direction, allocates resources, and ensures that the CoE’s activities align with the organization’s overall goals. They are responsible for endorsing the CoE’s initiatives and providing the necessary support for its operation. Their role is critical in driving the adoption of PIM best practices across KCCA.

- PIM CoE Director/Manager: The Director or Manager is responsible for the overall management and operation of the CoE. This includes overseeing the implementation of PIM processes, managing the CoE’s budget, and supervising the CoE’s staff. They serve as the primary point of contact for all PIM-related matters.

- Project Managers: Project managers are responsible for managing individual projects within KCCA. They utilize the resources and support provided by the CoE to ensure their projects are delivered successfully. They actively participate in training programs and adhere to the standardized PIM processes established by the CoE.

- Project Team Members: Project team members, including engineers, architects, and other specialists, work on individual projects under the direction of project managers. They are expected to follow the PIM guidelines and use the tools and resources provided by the CoE. Their input and participation are crucial for the successful implementation of PIM practices.

- IT Department: The IT Department provides technical support for the CoE, including the development and maintenance of the centralized project information repository and project management software. They ensure that the IT infrastructure supports the CoE’s operations.

- Training and Development Department: The Training and Development Department collaborates with the CoE to design and deliver training programs for KCCA staff. They ensure that the training content is relevant and effective in improving project management skills.

- External Consultants/Experts: External consultants or experts may be engaged to provide specialized expertise or training to the CoE. Their role is to supplement the internal capabilities of the CoE and to bring in best practices from other organizations.

Organizational Structure of the PIM CoE

The organizational structure of the PIM CoE is designed to facilitate efficient operations and effective collaboration.

A sample structure might include:

- Director/Manager: Leads and manages the CoE, responsible for strategic direction, budget, and overall performance.

- PIM Specialists/Analysts: Responsible for developing and implementing PIM processes, providing training, and analyzing project data.

- Data Management Officer: Manages the centralized project information repository, ensuring data accuracy and accessibility.

- Training and Capacity Building Officer: Designs and delivers training programs, coordinates workshops, and promotes knowledge sharing.

- Administrative Support Staff: Provides administrative support, manages communications, and coordinates meetings.

The CoE should also have a steering committee comprising representatives from KCCA leadership, project managers, and other key stakeholders to provide oversight and guidance. The structure should be flexible and adaptable to meet the evolving needs of KCCA and its projects. The lines of reporting should be clear to ensure accountability and effective communication.

Capacity Building

The PIM Centre of Excellence (CoE) played a crucial role in enhancing the project financial appraisal capabilities of KCCA staff. This was achieved through a comprehensive capacity-building program, meticulously designed to equip personnel with the necessary skills and knowledge. These programs were instrumental in ensuring that KCCA could effectively assess the financial viability of its projects, leading to more informed decision-making and improved resource allocation.

Training and Development Programs Implemented

The PIM CoE implemented a range of training and development programs tailored to meet the specific needs of KCCA staff involved in project appraisal. These programs were designed to be practical and engaging, ensuring that participants could immediately apply their new skills to real-world scenarios. The training curriculum was regularly updated to reflect the latest best practices and methodologies in project financial management.The training programs covered a wide spectrum of topics, including financial modeling, risk assessment, cost-benefit analysis, and project financing.

Various training methodologies were employed to cater to diverse learning styles and ensure maximum knowledge retention. These included workshops, interactive simulations, case studies, and practical exercises. Participants were encouraged to actively participate and share their experiences, fostering a collaborative learning environment.Here is a table summarizing the training programs:

| Training Program Topic | Target Audience | Duration |

|---|---|---|

| Financial Modeling for Project Appraisal | Project Managers, Finance Officers, Engineers | 5 days |

| Cost-Benefit Analysis and Project Selection | Senior Management, Planning Officers, Economists | 3 days |

| Risk Assessment and Mitigation in Project Finance | Project Risk Managers, Auditors, Project Team Members | 4 days |

Enhanced Project Financial Appraisal Methods

Source: ntara.com

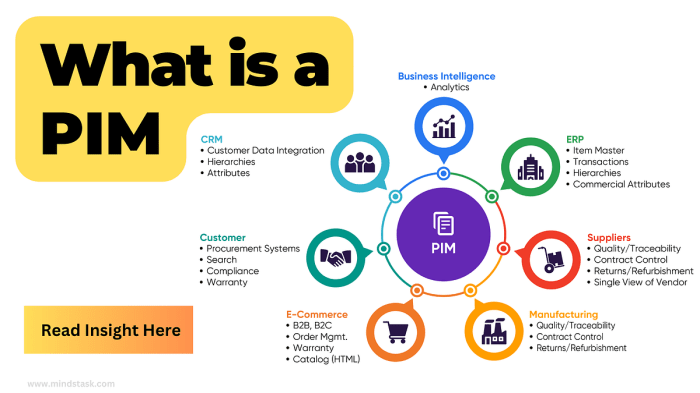

The PIM Centre of Excellence (CoE) significantly revamped the project financial appraisal process at KCCA. This involved introducing advanced methodologies and tools designed to boost the accuracy, efficiency, and overall effectiveness of financial assessments for proposed projects. The goal was to provide a more robust and reliable framework for decision-making, ensuring that KCCA’s resources were allocated strategically and efficiently.

New Methodologies and Tools for Project Appraisal

The CoE implemented a suite of new methodologies and tools, moving beyond traditional methods to incorporate more sophisticated techniques. This upgrade aimed to provide a more comprehensive view of a project’s financial viability.

- Discounted Cash Flow (DCF) Analysis: DCF became a cornerstone of the new appraisal process. This method forecasts future cash flows and discounts them back to their present value, providing a more realistic assessment of a project’s profitability. The CoE provided training and software to implement DCF effectively.

- Cost-Benefit Analysis (CBA): CBA was refined to include a wider range of costs and benefits, both direct and indirect. This holistic approach helped to capture the full impact of a project on the community and the environment. The CBA now incorporates social and environmental considerations, using methodologies to quantify non-monetary impacts.

- Sensitivity Analysis: To address uncertainties, sensitivity analysis was integrated. This involved testing how changes in key variables, such as interest rates or project costs, would affect the project’s financial outcomes. This allowed for the identification of critical risk factors and the development of mitigation strategies.

- Risk Assessment Matrix: A risk assessment matrix was introduced to systematically identify, assess, and prioritize project risks. This tool categorized risks based on their likelihood and potential impact, enabling KCCA to focus on the most critical threats.

Improvements in Accuracy and Efficiency of Financial Assessments

The introduction of these methods and tools significantly improved the accuracy and efficiency of financial assessments. These improvements translated into more informed decision-making and better resource allocation.

- Enhanced Accuracy: The DCF and CBA methods, with their detailed financial modeling, provided more precise estimates of project profitability and overall value. The inclusion of sensitivity analysis allowed for a more realistic evaluation, considering potential fluctuations in the economic environment.

- Increased Efficiency: The CoE provided specialized software and standardized templates, streamlining the appraisal process. These tools automated many of the calculations, reducing the time required to complete financial assessments.

- Improved Data Management: The implementation of standardized data input formats and centralized data storage improved data quality and accessibility. This facilitated easier comparison of project proposals and more efficient reviews.

Process of Project Proposal Evaluation

The new process for project proposal evaluation involved a structured, multi-stage approach, ensuring a comprehensive assessment of each project’s financial viability.

- Project Proposal Submission: Project proponents submitted detailed proposals, including project descriptions, cost estimates, and expected benefits.

- Initial Screening: The PIM CoE conducted an initial screening to ensure the proposals met the basic requirements and eligibility criteria.

- Financial Appraisal: The CoE performed a detailed financial appraisal using the new methodologies, including DCF, CBA, and sensitivity analysis.

- Risk Assessment: A comprehensive risk assessment was conducted to identify and evaluate potential risks associated with the project.

- Recommendation and Decision: Based on the financial appraisal and risk assessment, the CoE provided recommendations to the relevant decision-making bodies, who then made the final decisions on project approval and funding.

Step-by-Step Procedures for Conducting a Financial Appraisal

Conducting a financial appraisal using the new methods involved a series of clearly defined steps, ensuring consistency and thoroughness. This included data inputs and outputs.

- Data Collection: Gathered all relevant data, including project costs, revenues, operating expenses, and any other financial information.

- Cost Estimation: Estimated all project costs, including initial investment costs, operating costs, and any other relevant expenses.

- Revenue Forecasting: Forecasted the project’s revenues over its lifespan, considering market analysis, demand projections, and pricing strategies.

- Cash Flow Projections: Developed detailed cash flow projections, including all inflows and outflows of cash over the project’s life.

- Discounting: Discounted the projected cash flows using an appropriate discount rate, typically the Weighted Average Cost of Capital (WACC), to calculate the present value.

WACC = (E/V

- Re) + (D/V

- Rd

(1 – Tc)) where

E = Market value of equity, D = Market value of debt, V = Total value of the firm (E + D), Re = Cost of equity, Rd = Cost of debt, Tc = Corporate tax rate.

- Net Present Value (NPV) Calculation: Calculated the NPV of the project, which represents the difference between the present value of cash inflows and the present value of cash outflows.

- Internal Rate of Return (IRR) Calculation: Calculated the IRR, which is the discount rate that makes the NPV equal to zero.

- Sensitivity Analysis: Conducted sensitivity analysis to assess the impact of changes in key variables on the project’s financial outcomes.

- Risk Assessment: Performed a risk assessment using the risk assessment matrix to identify and evaluate potential risks.

- Reporting and Recommendation: Prepared a detailed report summarizing the financial appraisal findings, including the NPV, IRR, and sensitivity analysis results, and provided recommendations based on the assessment.

Technology and Tools

The PIM Centre of Excellence (CoE) at KCCA recognized the crucial role of technology in enhancing project financial appraisal. Implementing robust software and systems was key to streamlining processes, improving accuracy, and providing more insightful data analysis. This section details the specific technologies deployed and their impact on KCCA’s project evaluation capabilities.

Software and Systems Implemented

The PIM CoE integrated several key software and systems to support project financial appraisal, optimizing data management, analysis, and reporting. This strategic approach aimed to replace manual processes with automated solutions, leading to increased efficiency and improved decision-making.

- Financial Modeling Software: This software allowed for the creation of dynamic financial models, enabling sensitivity analysis and scenario planning.

- Data Management System: A centralized database was implemented to store project-related data, ensuring data integrity and accessibility.

- Reporting and Business Intelligence (BI) Tools: These tools facilitated the generation of comprehensive reports and dashboards, providing visual insights into project performance.

Streamlining Data Collection, Analysis, and Reporting

The integration of these technologies significantly streamlined the entire project appraisal process. Automation reduced manual data entry and minimized errors, while advanced analytical capabilities provided deeper insights into project feasibility. This led to faster decision-making and improved project outcomes.

- Data Collection: The data management system centralized data collection from various sources, reducing manual input and ensuring data accuracy.

- Data Analysis: Financial modeling software enabled detailed analysis of project financials, including discounted cash flow analysis, internal rate of return (IRR), and net present value (NPV).

- Reporting: BI tools generated customized reports and dashboards, providing real-time insights into project performance, enabling stakeholders to monitor progress effectively.

User Interface and Key Features of Primary Software

The primary software used was a financial modeling tool, selected for its versatility and user-friendly interface. The interface offered a clear and intuitive layout, simplifying complex financial analysis tasks. Key features enhanced the user experience and the quality of the analysis.

- Dashboard: A central dashboard displayed key performance indicators (KPIs) at a glance, allowing users to quickly assess project health.

- Scenario Planning: Users could easily create multiple scenarios (e.g., optimistic, pessimistic, and base case) to assess the impact of different variables on project outcomes.

- Sensitivity Analysis: The software enabled sensitivity analysis, identifying the critical factors that most significantly affected project profitability.

- Reporting: Customizable reports could be generated to present financial data in various formats, supporting clear communication with stakeholders.

Data Flow within the Implemented Systems

The diagram below illustrates the flow of data within the implemented systems. Data flowed seamlessly from collection to analysis and reporting, enabling efficient information management and informed decision-making.

Data Flow Diagram:

1. Data Input: Project data is gathered from various sources (e.g., project proposals, cost estimates, revenue projections).

2. Data Storage: The data is then entered into the data management system. This system acts as a central repository for all project-related information.

3. Data Analysis: The financial modeling software accesses data from the data management system. It then performs calculations, including discounted cash flow, sensitivity analysis, and scenario planning.

4. Data Output/Reporting: Finally, the BI tools access the processed data from the financial modeling software. These tools generate reports and dashboards, presenting key insights to stakeholders.

Case Studies: Successful Project Appraisals and Their Results

Source: medium.com

The PIM Centre of Excellence (CoE) has played a crucial role in enhancing the quality of project appraisals within KCCA. This has resulted in more effective resource allocation and the successful completion of numerous projects. Examining specific case studies allows us to understand the practical impact of the CoE’s methods and tools.These case studies showcase the CoE’s impact on project success, highlighting how improved appraisal techniques lead to tangible benefits for KCCA and the community.

The following examples demonstrate the application of the enhanced methods and the outcomes achieved.

Successful Project Appraisals Overview

The following projects benefited significantly from the PIM CoE’s improved appraisal processes. These projects were carefully selected to represent a diverse range of KCCA’s initiatives, illustrating the broad applicability of the CoE’s methodologies.

- Road Infrastructure Improvement Project: This project focused on upgrading and expanding road networks within Kampala.

- Drainage System Upgrade: Aimed at improving the city’s drainage infrastructure to mitigate flooding.

- Market Modernization Project: Focused on renovating and modernizing existing markets to improve trading conditions.

Challenges Addressed in Each Case Study Project

Each project presented unique challenges that the enhanced appraisal methods helped to overcome. The CoE’s approach allowed for a more comprehensive assessment of risks and potential returns, leading to more informed decision-making.

- Road Infrastructure Improvement Project: The primary challenge was accurately forecasting traffic volume and its impact on road lifespan. Another challenge was estimating the costs associated with land acquisition and relocation.

- Drainage System Upgrade: The main challenges were assessing the effectiveness of different drainage solutions and predicting the long-term impact on flooding. Another challenge was the accurate estimation of construction costs and the environmental impact.

- Market Modernization Project: This project faced challenges in estimating the revenue potential of modernized markets and assessing the impact on existing vendors. Another challenge was managing stakeholder expectations and minimizing disruption during construction.

Financial and Non-Financial Benefits Realized in Each Case

The application of the CoE’s appraisal methods resulted in significant financial and non-financial benefits for each project. These benefits demonstrate the value of improved project planning and execution.

- Road Infrastructure Improvement Project:

- Financial Benefits: Reduced construction costs by 12% due to improved cost estimation and better contract management. Increased revenue from road user fees by 15% due to improved traffic flow.

- Non-Financial Benefits: Reduced traffic congestion, leading to shorter commute times and improved air quality. Enhanced safety for road users.

- Drainage System Upgrade:

- Financial Benefits: Decreased spending on flood damage repairs by 20%. Reduced insurance premiums for affected properties.

- Non-Financial Benefits: Reduced flooding, protecting property and preventing disruption. Improved public health due to reduced waterborne diseases.

- Market Modernization Project:

- Financial Benefits: Increased revenue from market rentals by 25%. Improved efficiency of market operations.

- Non-Financial Benefits: Improved trading conditions for vendors. Enhanced customer experience.

Project Manager’s Testimony

“The PIM CoE’s support has been invaluable. The enhanced appraisal methods provided us with a much clearer understanding of the project’s feasibility and potential risks. This led to better planning, more efficient resource allocation, and ultimately, a more successful outcome. The improvements in cost estimation and risk management have been particularly significant.”

Challenges and Mitigation Strategies

Establishing and operating a Project Information Management (PIM) Centre of Excellence (CoE) within the Kampala Capital City Authority (KCCA) wasn’t without its hurdles. Successfully navigating these challenges was crucial to the CoE’s ultimate impact on project financial appraisal capacity. This section delves into the primary obstacles encountered, the strategies employed to overcome them, and the valuable lessons learned throughout the implementation process.

It also looks ahead to potential future challenges and proactive mitigation measures.

Initial Resistance and Buy-In

Gaining initial buy-in from various stakeholders within KCCA presented a significant challenge. This resistance often stemmed from a lack of understanding regarding the CoE’s purpose and the perceived impact on existing workflows. Overcoming this required a multifaceted approach.

- Stakeholder Engagement: The KCCA leadership actively championed the CoE, communicating its strategic importance and benefits across all departments. This top-down support was vital in creating an environment of acceptance.

- Demonstration of Value: Pilot projects were initiated to showcase the CoE’s capabilities and tangible benefits. These early successes helped build credibility and demonstrate the value of improved project financial appraisal.

- Training and Awareness Programs: Comprehensive training programs were rolled out to educate KCCA staff on the CoE’s functions, the new appraisal methods, and the benefits of these changes. This addressed concerns and built capacity.

- Clear Communication Strategy: A clear and consistent communication strategy was implemented to explain the CoE’s objectives, progress, and impact. Regular updates and feedback sessions were organized to keep stakeholders informed and involved.

Data Availability and Quality

The availability and quality of data were crucial for effective project financial appraisal. Inconsistent or incomplete data posed a significant threat to accurate analysis.

- Data Audits and Cleansing: Comprehensive data audits were conducted to identify data gaps and inconsistencies. A data cleansing process was then implemented to improve data quality.

- Standardized Data Collection Protocols: Standardized data collection protocols were developed and implemented across all KCCA departments. This ensured consistency and accuracy in future data collection efforts.

- Investment in Data Management Systems: The CoE advocated for and supported the implementation of robust data management systems to store, manage, and analyze project-related data. These systems facilitated data accessibility and integrity.

- Collaboration with IT Department: Close collaboration with the KCCA IT department was established to ensure data security, accessibility, and integration with other relevant systems.

Skills Gaps and Capacity Building

A lack of specialized skills in project financial appraisal within KCCA presented another major challenge. Addressing this required a targeted capacity-building strategy.

- Targeted Training Programs: Specialized training programs were designed and delivered to equip KCCA staff with the necessary skills in project appraisal methodologies, financial modeling, and risk assessment.

- Mentorship and Coaching: Experienced professionals were brought in to provide mentorship and coaching to KCCA staff, offering hands-on guidance and support.

- Knowledge Sharing and Best Practices: The CoE fostered a culture of knowledge sharing and collaboration, encouraging staff to learn from each other and from external experts.

- Partnerships with Universities and Research Institutions: The CoE established partnerships with universities and research institutions to provide advanced training and research opportunities for KCCA staff.

Technological Infrastructure and Adoption

Implementing new technology and ensuring its effective adoption posed challenges related to infrastructure, software, and user proficiency.

- Infrastructure Upgrades: Necessary upgrades were implemented to the KCCA’s IT infrastructure to support the new software and tools.

- Software Selection and Implementation: The CoE carefully selected and implemented appropriate software solutions for project financial appraisal, ensuring they were user-friendly and met the specific needs of KCCA.

- User Training and Support: Comprehensive training and ongoing support were provided to staff on how to use the new software and tools.

- Change Management Strategies: Change management strategies were implemented to address resistance to new technologies and ensure smooth transitions. This included communication, training, and ongoing support.

Lessons Learned During Implementation

The implementation phase provided valuable lessons that could be applied to future projects and initiatives.

- Importance of Strong Leadership: Strong leadership from the KCCA management was crucial for driving the CoE’s success and ensuring its long-term sustainability.

- Necessity of Stakeholder Engagement: Early and consistent stakeholder engagement was critical for building buy-in and addressing concerns.

- Value of Data Quality: Investing in data quality and data management systems was essential for accurate and reliable project financial appraisals.

- Impact of Capacity Building: Targeted capacity-building initiatives were essential for equipping staff with the necessary skills and knowledge.

- Adaptability and Flexibility: Being adaptable and flexible in response to challenges and changing circumstances was crucial for success.

Potential Future Challenges and Mitigation Measures

Looking ahead, the CoE may face new challenges that require proactive mitigation measures.

- Sustaining Momentum and Continuous Improvement: Maintaining momentum and continuously improving the CoE’s operations will require ongoing efforts.

- Mitigation: Establish a dedicated team responsible for monitoring performance, identifying areas for improvement, and implementing new initiatives.

- Keeping Up with Technological Advancements: Staying abreast of technological advancements in project financial appraisal will be critical.

- Mitigation: Invest in ongoing training, research, and development to keep the CoE at the forefront of technological innovation. Consider regular software updates and upgrades.

- Attracting and Retaining Skilled Personnel: Attracting and retaining skilled personnel will be essential for the CoE’s long-term success.

- Mitigation: Offer competitive salaries and benefits, provide opportunities for professional development, and create a positive and supportive work environment.

- Expanding the Scope and Reach of the CoE: Expanding the CoE’s scope and reach to cover a wider range of projects and activities will present new challenges.

- Mitigation: Develop a phased approach to expansion, starting with pilot projects and gradually scaling up operations.

- Ensuring Data Security and Privacy: Protecting sensitive data from cyber threats and unauthorized access will be crucial.

- Mitigation: Implement robust data security measures, including firewalls, encryption, and access controls. Provide regular training to staff on data security best practices.

Sustainability and Future Plans

The long-term success of the PIM Centre of Excellence (CoE) hinges on its ability to adapt, evolve, and remain relevant to KCCA’s changing needs. This section Artikels the strategies and initiatives designed to ensure the CoE’s continued effectiveness and its contribution to KCCA’s project management capabilities for years to come.

Long-Term Sustainability Plan for the PIM CoE

The sustainability plan focuses on several key areas to ensure the PIM CoE remains a valuable resource. This involves financial stability, knowledge management, and continuous improvement.* Financial Sustainability: Diversifying funding sources is crucial. This includes exploring partnerships with international development agencies, seeking grants, and potentially offering training programs to other organizations.

Knowledge Management and Retention

Establishing a robust knowledge management system is essential. This includes creating a centralized repository for project appraisal documents, training materials, and best practices. Implementing mentorship programs and succession planning will ensure knowledge transfer and retention within the CoE.

Continuous Improvement

The CoE will adopt a culture of continuous improvement through regular performance reviews, feedback from stakeholders, and the adoption of new project management methodologies and tools. This will involve regular audits of project appraisal processes to identify areas for improvement and to ensure alignment with best practices.

Capacity Building for Trainers

Investing in the professional development of the CoE’s trainers is paramount. This includes providing opportunities for them to attend international conferences, pursue advanced certifications (e.g., PMP, PRINCE2), and stay abreast of the latest project management trends.

Stakeholder Engagement

Maintaining strong relationships with key stakeholders, including KCCA departments, the Ministry of Finance, and external partners, is critical. Regular communication, feedback sessions, and collaborative projects will ensure that the CoE remains aligned with the needs of the organization.

Future Projects and Initiatives to Enhance KCCA’s Project Management Capabilities

The PIM CoE will continue to drive innovation in project management within KCCA. Several future projects and initiatives are planned to build upon the existing foundation.* Implementation of a Project Portfolio Management (PPM) System: This system will provide a centralized platform for managing all KCCA projects, enabling better prioritization, resource allocation, and performance monitoring. This will involve the selection and implementation of a PPM software solution and training for all relevant staff.

Development of Sector-Specific Appraisal Guidelines

Tailoring project appraisal methodologies to specific sectors, such as infrastructure, education, and health, will improve the accuracy and effectiveness of appraisals. This will involve conducting research into sector-specific best practices and developing customized appraisal templates.

Establishment of a Project Risk Management Framework

Implementing a comprehensive risk management framework will help KCCA proactively identify, assess, and mitigate project risks, reducing the likelihood of project delays and cost overruns. This will involve developing a risk register, conducting risk assessments, and implementing mitigation strategies.

Advanced Training Programs

Offering advanced training programs in areas such as financial modeling, data analytics, and project leadership will enhance the skills of KCCA’s project management professionals. These programs will be designed to address specific skill gaps and to equip staff with the latest tools and techniques.

Collaboration with Universities and Research Institutions

Partnering with local universities and research institutions will facilitate knowledge sharing, promote innovation, and provide access to cutting-edge research in project management. This may involve joint research projects, internships, and guest lectures.

Strategies to Ensure the Continued Effectiveness of the PIM CoE

Several strategies will be implemented to ensure the PIM CoE continues to meet the evolving needs of KCCA and to maintain its effectiveness.* Regular Review and Updates of Training Materials: The CoE will regularly update its training materials to reflect the latest project management methodologies, industry best practices, and technological advancements. This will involve incorporating feedback from trainees, conducting research into emerging trends, and updating training content accordingly.

Performance-Based Incentives for Staff

Implementing a performance-based incentive system for CoE staff will motivate them to excel in their roles and to contribute to the overall success of the CoE. This will involve setting clear performance targets, providing regular feedback, and rewarding high performers.

Adoption of Agile Project Management Principles

Incorporating agile project management principles into the CoE’s operations will improve its responsiveness, flexibility, and ability to adapt to changing circumstances. This will involve adopting iterative development cycles, embracing collaboration, and prioritizing customer feedback.

Building a Strong Brand Identity

Establishing a strong brand identity for the PIM CoE will enhance its visibility, credibility, and appeal to stakeholders. This will involve developing a clear brand message, creating a professional website, and promoting the CoE’s activities through various channels.

Fostering a Culture of Innovation

Encouraging a culture of innovation within the CoE will drive continuous improvement and ensure that it remains at the forefront of project management best practices. This will involve creating opportunities for staff to experiment with new ideas, providing support for innovation projects, and celebrating successes.

Key Performance Indicators (KPIs) to Track the Ongoing Success of the PIM CoE

The following KPIs will be used to monitor the ongoing success of the PIM CoE and to measure its impact on KCCA’s project management capabilities. These metrics will provide valuable insights into the CoE’s performance and will inform future decision-making.* Number of Projects Appraised Annually: This KPI will measure the volume of project appraisals conducted by the CoE, indicating its workload and contribution to KCCA’s project pipeline.

Average Appraisal Cycle Time

Tracking the time it takes to complete a project appraisal will help identify bottlenecks and improve efficiency.

Percentage of Projects Approved Based on CoE Appraisals

This metric will assess the impact of the CoE’s appraisals on project selection and investment decisions.

Project Success Rate (on time and within budget)

Measuring the success rate of projects appraised by the CoE will provide evidence of the effectiveness of the appraisal process.

Stakeholder Satisfaction

Conducting regular surveys to assess stakeholder satisfaction with the CoE’s services will provide valuable feedback for improvement.

Number of Training Participants and Training Satisfaction

Measuring the number of participants in training programs and their satisfaction levels will indicate the effectiveness of the training programs.

Cost Savings from Improved Project Management

Tracking cost savings achieved through improved project management practices will demonstrate the financial benefits of the CoE’s work.

Number of Certified Project Management Professionals

The number of staff holding professional certifications (e.g., PMP) is an indicator of the CoE’s success in capacity building.

Knowledge Repository Usage

Tracking the usage of the knowledge repository will help assess its effectiveness as a resource for project management information.

End of Discussion

In conclusion, the PIM Centre of Excellence has significantly enhanced KCCA’s capacity for project financial appraisal, providing a robust framework for better project outcomes. Through strategic training, the adoption of innovative tools, and a focus on continuous improvement, the PIM CoE ensures KCCA’s projects are managed with greater efficiency and effectiveness. The future looks bright as KCCA continues to build on these successes, driving urban development and creating a more sustainable future for Kampala.

Top FAQs

What is the primary mission of the PIM Centre of Excellence?

The PIM CoE’s core mission is to enhance KCCA’s project management capabilities through improved financial appraisal, training, and the adoption of advanced tools and methodologies.

How does the PIM CoE contribute to KCCA’s strategic goals?

By improving project outcomes, the PIM CoE ensures KCCA can more effectively implement its urban development plans, manage its resources efficiently, and deliver better services to the community.

What kind of training programs are offered by the PIM CoE?

The PIM CoE offers various training programs, including workshops and simulations, that cover topics such as project financial appraisal methodologies, data analysis, and risk management, tailored to KCCA staff.

What specific software or systems are used to support project financial appraisal?

The PIM CoE integrates software and systems that streamline data collection, analysis, and reporting, which improve the efficiency and accuracy of project appraisals.

How are project outcomes measured after the implementation of the PIM CoE?

Project outcomes are measured through quantifiable metrics, such as cost savings, project completion rates, and improved project timelines, allowing KCCA to track the success of the PIM CoE.